- Powell confirmed that US monetary policy is slowing the economy as expected.

- There is a 60% chance the Fed will cut rates by March.

- The Reserve Bank of Australia is likely to keep its key interest rate at 4.35%.

There is a subtle bearish tone to the AUD/USD forecast on Monday as the greenback tries to recover after falling due to cautious remarks from Federal Reserve Chairman Jerome Powell. On Friday, Powell confirmed that US monetary policy is slowing the economy as expected and the benchmark overnight interest rate is “in restrictive territory”. Accordingly, markets have adjusted, indicating a 60% probability of a rate cut by the March meeting, up from 21% just over a week ago.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Kyle Rhoda, senior financial market analyst at Capital.com, noted that US data remains the “primary driver” for G10 currencies. Moreover, non-farm payrolls are the “top risk event” for the week. The eagerly awaited November employment report is due out on Friday. According to Rodda, the performance of the dollar pair may receive continued support based on US economic data.

Meanwhile, the Reserve Bank of Australia is likely to hold its key interest rate at 4.35% tomorrow. Moreover, the Reuters poll indicates a change in expectations for a rate cut. Markets currently do not expect a rate cut until the fourth quarter of next year due to a strong housing market.

Rates in Australia are at a 12-year high. Still, Australian house prices have rebounded from 2022 losses since hitting a low in January. Furthermore, projections point to an 8% increase in prices this year and an additional 5% next year.

AUD/USD key events today

Investors are not expecting strong news releases from Australia or the US today. Consequently, it can be a quiet session for the couple.

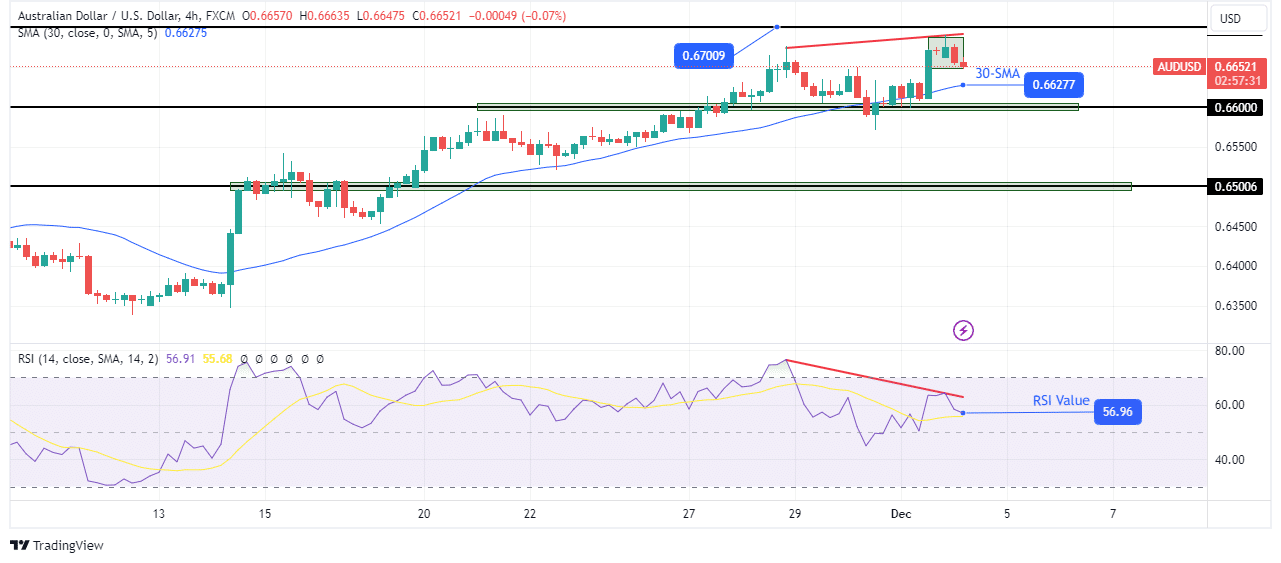

AUD/USD Technical Forecast: Potential pullback as uptrend shows fatigue

The Aussie made a new high on the charts after bouncing off the 30-SMA and the 0.6600 support level. Furthermore, the price is above the SMA and the RSI is above 50, supporting the bullish bias. However, despite the new high, the bullish momentum is fading. A closer look at the RSI shows a bearish divergence, a sign that the bulls are exhausted.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

Exhaustion can lead to pullbacks or trend reversals. Already, the price action at the last high level is showing the weakening of the bulls and the strengthening of the bears. Price made a doji candle and a bear candle, indicating an imminent decline.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.