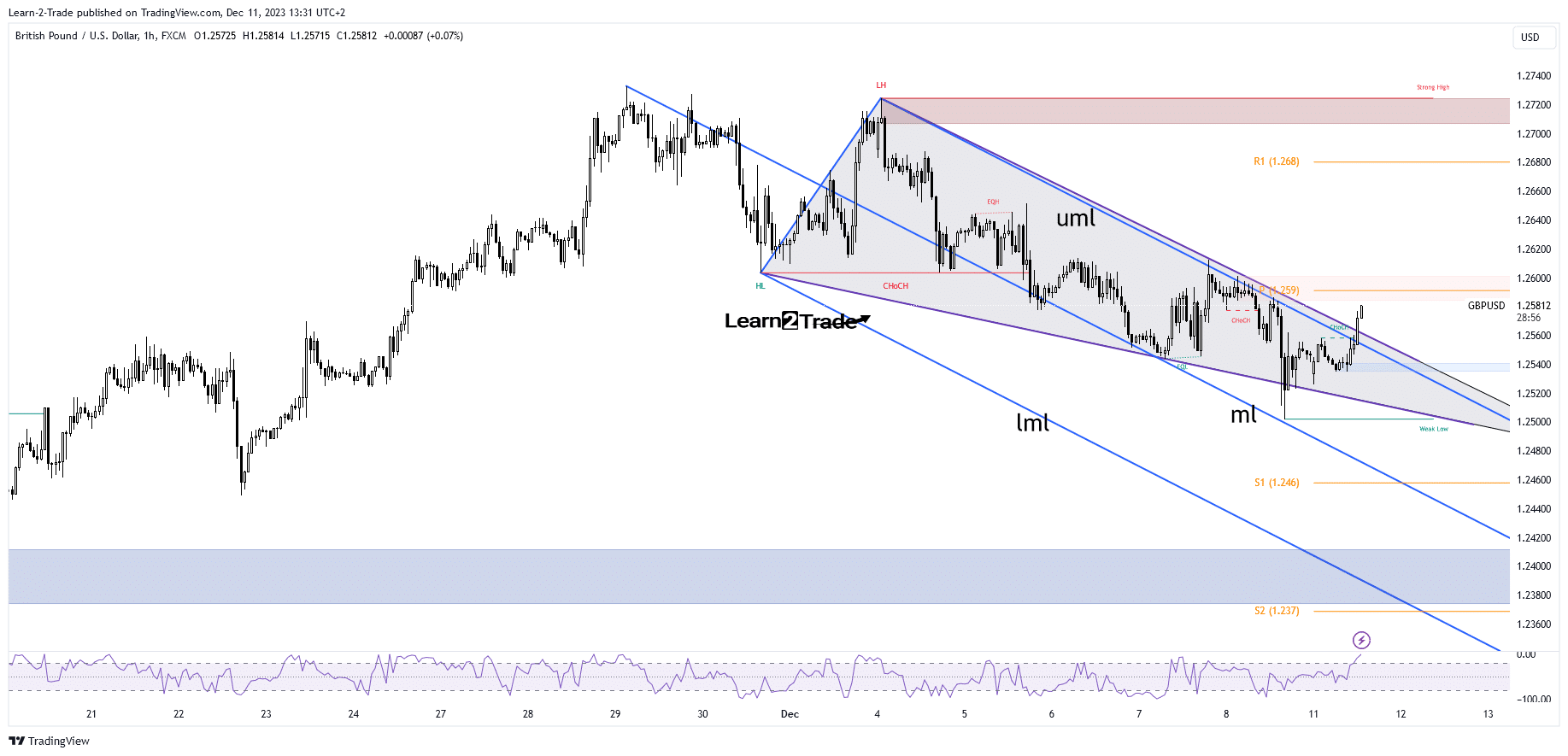

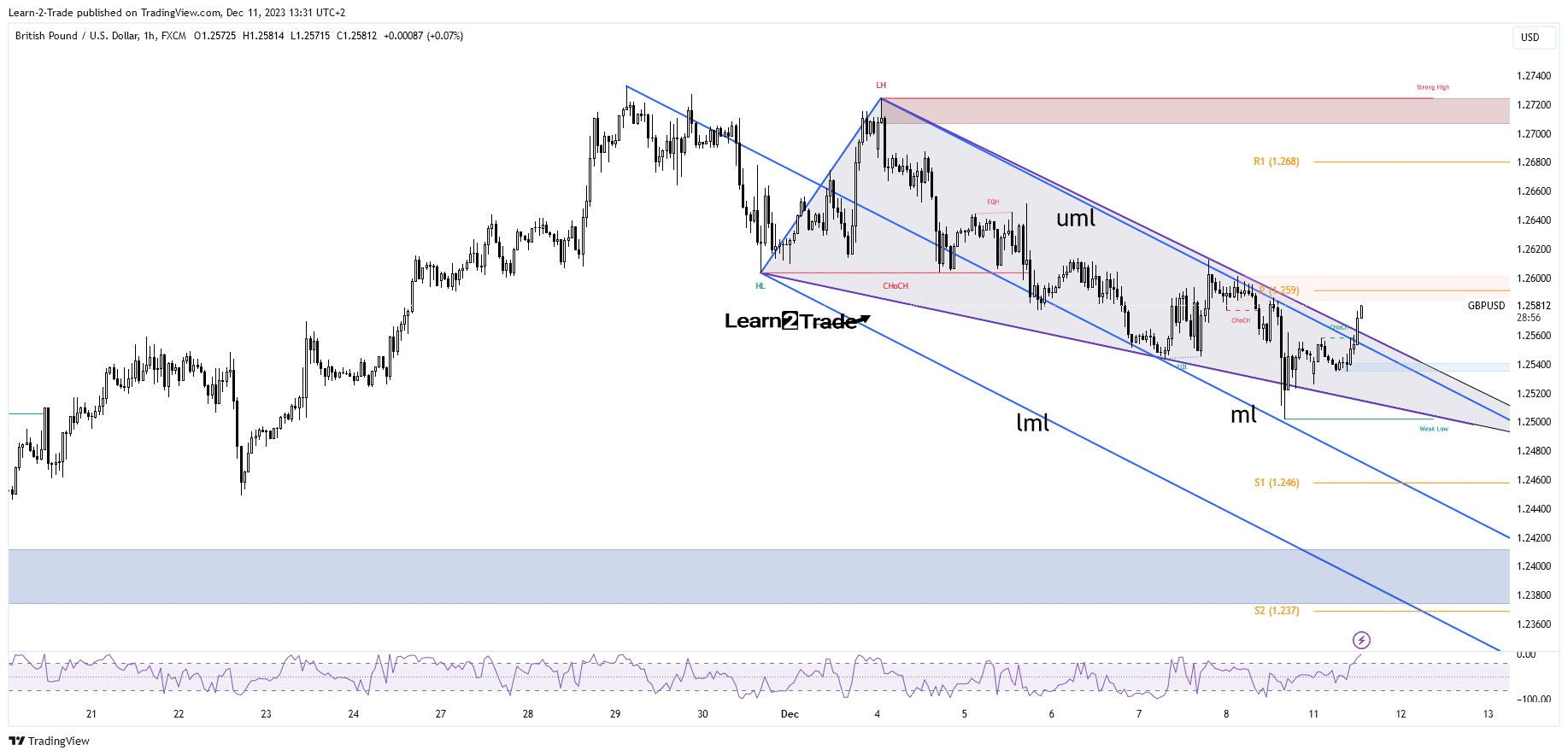

- Clearing the psychological level 1.26 activates further growth.

- Its failure to retest the median line (ml) heralded exhausted sellers.

- The consumer price index in the US should bring sharp developments.

The GBP/USD price turned higher, trading at 1.2579 at the time of writing. Surprisingly or not, the pair bounced back higher after hitting Friday’s low of 1.2502, even as the US released better-than-expected data.

–Are you interested in learning more about ECN brokers? Check out our detailed guide-

US payrolls totaled 199,000 vs. 184,000 expected, average hourly earnings rose 0.4%, beating estimates of 0.3% growth, the unemployment rate unexpectedly fell from 3.9% to 3.7%, while Prelim UoM Consumer was reported higher at Senti 69.4 points against 62.0 forecast.

Unfortunately for the US dollar, the US dollar printed a temporary pullback after hitting the key upside barrier of 104.21. Removing this obstacle activates further growth and helps the dollar dominate the currency market. Fundamentals should have a big impact tomorrow. The US will release inflation data. The consumer price index could post a 0.0% increase in November after a 0.0% increase in October. The CPI could register an annual growth of 3.1%, while the core CPI is expected to register a growth of 0.3%, compared to a growth of 0.2% in the previous reporting period.

On the other hand, the United Kingdom should publish data on changes in the number of claimants, average hourly earnings and the unemployment rate.

GBP/USD technical analysis: bullish momentum

From a technical point of view, the GBP/USD pair developed a falling wedge pattern after failing to break out the middle line (ml) of the descending fork. Its failure to retest this dynamic support heralded exhausted sellers.

–Are you interested in learning more about day trading brokers? Check out our detailed guide-

As you can see, the price has jumped above the downtrend line (pattern resistance) and through the upper middle line (uml), signaling a new leg higher. It is now almost at the weekly midpoint of 1.2590. This represents the static resistance. Removing this level and stabilizing above the psychological level of 1.26 activates further growth.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.