- The data revealed that the number of US jobs fell to the lowest level in more than 2 ½ years.

- Last month saw a slight easing of the fall in Eurozone business activity.

- Schnabel suggested that the ECB could rule out further interest rate hikes.

The EUR/USD forecast on Wednesday painted a bearish picture as the greenback stood near a two-week high against its peers. Meanwhile, investors reviewed US economic data that indicated a cooling labor market, speculating that the Fed could implement interest rate cuts next year. Data on Tuesday revealed that the number of US jobs fell to the lowest level in more than 2 1/2 years.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Elsewhere, there was a slight easing of the fall in eurozone business activity last month. However, the survey suggested the bloc’s economy was poised to shrink again this quarter. Moreover, the dominant service industry is struggling to generate demand, with the economy contracting 0.1% in the most recent quarter.

November’s composite purchasing managers’ index (PMI), released on Tuesday, points to a recurring contraction in the eurozone this quarter. Accordingly, it meets the technical definition of a recession.

Meanwhile, European Central Bank (ECB) board member Isabelle Schnabel hinted at a dovish move in response to a sharp drop in inflation. Moreover, Schnabel advised that rates would not remain steady until mid-2024 and suggested that the ECB could rule out further rate hikes. As a result, expectations for a rate cut rose on Tuesday.

Inflation in the eurozone fell to 2.4% last month, from over 10% a year earlier, after ten consecutive rate hikes. Consequently, it put the ECB’s 2% inflation target on the back burner and raised doubts about policymakers’ warnings of two more years of persistent price rises.

EUR/USD key events today

- Report on Changes in US Private Employment

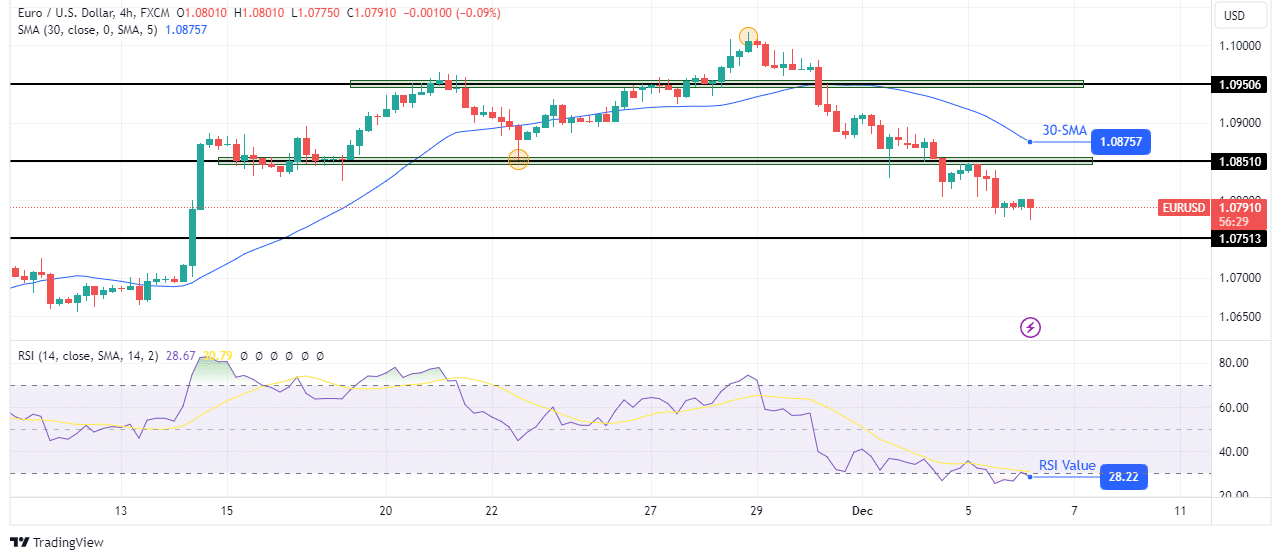

EUR/USD Technical Forecast: Bears on zero at 1.0751 as next support

The euro fell below the key 1.0851 level to make a new low, strengthening the bearish bias. The price is trading well below the 30-SMA and the RSI is oversold. The bears took over when the price made a strong candle that broke below the 30-SMA and the key 1.0950 level. Since then, the price has fallen with a shallow pullback. Bears are now targeting the next support at 1.0751.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

However, the bulls could soon re-emerge for a stronger pullback to retest the 30-SMA resistance as the price is currently oversold. It would be the first test since the Bears took over. Therefore, strong resistance at the SMA would mean that the bears are holding tight to the current move and could continue below the support level at 1.0751.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.