- KSAU/USD remains bullish despite the current pullback.

- A stay near 1,993 may herald an imminent breakout.

- A new lower low triggers a deeper decline.

The price of gold fell slightly today, falling from a high of 1,994 to 1,988. After the recent increase, it was kind of expected. But don’t count gold out just yet – the pressure for it to rise remains strong as the US dollar isn’t doing so well.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

Today, what is happening around the world could change the price of gold. The Canadian Consumer Price Index report is due, which could show an increase of 0.1%, better than the 0.1% decline in the last report. They also publish data on the core CPI, the composite CPI, the abbreviated CPI, and the median CPI.

But the big deal is the FOMC meeting minutes. This could shake things up. The US dollar saw some changes after US inflation data was released. If the minutes of the meeting sound tough, it could strengthen the US dollar and send gold prices lower. But if the report is more dovish, gold prices could rise again.

A number of things could move the price of gold tomorrow – such as the US jobless claim, revised UoM consumer sentiment, durable goods orders and core durable goods orders. Watch out for them!

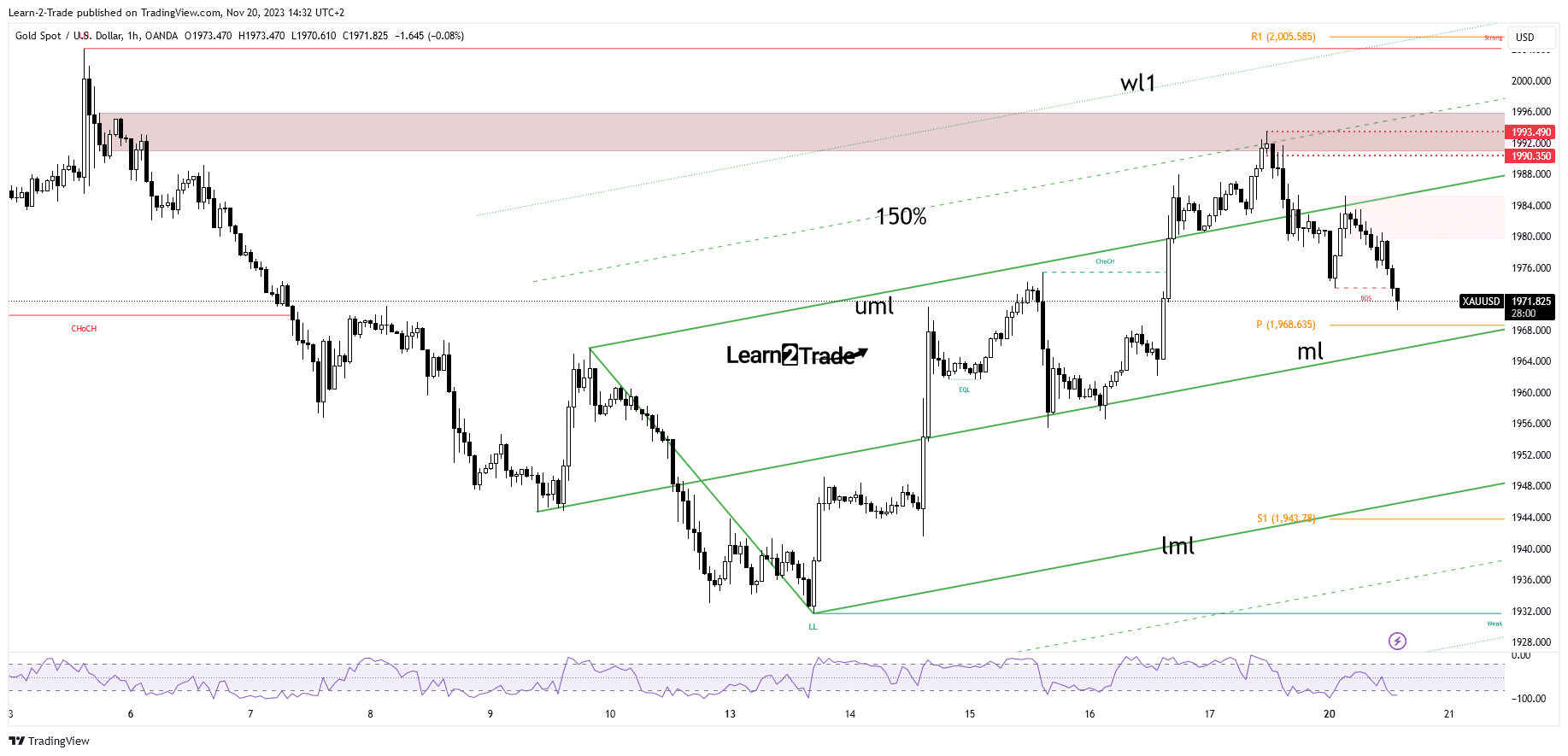

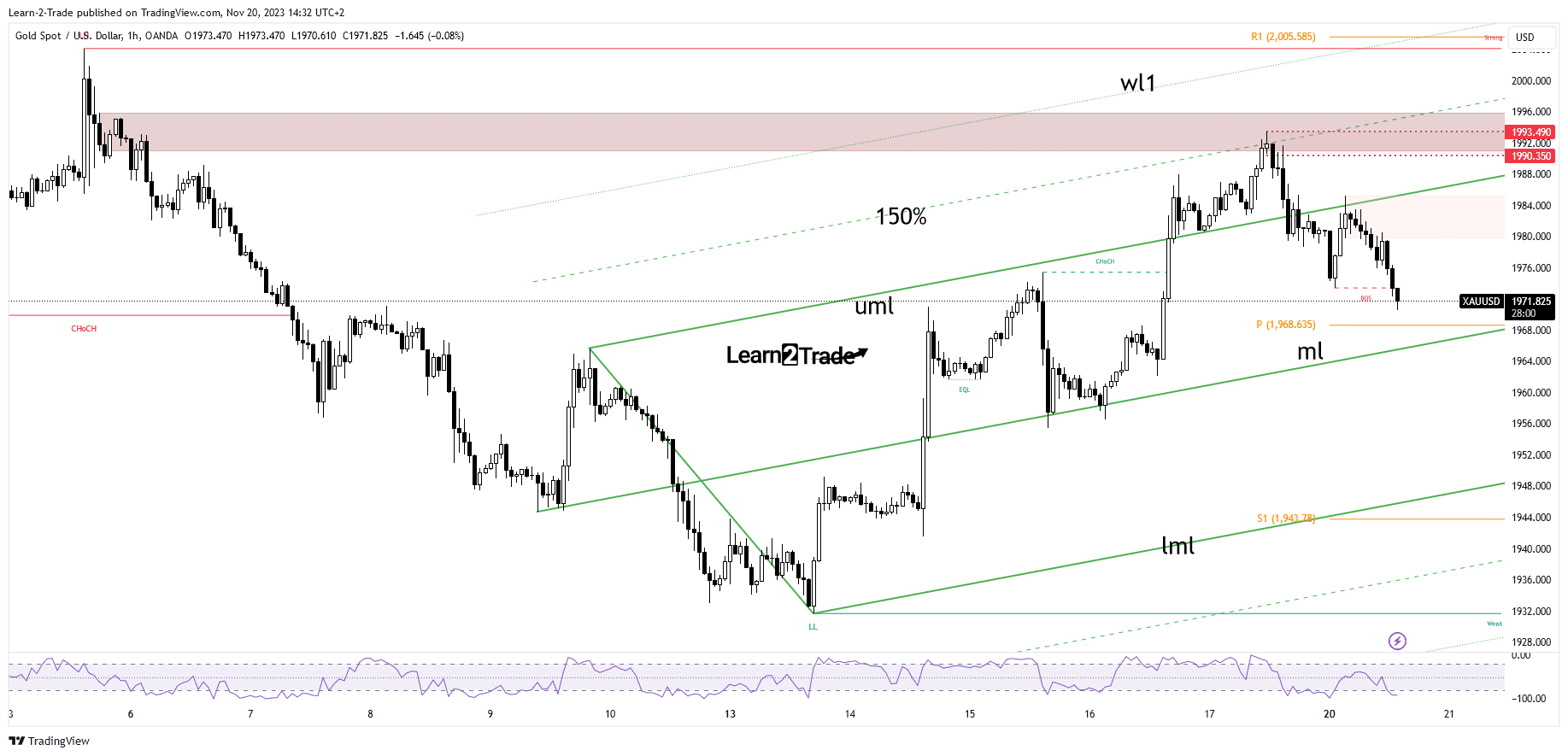

Technical analysis of the price of gold: selling territory

Looking at the hourly chart, the rate reached a high of 1,993 but could not stay there, showing some false breakouts. Now, it goes down. It tries to challenge the upper midline (uml). When it could not reach and test the 150% Fibonacci line, it indicated that buyers might be tired.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

To really see more declines, it has to drop below that upper middle line (uml) and make a new lower low. If it hangs around 1,993, we may be on the verge of a breakout and things could continue to move in the same direction. If it manages to break out of the supply zone, that’s a good sign for more upside. R1 (2.005) is like a target that can be reached if things continue to go up.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.