- China’s upward movement of the yuan weighed on the dollar.

- The yen gained over 0.5%, hitting a seven-week high.

- Investors await the release of the Fed’s minutes.

On Tuesday, the USD/JPI outlook was bearish, led by the dollar falling to new lows against the yen. This movement occurred due to China’s upward trend in the yuan, which contributed to the spread of weakness in the value of the dollar. As such, the yen gained over 0.5%, hitting a seven-week high of 147.5 to the dollar.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

Moreover, a report by Bloomberg News about upcoming support for China’s real estate sector increased risk appetite, which hurt the dollar.

Meanwhile, US yields fell on expectations that US interest rates had peaked. Markets have all but ruled out the risk of a further increase in US interest rates in December or next year. On the other hand, investors expect the release of the Fed minutes at 19:00 GMT.

The yen has shown signs of a reversal. After decades of falling prices, global inflationary pressures are gradually affecting the Japanese economy. Consequently, investors are reassessing their Japan-related investments as the Bank of Japan considers a significant policy change. Inflation data on Friday is likely to reveal an acceleration in core consumer prices in Japan in October.

Mizuho Bank’s chief economist, Vishnu Varatan, stressed the need for a reality check on the Fed’s bias. He stated that it is not independent of the yield movement. Moreover, he noted the potential for a self-policing mechanism if yields fall too far, suggesting the dollar’s slide could be halted. Finally, Varathan cautioned against premature statements until the Fed’s December meeting.

Today’s minutes could be significant if the language regarding the bond market changes.

USD/JPI Key Events Today

- Existing US Home Sales

- FOMC meeting minutes

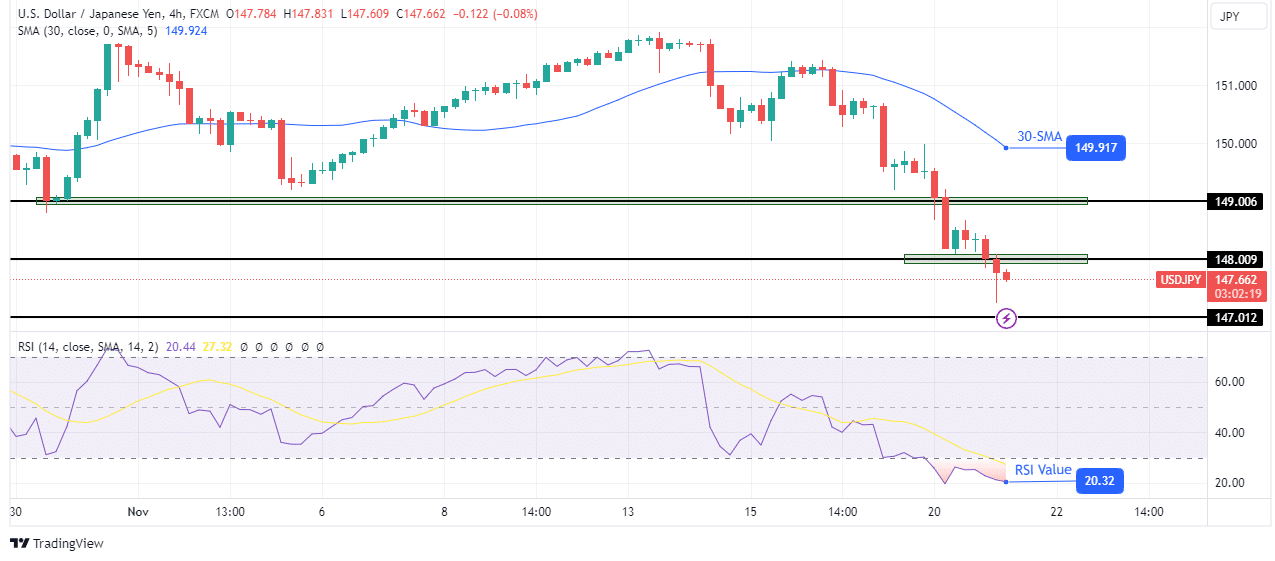

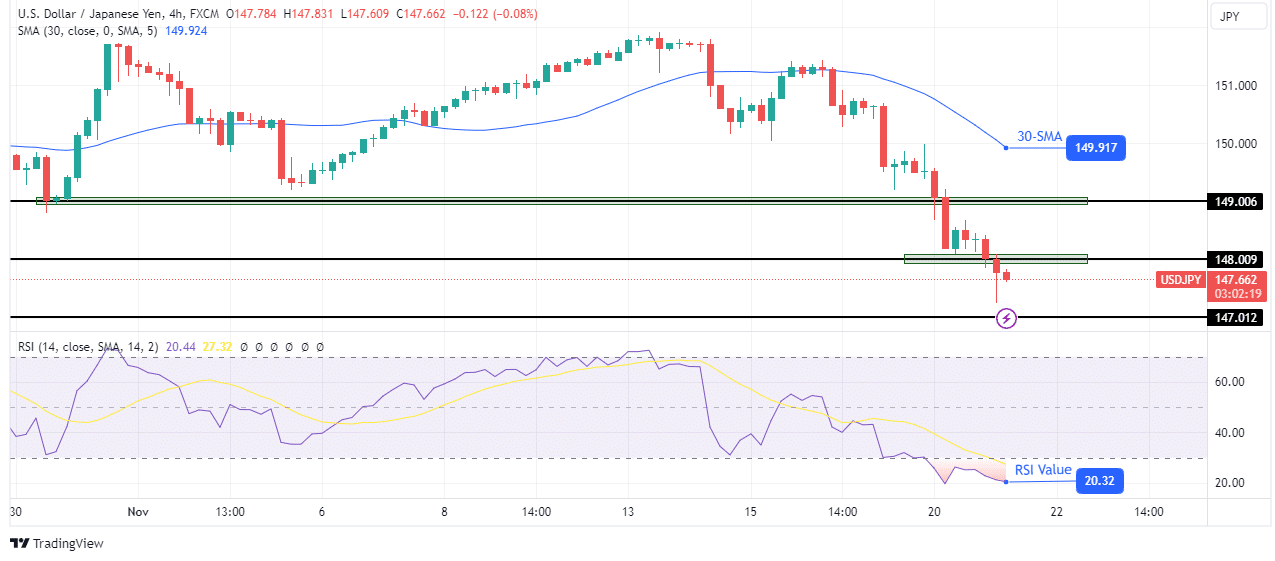

USD/JPI Technical Outlook: Prices fall as bearish momentum strengthens

On the charts, the price of USD/JPI is in a downward spiral, with the price jumping above the support level. The bearish trend started when the price crossed below the 30-SMA. Moreover, the bears confirmed the new direction when the price retested and respected the 30-SMA resistance.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

Since then, the price has fallen and crossed below key support levels. Most recently, the bears broke below the 148.00 support level. However, with the RSI in the oversold region, the price could finally pause for a comeback. However, before that we could see it falling to the support level of 147.01.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.