- An unexpectedly softer US inflation reading weighed on the dollar.

- The euro was trading slightly below the more than two-month high reached on Tuesday.

- The data confirmed a slight decline in the Eurozone economy in the third quarter.

The EUR/USD forecast is bullish as the dollar struggles significantly lower. The struggle comes after an overnight drop caused by an unexpectedly softer reading of inflation in the US. The report reinforced the belief that the Federal Reserve has ended its cycle of monetary tightening. The dollar’s decline sent many peers higher, with the euro trading slightly below a more than two-month high hit on Tuesday.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Data showed that US consumer prices were unchanged in October. Moreover, the annual increase in headline inflation was the lowest in the last two years. In the 12 months to October, the consumer price index (CPI) rose by 3.2%, below economists’ projections. Consequently, market participants have all but ruled out another rate hike at the Fed’s December monetary policy meeting. Meanwhile, expectations for a rate cut next May have risen to around 50%.

The dollar fell 1.5% against major currencies overnight. In addition, US Treasury yields, which previously contributed to the dollar’s strength, saw a significant decline.

Meanwhile, a new estimate on Tuesday confirmed a slight contraction in the eurozone economy in the third quarter. As a result, there are concerns about a potential technical recession if the fourth quarter follows a similarly weak trend. However, it was positive as the level of employment continued to rise.

EUR/USD key events today

Key events from the US today will include reports on,

- Basic retail

- Producer Price Index

- Retail

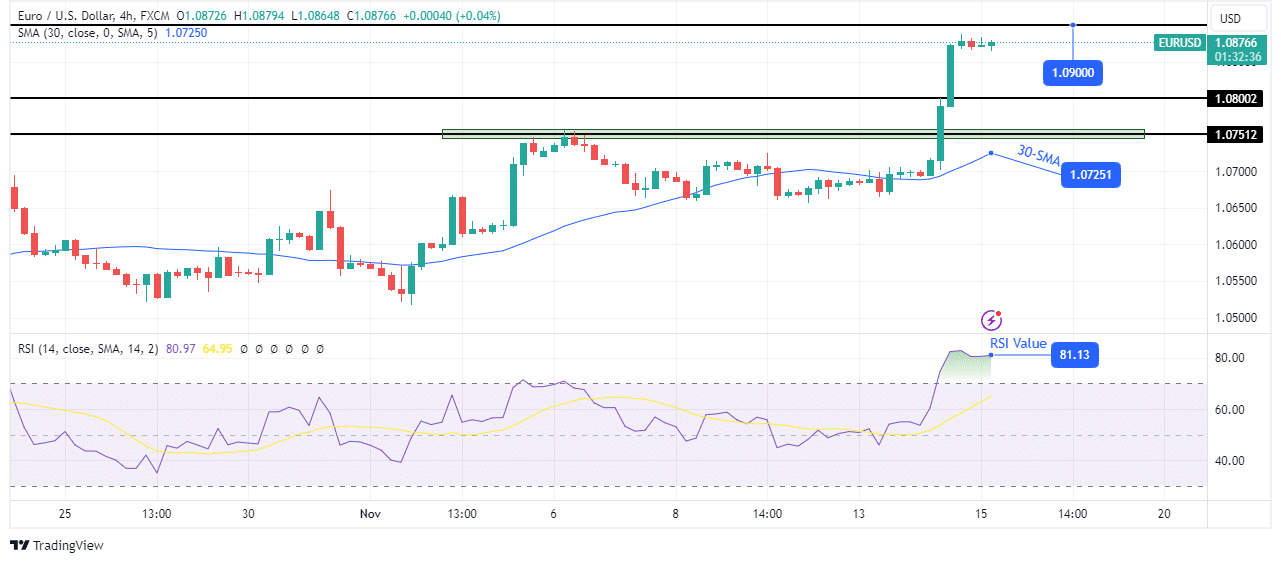

EUR/USD Technical Forecast: Bullish trend rising well above 1.0751.

The bullish bias for EUR/USD is strong as it finally broke the resistance level at 1.0751 and made a new high. The price traded sideways below 1.0751 for a while before going above. Moreover, it strengthened and is approaching the key resistance level of 1.0900.

–Are you interested in learning more about Thai forex brokers? Check out our detailed guide-

However, the price is too expensive, as seen in the RSI, which is trading above 70. This could allow the bears to resurface for a pullback. At the same time, the price is trading too far above the 30-SMA, and may have to pull back before it continues to rise. However, the bulls are likely to take down the key level of 1.0900 soon.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.