- Traders are betting on an ECB key rate cut from March 2024.

- The euro is down 1 percent this week, its biggest weekly drop since May.

- US private payrolls rose less than expected in November.

On Thursday, the euro fell to its lowest level in more than three weeks, forming a bearish EUR/USD outlook as traders bet on an ECB rate cut starting in March 2024. Meanwhile, the dollar held steady ahead of key wages data this week.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

The euro is down 1 percent this week, its biggest weekly drop since May. Traders estimate an 85% probability that the ECB will cut interest rates at its March meeting. Moreover, they are pricing in nearly 150 basis points of easing by the end of next year.

Meanwhile, a Reuters poll shows most economists expect the ECB to cut rates in the second quarter of next year.

In an interview published on Wednesday, ECB member and head of the Bank of France Francois Villeroy de Gaulle hinted at the possibility of a rate cut starting in 2024. In addition, he cited a faster-than-expected drop in inflation. The ECB is expected to keep interest rates at their current record high of 4% next week. However, the focus will shift to comments from officials on the rate outlook.

Elsewhere, data showed U.S. private payrolls rose less than expected in November, signaling a gradual cooling in the labor market. Investors will closely monitor Friday’s nonfarm payrolls data for a clearer view of the labor market.

Soft economic data and comments from Fed officials fueled expectations that the central bank is ending its rate-hiking cycle and could begin cutting rates as early as March.

EUR/USD key events today

- US Jobless Initial Claims Report

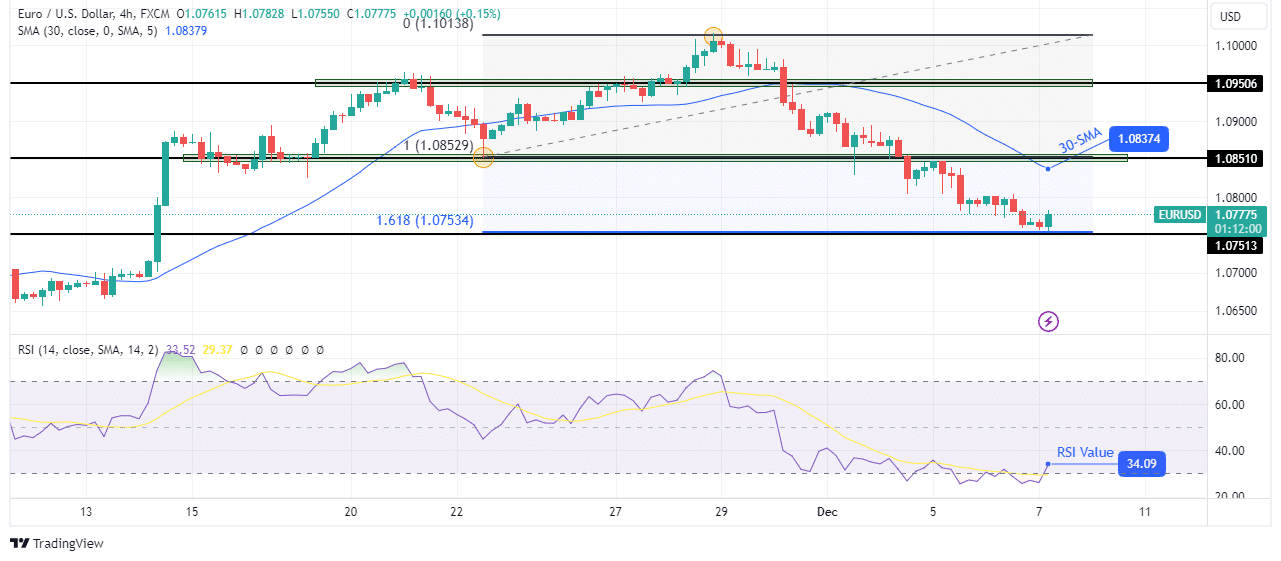

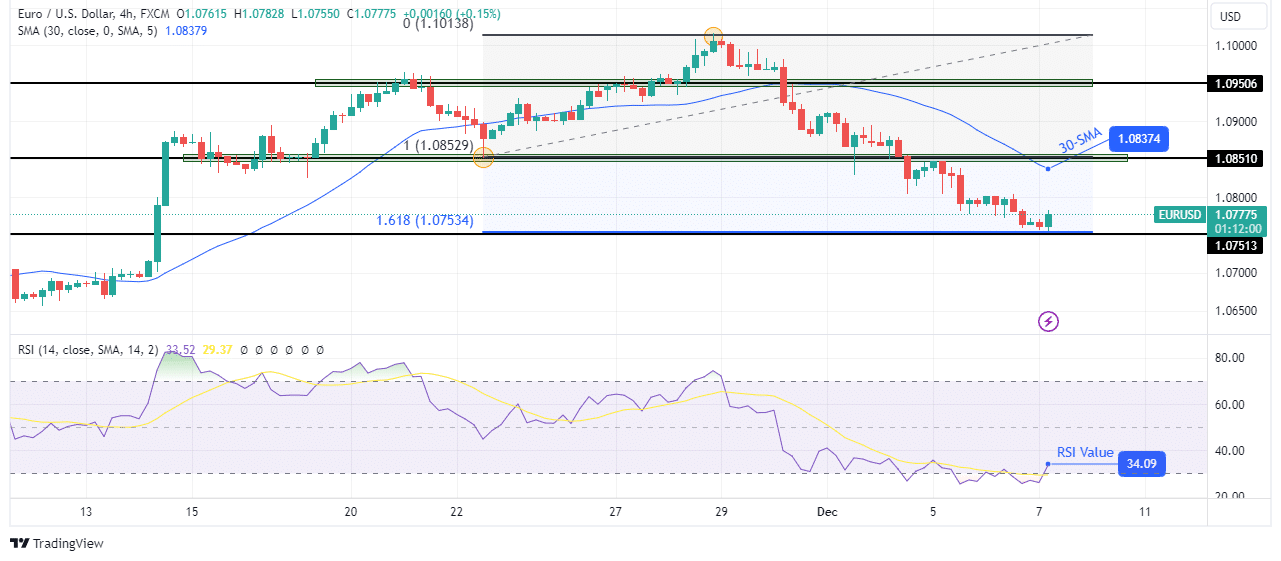

Technical outlook for EUR/USD: Buyers ready to return to 1,618 Fib extension

After breaking below the key support level of 1.0851, EUR/USD collapsed to the support of 1.0751. There is a solid bearish bias, supported by the 30-SMA, which is trading well above the price. At the same time, the RSI held close to the oversold region, indicating strong bearish momentum.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

However, the price fell without significant movements. Therefore, strong support may lead to a deeper pullback for EUR/USD before the downtrend continues. Notably, the price is close to the key fib extension level of 1,618. This and the 1.0751 level are likely to be strong enough to trigger a deep pullback.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.