- US inflation data will shape the Federal Reserve’s policy decision on Wednesday.

- US headline inflation is expected to remain flat for November.

- The difference in interest rates between the UK and the US could widen in the coming year.

Traders turned their attention to upcoming US inflation data and various central bank meetings, leading to a lower dollar leading GBP/USD price analysis on Tuesday. Inflation data in the US will shape Fed policy on Wednesday.

–Are you interested in learning more about ECN brokers? Check out our detailed guide-

Headline inflation for November is likely to remain unchanged. At the same time, core inflation is likely to remain steady at an annual rate of 4% – well above the Fed’s 2% target. The dollar has been sliding since October’s soft US inflation report. However, it stabilized following positive jobs data released on Friday.

Meanwhile, the pound strengthened against the dollar on Monday as investors braced for a busy week of data releases and central bank meetings, including the Bank of England’s policy meeting on Thursday.

Most market participants do not foresee a change in the current bank rate, which is at a 15-year peak of 5.25%. As a result, the focus has shifted to when the BoE might cut interest rates.

Stuart Cole, chief macroeconomist at Equity Capital, attributed the pound’s rise on Monday partly to the underlying expectation that the interest rate differential between the UK and the US will widen in the coming year.

Furthermore, the UK will release GDP data on Wednesday to provide insight into the country’s economic health.

On Monday, Make UK, the manufacturing trade body, reported that Britain’s struggling factories were showing signs of recovery. This is due to the long-awaited restocking and increased export orders, which offer potential support to the sector in the challenging year ahead.

GBP/USD key events today

- US core CPI month over month

- US CPI month over month

- US CPI year over year

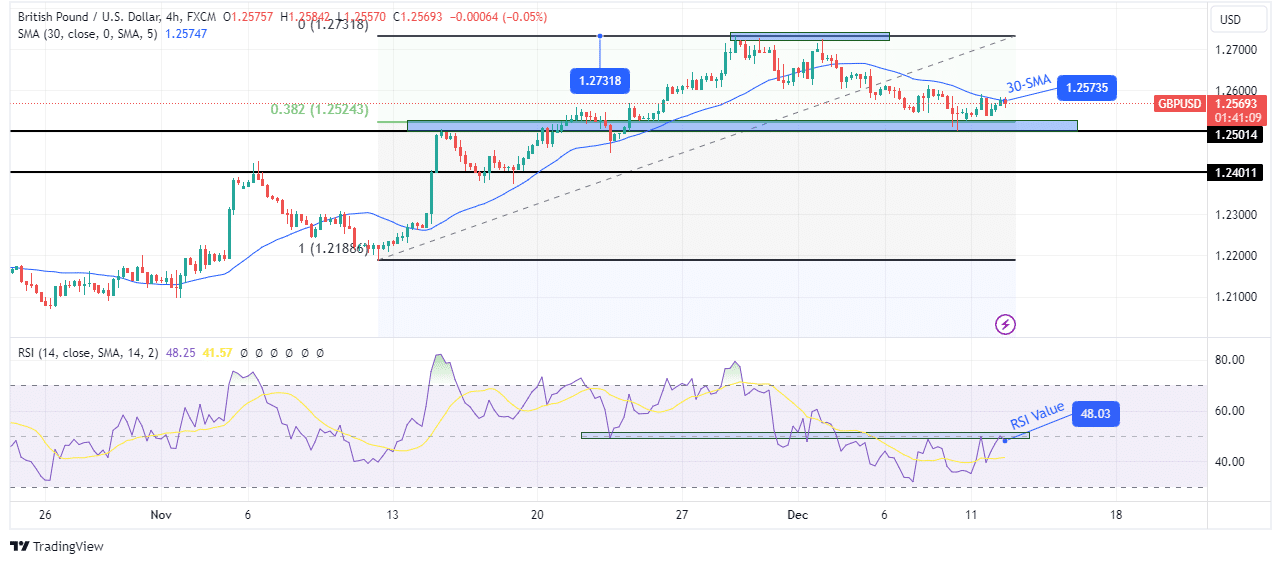

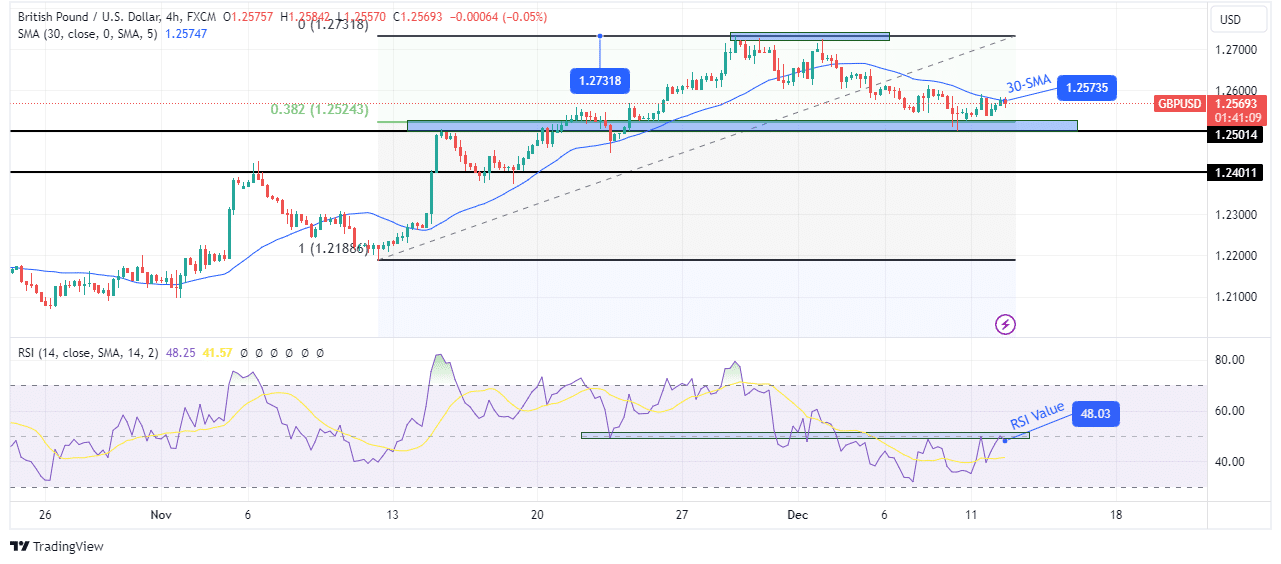

GBP/USD technical price analysis: Bears return when price meets 30-SMA resistance

After a strong bullish trend, sentiment has turned bearish for GBP/USD. Price is currently making new lows below the 30-SMA. At the same time, the RSI respects the key level of 50 and remains below in bearish territory.

–Are you interested in learning more about day trading brokers? Check out our detailed guide-

However, the new bearish move is stopped at the support zone consisting of 0.382 fib retracement and 1.2501 support level. This triggered a bounce to the 30-SMA resistance. Given the bearish bias, the price is likely to respect the 30-SMA resistance and bounce lower. Meanwhile, a break below the support at 1.2501 would allow the price to retest the support level at 1.2401.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.