- Investors are focused on when the Federal Reserve might start cutting rates.

- There was an unexpected fall in the volume of British retail sales in October.

- US single-family home construction rose slightly in October.

As the new week dawned on Monday, a bullish glow enveloped the GBP/USD outlook as the pound strengthened on a weaker dollar. This drop in the dollar came as investors focused on when the Federal Reserve might start cutting rates. Currently, markets have ruled out further rate hikes from the Fed due to weaker inflation readings.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

Meanwhile, official data on Friday revealed an unexpected drop in UK retail sales in October, signaling financial pressure among consumers. It fell 0.3% month-on-month, following a revised 1.1% drop in September, which was worse than initially estimated.

Economists had expected an increase in the volume of sales in October by 0.3%. Moreover, the figures are consistent with a gloomy outlook for the UK economy. Economic growth continues to stagnate, and strong price pressures are slowly easing. Consequently, investors expect these factors to force the Bank of England to cut interest rates next year.

Moreover, given the narrow avoidance of economic contraction in the third quarter, Friday’s numbers point to the risk of GDP being revised to a negative reading. Compared to last year, retail turnover is 2.7% lower.

Meanwhile, U.S. data on Friday showed a slight increase in U.S. single-family home construction. However, the near-term outlook suggests that activity may remain subdued due to elevated mortgage rates. These higher rates have contributed to a significant drop in homebuilder confidence.

GBP/USD key events today

There are no key events today that could lead to a slow start to the week for GBP/USD.

GBP/USD Technical Outlook: Bullish bias persists, but momentum weakens.

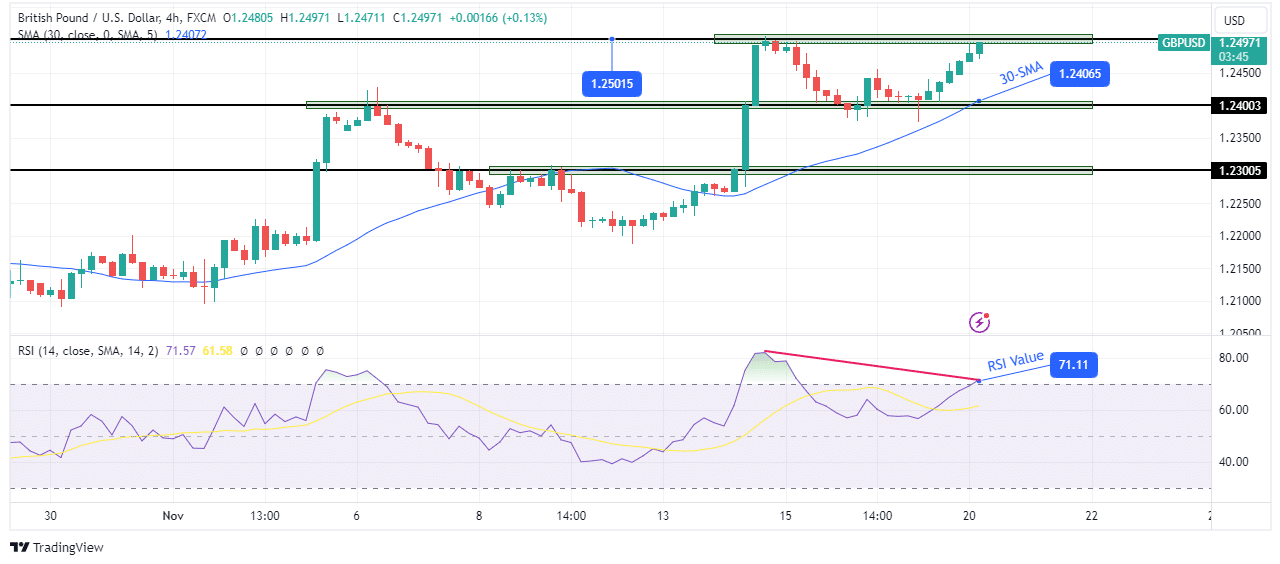

The GBP/USD price has bounced off the key support level of 1.2400 and is approaching the resistance level at 1.2501. The bias is bullish, but momentum has weakened. In addition, this weakness can be seen in the RSI, which made a bearish divergence while the price made a double top.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

If the bulls are weaker, the price is likely to fail to break above the resistance at 1.2501. Therefore, the bears could resurface to push the price back to the 1.2400 support. However, if the bulls regain momentum, the price will rise above the resistance at 1.2501.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.