- The Canadian dollar weakened after the Bank of Canada kept rates steady at 5%.

- Oil fell for a seventh week on concerns over oversupply.

- The US economy reported 199,000 jobs last month, while the unemployment rate fell to 3.7%.

There is bullish optimism in the weekly USD/CAD forecast amid a stronger dollar. Stronger-than-expected employment growth in the US points to a still tight labor market, supported by the dollar.

–Are you interested in learning more about ECN brokers? Check out our detailed guide-

USD/CAD Ups and Downs

USD/CAD closed the week higher amid key developments in Canada and the US. The Canadian dollar weakened after the Bank of Canada kept rates steady at 5%. However, the bank indicated the possibility of another rate increase as inflation remains a concern. Moreover, the weakness came amid falling oil prices. Oil fell for a seventh week on concerns over oversupply.

Meanwhile, the dollar ended the week on the front foot after stronger-than-expected employment data. The US economy reported 199,000 jobs last month, while the unemployment rate fell to 3.7%.

Next week’s key events for USD/CAD

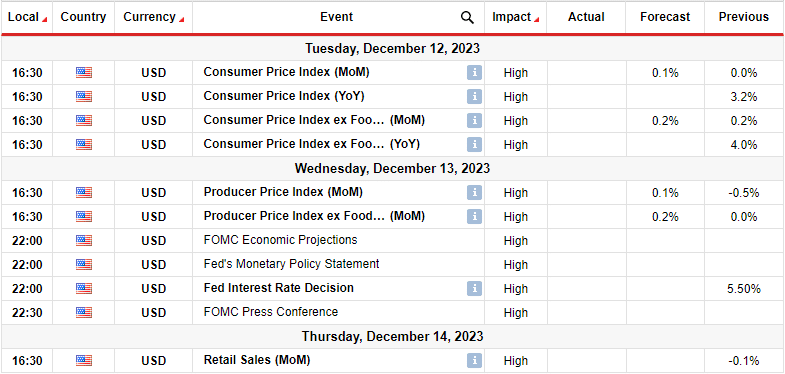

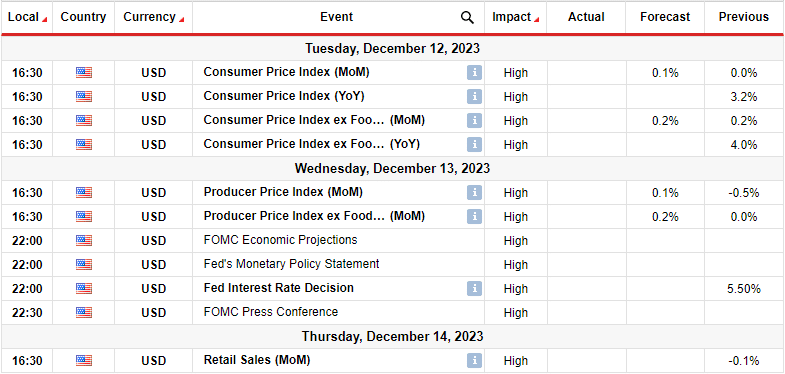

Next week is packed with high-impact events from the US, including the Fed meeting and inflation and retail sales data.

Consumer and producer inflation data will be released before the Fed meeting. Therefore, these reports will determine whether the Fed is a hawk or a dove at the meeting. Falling inflation will suggest a more dovish Fed and increase bets for a rate cut.

Meanwhile, the Fed is likely to hold rates steady on Wednesday. In addition, the Fed will present a summary of its economic projections, revealing officials’ expectations for rates for the coming year.

USD/CAD weekly technical forecast: 1.3502 level temporarily halts decline

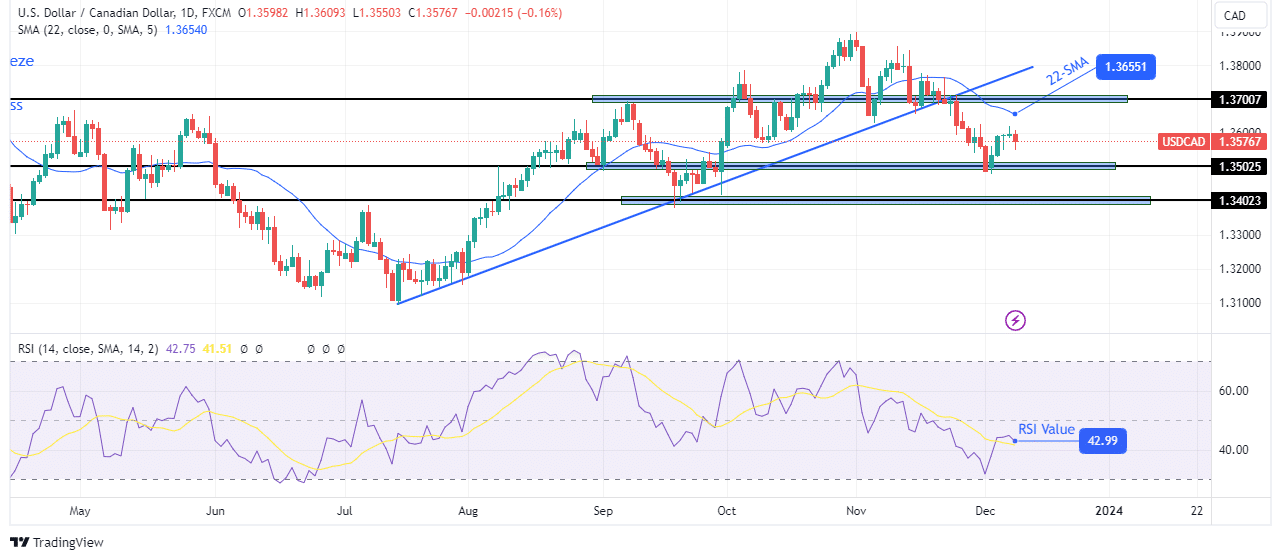

After trading in a bullish trend for a while, the price broke below its support trend line, signaling a reversal. At the same time, the RSI fell well below the central level of 50, indicating a change in sentiment.

–Are you interested in learning more about day trading brokers? Check out our detailed guide-

The decline is paused at the 1.3502 support level for a short bounce. However, the bearish bias is strong, which means that the recovery is only temporary. Bears are probably waiting at the nearest resistance level to continue the downtrend. If the price continues to rise next week, it will likely stop at the 22-SMA resistance.

However, there is also a chance that the price will climb higher to retest the recently broken trend line. However, once the bears return, the price will drop to retest the support levels at 1.3502 and 1.3402.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.