- Core consumer price inflation picked up in Japan.

- The dollar fell 2.8% for the month, heading for its weakest monthly performance.

- Japanese factory activity contracted for the sixth consecutive month in November.

Friday’s USD/JPI price analysis suggests subtle bearish sentiment, with the yen gaining strength in response to an increase in core consumer price growth in Japan. This upward trend further reinforced the expectation that the Bank of Japan could potentially withdraw its monetary stimulus in the near future.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

Notably, core consumer price growth in Japan edged up slightly in October, reversing the previous month’s decline. Accordingly, investors expect persistent inflation to force the Bank of Japan to reduce its monetary stimulus soon. At the same time, ING economists expect the BOJ to move away from its dovish stance next year.

The Japanese yen gained 0.21% to 149.23 per dollar, gradually recovering from a near 33-year low of 151.92. In addition, an increase of 1.5% was recorded for the month.

Furthermore, a business survey on Friday revealed that Japanese factory activity contracted for a sixth consecutive month in November. Japan’s economy remains fragile due to weak demand and inflation.

Meanwhile, the greenback fell 0.058% to 103.71, remaining close to a two-and-a-half-month low of 103.17 earlier this week. Moreover, the dollar fell 2.8% for the month, on track for its weakest monthly performance of the year. This drop came on the back of growing expectations that the Fed will end its rate hikes and begin cutting interest rates next year.

However, market expectations for a Fed rate cut in 2024 have eased. Right now, futures point to a 26% chance of a rate cut at the March 2024 policy meeting. That’s down from a 33% chance last week.

USD/JPI Key Events Today

- US S&P Global Services PMI (November)

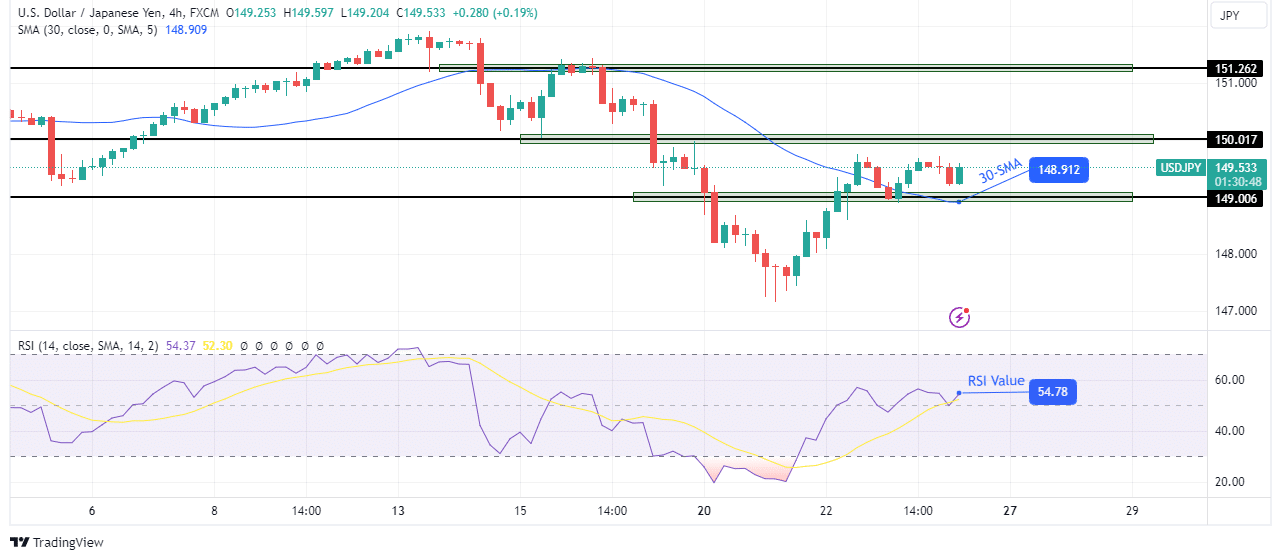

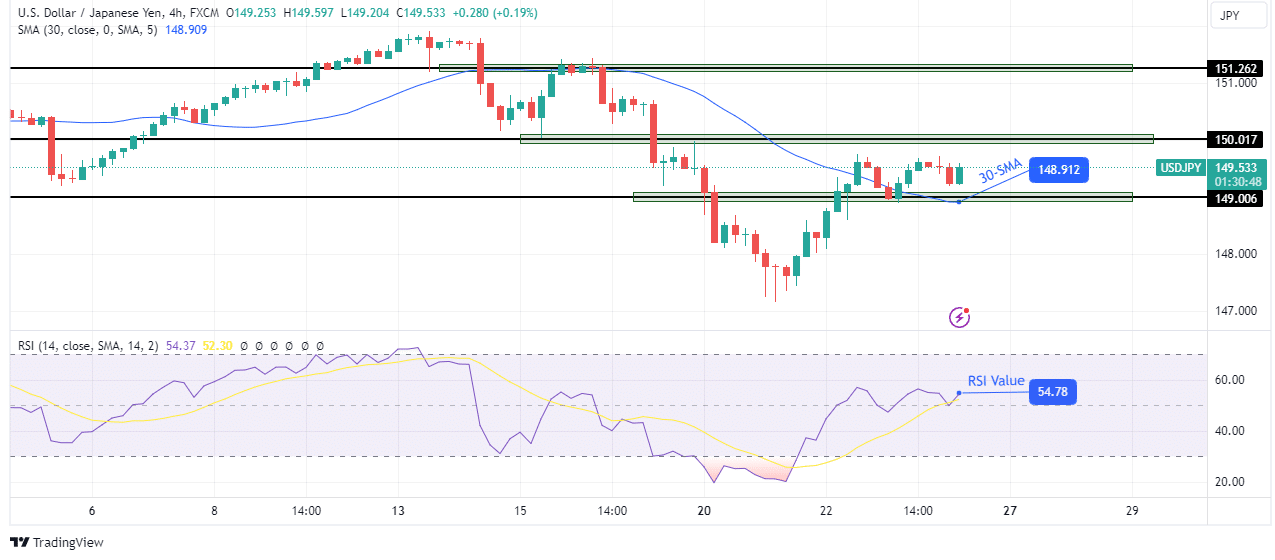

USD/JPI Technical Price Analysis: Bulls struggle to break ties with 30-SMA

On the technical side, the USD/JPI price is trading between the 149.00 support and the 150.01 resistance level. The move comes after the bulls took control pushing the price above the 149.00 level and the 30-SMA. Furthermore, the RSI rose above 50 to support a solid bullish momentum.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

However, the price is still pulling back to retest the SMA and has yet to make a major bullish move. Therefore, to confirm the new bullish trend, the bulls must break away from the 30-SMA and clear the 150.01 resistance level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.