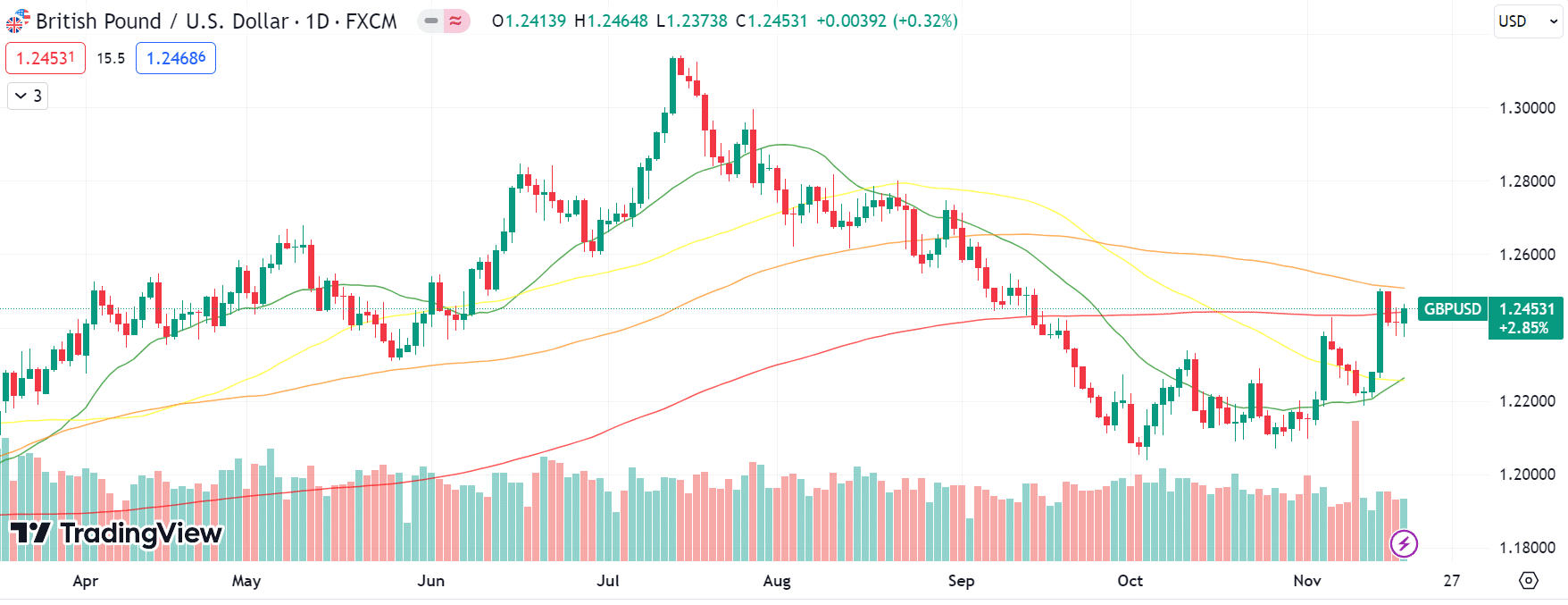

GBP/USD’s weekly forecast is bullish as the pair ended a challenging week marking a two-week high around 1.2500. The pair’s path depends on speculation about future central bank actions and upcoming PMI manufacturing data.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

The ups and downs of the past week

The US market, awash with data, suggests that the Federal Reserve (Fed) has concluded its cycle of interest rate hikes. Coupled with lower US Treasury yields, this sentiment allowed GBP/USD to regain lost ground.

Soft US economic data fueled expectations of an extended Fed pause, with markets already pricing in the lead-up to May 2015. Notable indicators include a significant drop in US PPI in October, US inflation rate slowing to 3.2% y-o-y and negative 0.1% Monthly retail turnover in October. In addition, US initial jobless claims reached 231,000 in the week ending November 11.

The dollar index touched a two-month low as the yield on the 10-year UST bond fell below 4.50%. Accordingly, GBP/USD strengthened, surpassing the 1.2506 mark.

GBP buyers remained resilient despite UK CPI falling to 4.6% y-o-y in October. In September, the ILO unemployment rate in the UK was 4.2%, while average earnings without bonuses rose by 7.7% compared to the previous three months. Market bets adjusted for potential BoE rate cut in 2024.

Sterling rallied against the dollar but faced headwinds towards the end of the week amid concerns over China’s property sector. Weakness in US Treasury yields sent USD/JPI lower, offsetting losses in GBP/USD after weak UK retail sales fell 0.3% in October.

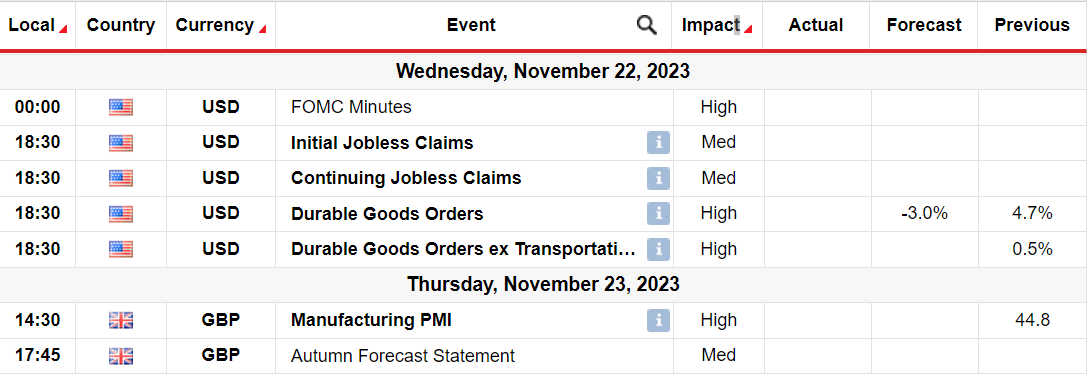

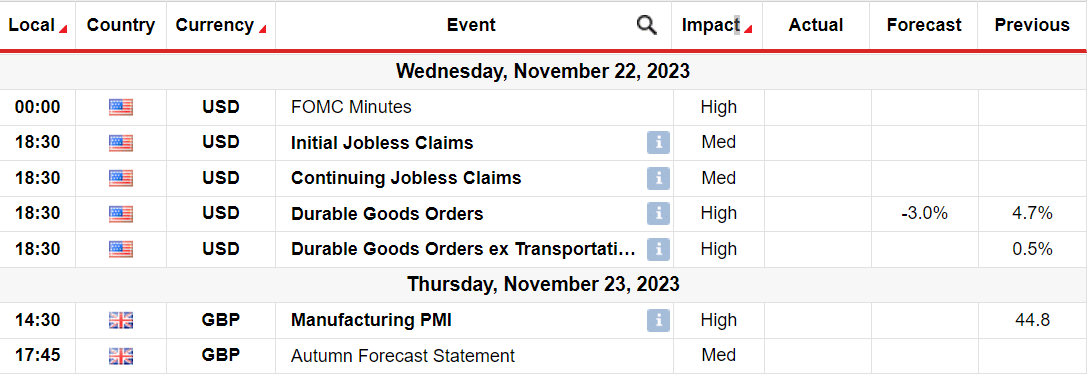

GBP/USD key events/data next week

Thin trading is expected on Wednesday due to Thanksgiving on Thursday.

BoE Governor Andrew Bailey is scheduled to speak on Monday, though not necessarily on monetary policy. No significant events are scheduled for that day in the American economic calendar.

Key announcements on Wednesday include US dollar valuations influenced by US existing home sales and minutes from the Fed’s November meeting.

Thursday focuses on early UK manufacturing and services PMIs, while Friday sees the US S&P global PMI.

Speeches from Federal Reserve policymakers will be closely watched for insight into the outlook for US interest rates.

GBP/USD Weekly Technical Forecast: Bulls in control

The price of GBP/USD is hovering around the 200-day and 100-day SMA. The pair needs a strong push to break and stay above this resistance zone.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

However, the 20-day and 50-day SMAs created a bullish crossover. This shows the potential of the rally to continue. The 1.2500 level remains a tough nut to crack. On the downside, 1.2350 is strong support.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.