- Jeremy Hunt introduced tax cuts and growth-boosting measures in his autumn budget.

- Hunt forecast a slower-than-expected UK economic outlook.

- The data pointed to a larger-than-expected drop in US jobless claims.

Thursday saw the pound settle, pausing its decline in the previous session and contributing to a cautiously optimistic outlook for GBP/USD. Britain’s Chancellor of the Exchequer, Jeremy Hunt, introduced tax cuts and growth-boosting measures in his autumn budget on Wednesday. However, despite these initiatives, he forecast a slower-than-expected economic outlook.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

In particular, he announced tax cuts for workers and provided permanent investment incentives for businesses. These reforms aim to jump-start an economy stuck in a pattern of slow growth ahead of an expected 2024 election.

In contrast, the dollar index rose on Wednesday, recovering after economic data showed a bigger-than-expected drop in US jobless claims last week. The Labor Department reported a drop of 24,000 in initial claims for state unemployment benefits. That was the lowest level in more than a month.

Moreover, the dollar continued to rise after a University of Michigan survey found that US consumers’ inflation expectations rose for a second month in November.

Meanwhile, other data showed a sharper-than-expected drop in orders for US durable goods in October. This decline was due to lower orders for motor vehicles. Moreover, the United Auto Workers union went on strike against the Big Three automakers in Detroit.

The dollar index hit its lowest level since August 31 on Tuesday. However, it stabilized after a few minutes from the last Federal Reserve meeting. The minutes indicated the tendency of the central bank to maintain a restrictive stance on interest rates for some time. However, further rate hikes are unlikely.

GBP/USD key events today

The pair is likely to move sideways as US markets are closed for the Thanksgiving holiday.

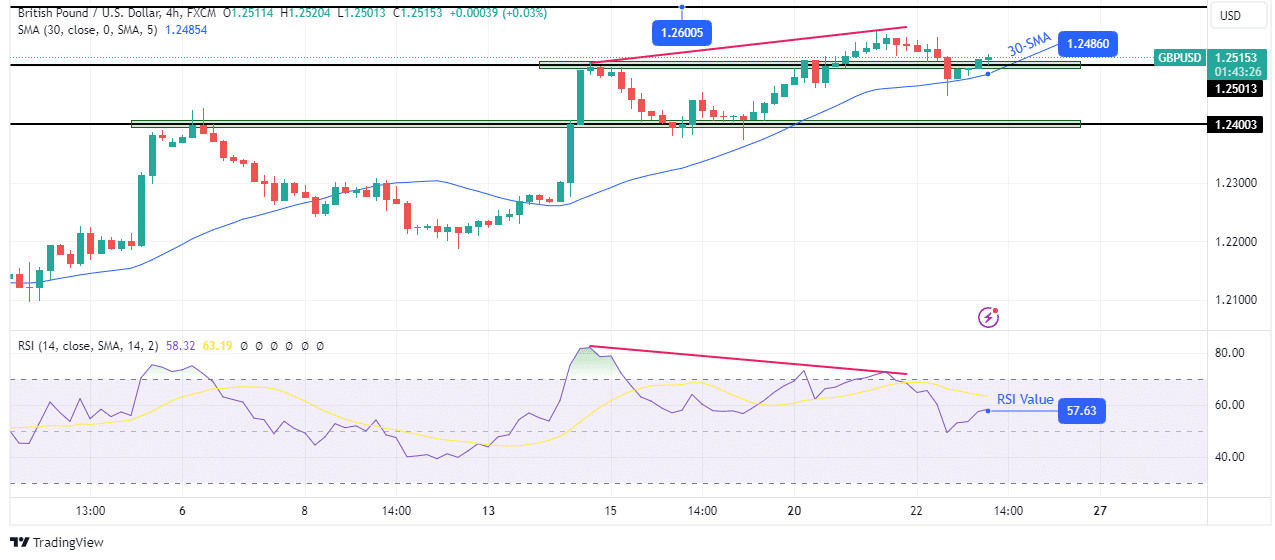

GBP/USD Technical Outlook: Price hits 30-SMA support amid weakness in uptrend

The pound fell to the 30-SMA support after the RSI indicated the weakness of the uptrend. This is a sign that the bears have taken advantage of the bullish weakness to lower the price. However, they could not change the bias to bearish as they failed to break below the 30-SMA.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

Moreover, the RSI remained above the central level of 50, supporting the bullish momentum. The price is currently trading near the key level of 1.2501 and the SMA. There is a good chance that the bulls will regain momentum and bounce off this support zone. However, there will be a change in sentiment if the price falls below the 30-SMA.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.