- Oil fell for the fourth consecutive week.

- US jobless claims rose to 231,000, beating expectations of 220,000.

- US industrial production fell by 0.6% in October.

The USD/CAD outlook is bright as the Canadian dollar softens amid lower oil prices, with the pair rising despite dollar weakness. Oil prices showed little change on Friday, but were on course for a fourth straight week of decline. However, they fell about 5% to a four-month low on Thursday on concerns about global demand. This decline weighed heavily on the Canadian dollar.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

It is notable that this week’s drop in oil is primarily due to a significant increase in crude oil inventories in the US and a record level of production. Consequently, there are concerns about weak demand in the world’s largest oil consumer.

Furthermore, JPMorgan Commodities Research reported that its global oil demand tracker showed average demand of 101.6 million barrels per day in the first half of November. However, this figure is 200,000 barrels per day lower than projected demand for the month.

At the same time, analysts suggest that the recent drop in prices could lead Saudi Arabia to extend oil production cuts until 2024.

Meanwhile, the US dollar was weak after a series of bad data. Jobless claims rose to 231,000, beating the expected 220,000 reading. At the same time, industrial production fell by 0.6% on a monthly basis in October, with a 0.7% drop in manufacturing production.

ANZ noted: “Manufacturing pointed to ongoing struggles in the sector. The lingering effects of monetary tightening are now seeping through. Furthermore, we expect production, labor and inflation to moderate in the coming months and quarters.

Elsewhere, Federal Reserve Governor Lisa Cook noted Thursday that U.S. economic risks are two-sided. However, there is a possibility of a ‘soft landing’.

USD/CAD Key Events Today

- US Building Permits Report

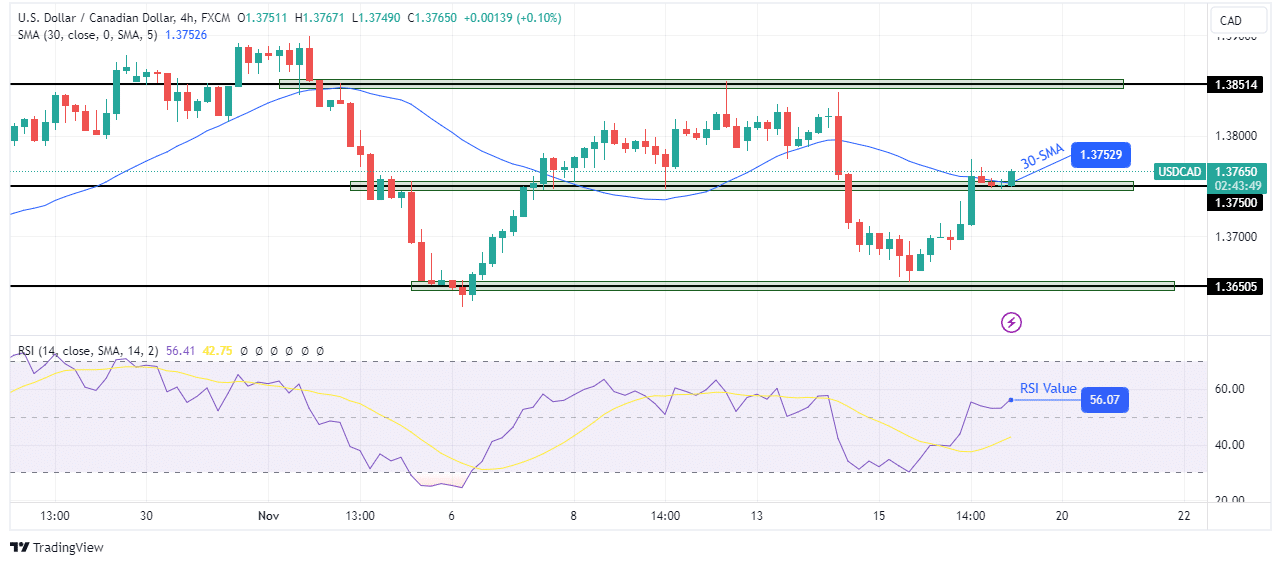

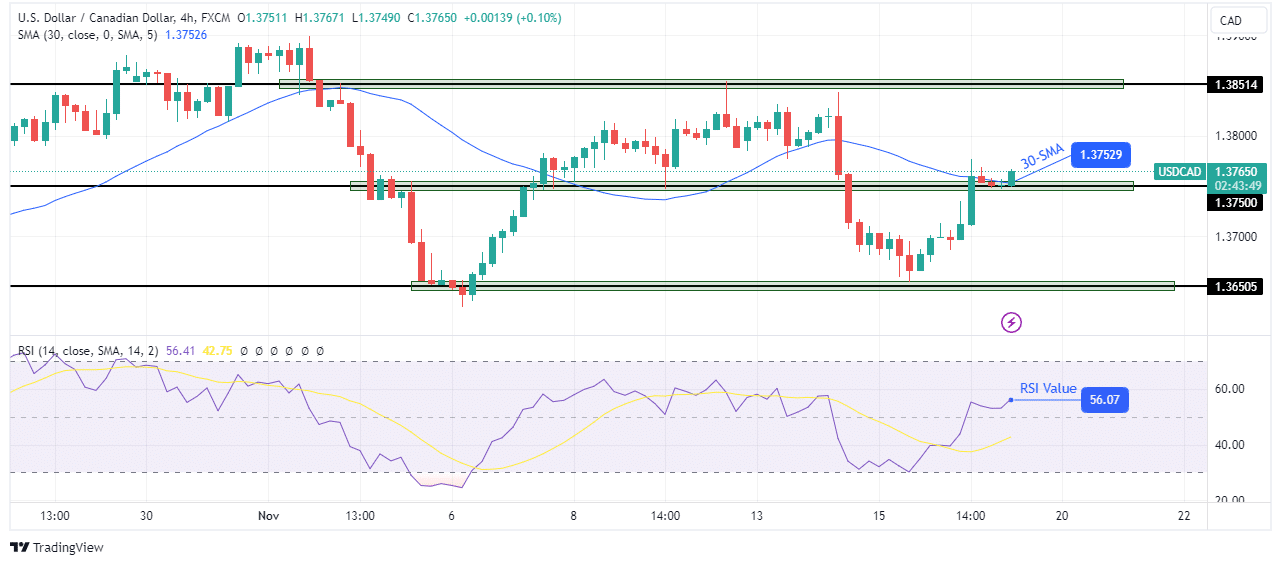

USD/CAD Technical Outlook: Bulls take lead above 30-SMA.

On the charts, the USD/CAD price is on the verge of breaking above the 30-SMA. This comes after the bulls broke the resistance level at 1.3750. At the same time, the RSI crossed above 50, indicating a change in sentiment to bullish.

–Are you interested in learning more about Thai forex brokers? Check out our detailed guide-

The bulls may soon take over. However, the price is still trading in a larger range. There is almost equal strength for bulls and bears between support at 1.3650 and resistance at 1.3851. Therefore, the bulls must break above the resistance at 1.3851 for the price to start trending.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.