- The data revealed minimal growth in the Australian economy in the third quarter.

- The RBA may not need to implement further increases.

- In the United States, data pointed to the lowest level of US job creation in October in more than 2-1/2 years.

In Wednesday’s AUD/USD price analysis, the Aussie showed resilience despite data revealing minimal growth in the Australian economy in the third quarter. This slow growth marked the eighth consecutive quarter of expansion, but the slowest of the year. It is significant that real GDP increased by 0.2% from July to September. The figure reinforced the argument that the Reserve Bank of Australia may not need to continue to tighten its policy.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Meanwhile, annual GDP growth remained at 2.1%, showing little change from the previous quarter.

Furthermore, the decline is seen as a deliberate result of the Reserve Bank of Australia’s monetary efforts to bring inflation back within the target range of 2-3%. Inflation of 4.9% was recorded in October.

As a result, the Reserve Bank of Australia decided on Tuesday to maintain its current stance. The bank plans to assess the impact of a significant increase in interest rates by 425 basis points since May last year.

As such, market sentiment is now leaning towards the belief that the RBA may not need to implement further hikes, especially given the recent moves by the Federal Reserve and the European Central Bank.

Meanwhile, in the United States, data pointed to the lowest level of US job creation in October in more than 2-1/2 years. This is a strong indication that higher interest rates are stifling the demand for workers. In addition, the data revealed 1.34 job vacancies for every unemployed person in October, the lowest level since August 2021.

AUD/USD key events today

- US ADP change in non-farm employment

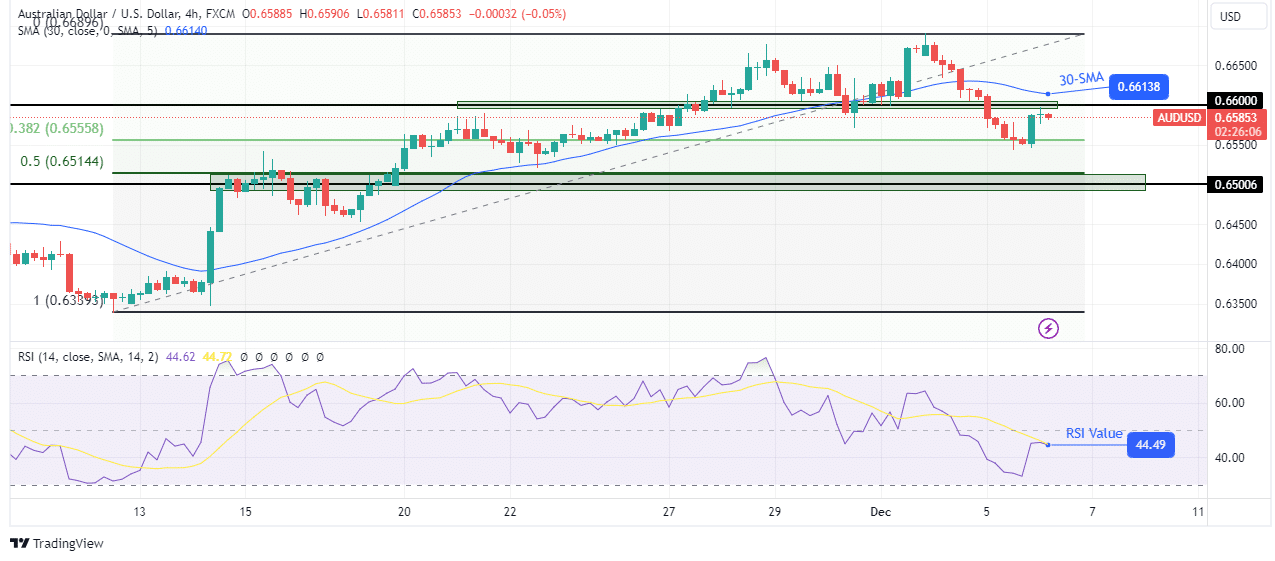

AUD/USD Price Technical Analysis: Bounce finds strong resistance at 0.6600

The bias for AUD/USD on the technical side is bearish as the price made a lower low below the 30-SMA. At the same time, the RSI is in bearish territory below 50, supporting bearish momentum. However, the bears found strong support at the fib retracement level of 0.382. This led the price to pull back to retest the recently broken key level of 0.6600.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

However, the bulls will not take control until the price crosses the 30-SMA. Therefore, there is a good chance that the price will make a lower high and bounce lower. The next downtrend target is at the 0.5 fib level, near the key 0.6500 level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.