- Currencies were little moved and markets were closed for the US Thanksgiving holiday.

- US data revealed a larger-than-expected drop in US jobless claims.

- The European Central Bank will publish the minutes of its October policy meeting.

While the EUR/USD forecast tilted slightly, currency markets remained quiet on Thursday due to holidays in Japan and the United States. Meanwhile, the U.S. dollar struggled to hold on to mild gains after the data led investors to reconsider a peak for Fed rates.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

The euro saw little movement and markets were closed for the US Thanksgiving holiday. However, the euro fell as the dollar index recovered overnight, rising from a 2-1/2 month low. Economic data revealed a larger-than-expected drop in the number of Americans who filed new jobless claims last week.

However, confusing investors, the data also showed a larger-than-expected fall in October. Thus, it shows a significant slowdown in the economy after strong growth in the third quarter.

Meanwhile, a Michigan survey found that consumers expect higher inflation in the near and long term.

Market expectations for a Fed rate cut in 2024 have eased. Notably, CME Group’s FedWatch tool indicates a 27% chance of a rate cut at the March 2024 policy meeting.

Elsewhere, the ECB will release the minutes of its October policy meeting. In addition, policymakers are anticipating a reversal of recent rate hikes. Governing Council member Joachim Nagel suggested that rates in the eurozone are at or near their peak in the current cycle.

Moreover, global Purchasing Managers’ Indices (PMIs) will be released in November. This will help investors assess recession risks and the timing of rate cuts.

EUR/USD key events today

Investors do not expect significant economic releases as the US celebrates the Thanksgiving holiday. Therefore, trading could be weak today.

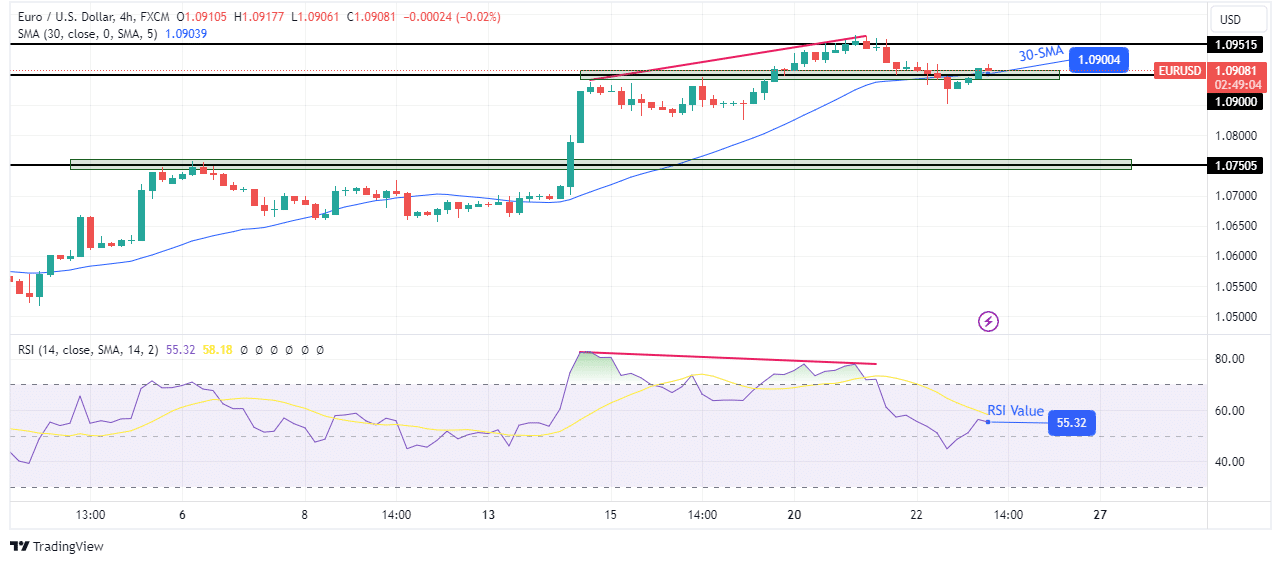

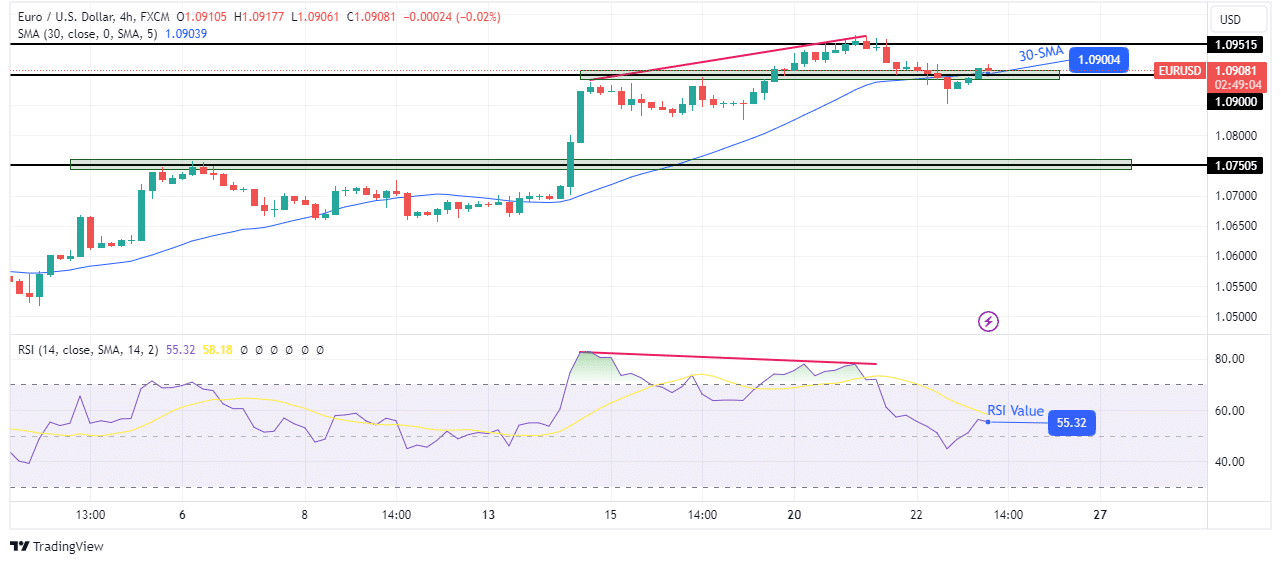

EUR/USD Technical Forecast: Bearish RSI divergence takes effect

A bearish divergence on the RSI played out on the charts, pushing the price below the 30-SMA. At the same time, the price broke below the key level of 1.0900 before pulling back for a retest. It was a good effort for the bears to take control.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

However, the price still needs to be separated from the SMA. Furthermore, the RSI must start trading in bearish territory to confirm a bearish takeover. If the bears win this battle, the price is likely to fall to the 1.0750 support level. However, if the bulls regain strength, the price is likely to break out of the 1.0951 resistance level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.