- Core inflation in Tokyo slowed in November.

- Market participants expect a gradual withdrawal of the BOJ’s extensive incentives.

- The BOJ will monitor annual wage negotiations for the coming year and the outlook for service prices.

Despite falling inflation in Tokyo, the yen strengthened against the dollar on Tuesday, signaling a persistently weak USD/JPI outlook. Moreover, the pair remained close to the three-month low of 146.235 yen recorded in the previous session.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

In November, core inflation slowed in Tokyo, supporting the central bank’s belief that cost pressures in the world’s third-largest economy will gradually ease.

Meanwhile, service prices, closely watched by the central bank for signs of wage-driven inflation, saw their fastest growth since 1994. Analysts attributed the rise to a surge in hotel fees amid a surge in tourists.

Still, inflation has exceeded the Bank of Japan’s (BOJ) target of 2% for more than a year. Accordingly, many market participants expect the gradual abolition of the bank’s extensive incentives in the coming year. Furthermore, BOJ Governor Kazuo Ueda emphasized the maintenance of ultra-loose policy. The BOJ is waiting for demand-led price increases to replace recent cost-driven inflation.

In addition, Ueda believes next year’s annual wage negotiations and the outlook for service prices, which reflect labor costs, will play a key role in determining when the BOJ can exit its ultra-easy policy. The BOJ, unlike its global counterparts, remains dovish, continuing with ultra-loose policies. At the same time, other major central banks raised interest rates aggressively to tame rampant inflation.

USD/JPI Key Events Today

- US ISM services PMI

- US JOLTs job creation report

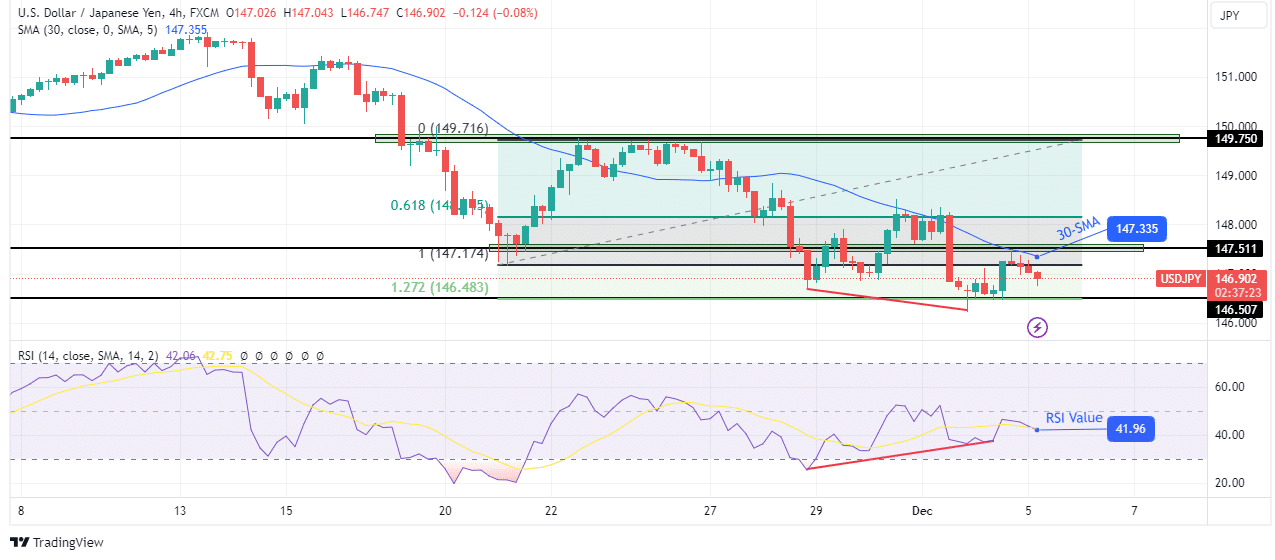

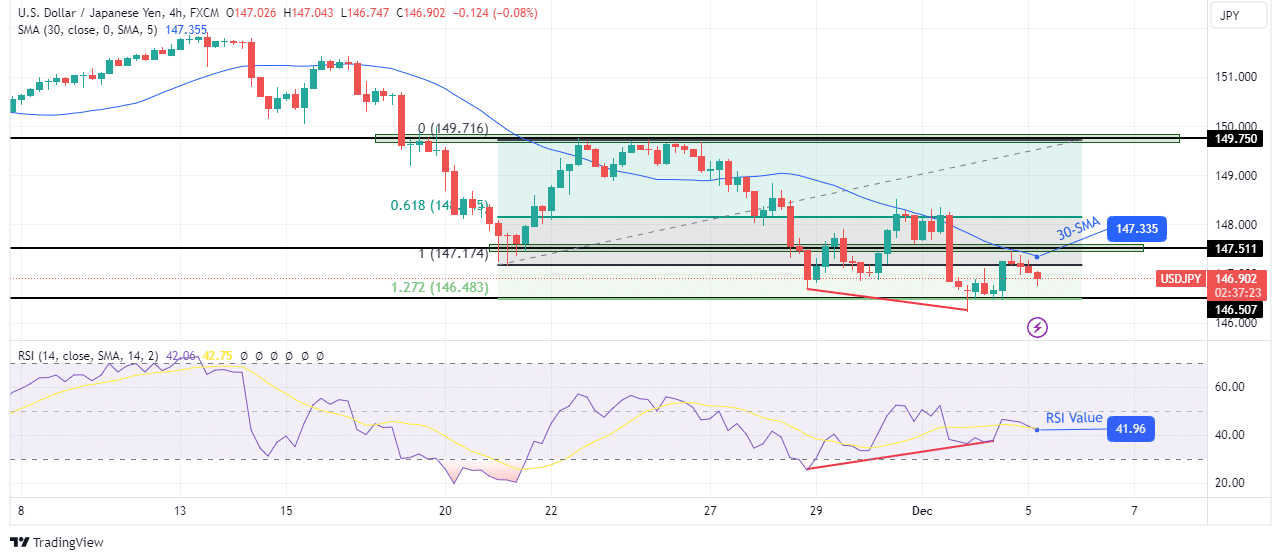

USD/JPI Technical Outlook: Bullish signs point to bulls taking the lead

On the technical side, the USD/JPI downtrend is paused at the 146.50 support level. However, the bearish bias remains strong as the price has yet to break above the 30-SMA. Furthermore, the RSI is still in bearish territory below 50.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

However, there are growing signs that the bulls may soon take over. First, the RSI made a bullish divergence with the price, indicating the weakness of the bearish momentum. Second, the price extended to the key 1.27 fib level, which is a strong support. Finally, the bulls showed strength with a large body candle after the 146.50 support level. However, the bearish trend will continue if the price does not cross the 30-SMA.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.