- In November, US employers expanded their payrolls by 199,000 workers.

- Consumer sentiment in the US improved in December.

- The US central bank is likely to keep rates within the existing range of 5.25%-5.50%.

Entering Sunday, the EUR/USD outlook was bearish, with the euro holding close to a more than three-week low of $1.07235 set on Friday. Meanwhile, the pair fell on Friday as the dollar rose, boosted by upbeat employment data.

–Are you interested in learning more about ECN brokers? Check out our detailed guide-

In November, US employers expanded their payrolls by 199,000 workers, beating economists’ expectations of 180,000. Moreover, the report revealed an unexpected drop in the unemployment rate to 3.7% from October’s 3.9%.

Despite a strong U.S. labor market, traders speculated on Friday that the Federal Reserve could continue its string of interest rate cuts next year. However, the first cut could come later than expected, in May. Before Friday’s jobs report, there was a likelihood that a 60 percent rate cut would begin in March. However, the data has reduced that to just under 50%, with the first cut now more likely to occur in May.

Meanwhile, another report on Friday indicated a more significant improvement than expected in US consumer sentiment for December.

Attention now shifts to US inflation data due on Tuesday, with consumer prices expected to continue to ease year-on-year. The Fed will announce its policy decision on Wednesday after a two-day meeting. In particular, the US central bank is likely to keep rates within the existing range of 5.25%-5.50%.

EUR/USD key events today

Traders do not expect major events from the Eurozone or the US today. As a result, the pair could consolidate ahead of the US inflation report.

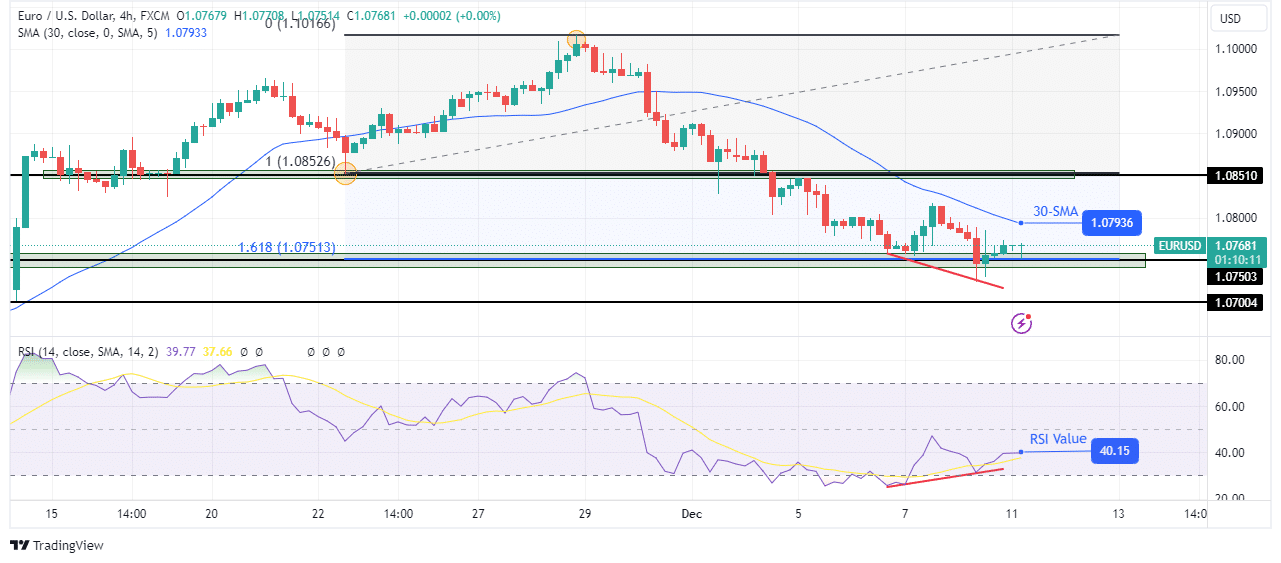

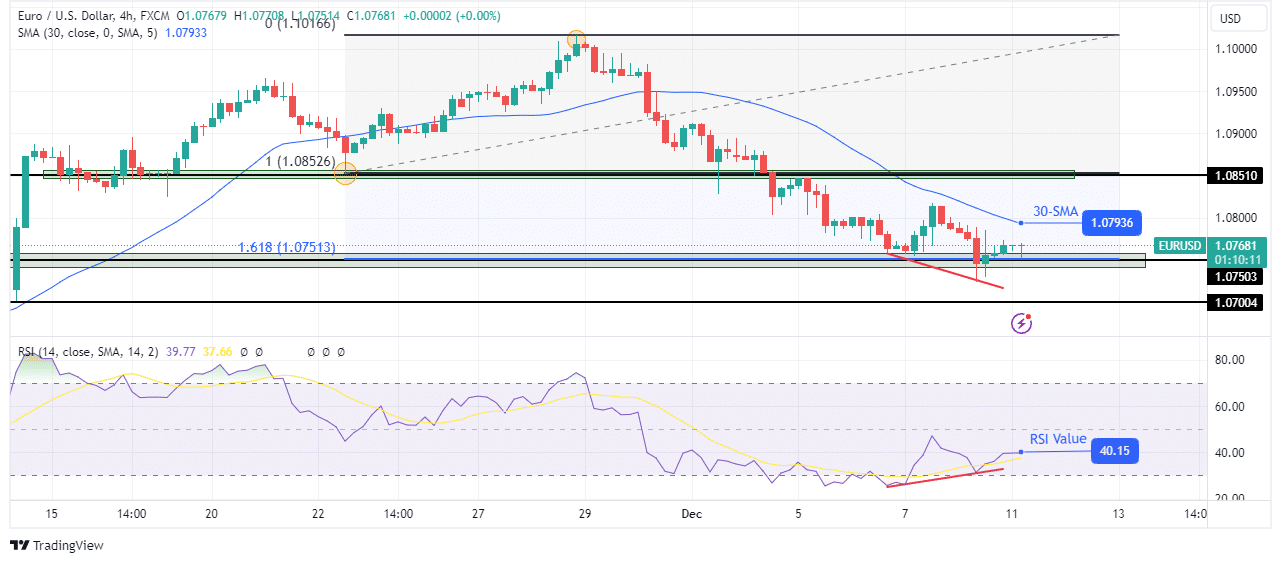

Technical outlook for EUR/USD: Downtrend stops at fib extension level at 1,618

on charts, Euro the bulls returned after the bears were rejected below the key support level of 1.0750. However, bearish bias remains strong as price is trading below 30-SMA with RSI below 50.

–Are you interested in learning more about day trading brokers? Check out our detailed guide-

However, the bulls could soon strengthen. The RSI is showing a bullish divergence, a sign that bears have weakened at the key 1.0750 level. Moreover, the price extended to the 1,618 fib level of the previous swing. This large extension can lead to a deep pullback or reversal. The downtrend will only continue if the 30-SMA resistance remains firm.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.