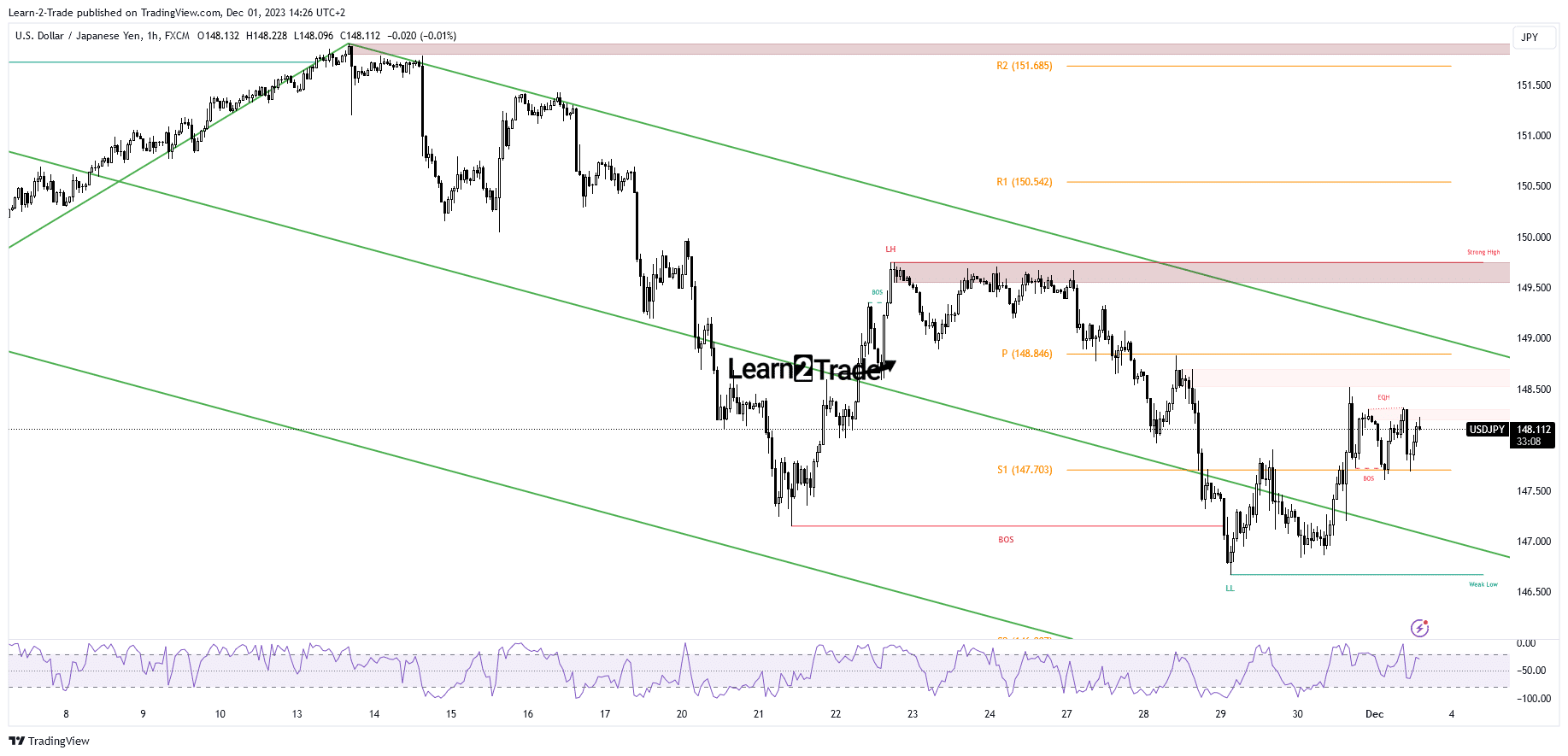

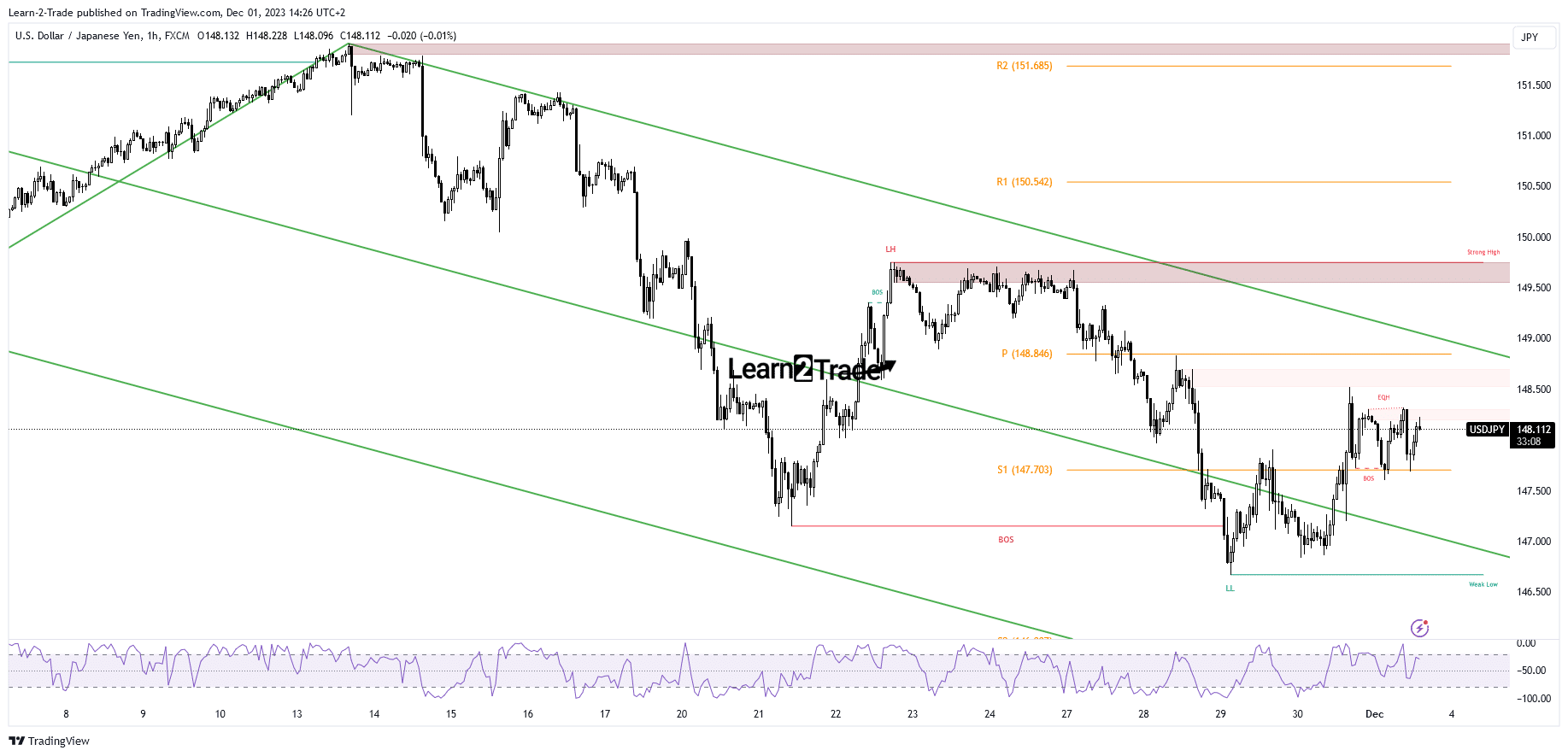

- The current sideways movement is seen as a bullish formation.

- The upper middle line (uml) stands as an important target to the upside.

- US data should bring big action today.

USD/JPI is trading at 148.02 at the time of writing and looks overpriced in the short term. After the recent rally, the pair could correct the decline amid profit taking.

–Are you interested in learning more about scalping brokers? Check out our detailed guide-

The price rose yesterday as the Chicago PMI, pending home sales and jobless claims were better than expected, while the core price index PCE, personal income and personal consumption were in line with expectations.

Today, the price retreated slightly as Japan’s unemployment rate came in at 2.5% vs. 2.6% expected, final manufacturing PMI was higher at 48.3 vs. 48.1 forecast, while capital spending matched expectations.

Later, US data should move the market. ISM Manufacturing PMI is expected to jump from 46.7 points to 47.9 points, Final Manufacturing PMI could remain stable at 49.4 points, ISM Manufacturing Prices could jump to 46.1 points, while construction spending could again to announce a growth of 0.4%. In addition, Fed Chairman Powell’s speeches and overall US Wards vehicle sales should have an impact.

Technical analysis of USD/JPI price: A leg up

Technically, the USD/JPI price is moving sideways, above the weekly S1 of 147.70, trying to accumulate more bullish energy before jumping higher. The current range could represent accumulation, a bullish continuation.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

However, just making a new higher high triggers more gains going forward. The upper middle line of descending villas represents the next big upside target. This represents the dynamic resistance.

Greater growth could be activated only after removing this obstacle. I believe the upside continuation could be reversed only if the rate makes a new lower low, if it falls and closes below S1.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.