- Core consumer price inflation in Japan rose slightly in October.

- BOJ may soon withdraw monetary stimulus due to persistent inflation.

- The dollar was generally weak as investors held onto the belief that the Fed had hiked.

The weekly USD/JPI forecast hints at bearishness as Japan’s inflation spike signals a potential shift in BOJ policy, setting the stage for the yen to regain strength.

–Are you interested in learning more about scalping brokers? Check out our detailed guide-

USD/JPI ups and downs

USD/JPI fell, but ended the week almost flat. The decline came as the yen strengthened after core consumer price growth in Japan rose slightly in October. Accordingly, expectations that the Bank of Japan may soon withdraw monetary stimulus due to persistent inflation have strengthened.

On Friday, Tatsuo Yamasaki, Japan’s former top currency official, said he expected minimal weakening of the yen from its current 150 to the dollar. In addition, he foresees a potential strengthening of the yen next year. Moreover, he believes that the Bank of Japan could abandon its negative interest rate policy in April.

Meanwhile, the dollar was generally weak as investors held onto the belief that the Fed had hiked.

Next week’s key events for USD/JPI

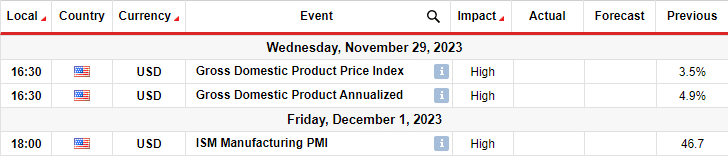

Important data will come from the US next week, including GDP and manufacturing PMI. These reports will give a clear picture of the economy amid high interest rates. The GDP report will show whether the economy grew or shrank. Meanwhile, the PMI report will show business activity in the manufacturing sector.

Recent data shows that high interest rates applied by the Federal Reserve have started to cool the economy. If this trend continues next week, investors are likely to increase bets on a Fed rate cut. Consequently, the dollar will suffer and USD/JPI will continue to decline.

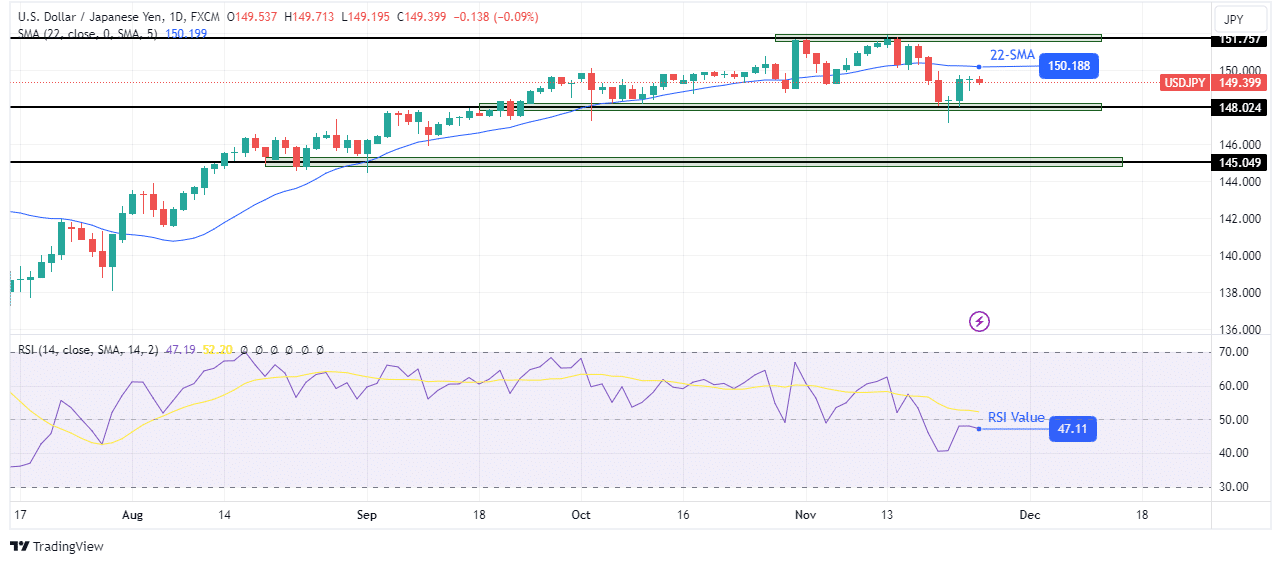

USD/JPI Weekly Technical Forecast: Bulls Retreat, Bears Advance

On the charts, the USD/JPI price has moved from bullish to bearish. The previous bullish bias stopped at the resistance level of 151.75. Although the bulls tried twice to push above the resistance, they failed. As such, the bears took control by breaking below the 22-SMA.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

At the same time, the RSI fell below 50, signaling a change in sentiment. Now that the bears have momentum, the price is likely to continue lower next week. At this point, the price pulled back to retest the SMA after finding support at the 148.02 level. There is a good chance that the 22-SMA will hold firm resistance, pushing the price lower.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.