- XAU/USD is strongly bullish as the DXI fell after the FOMC.

- Breaking the resistance level may herald further growth towards the middle line.

- BOE and ECB should bring high volatility today.

The price of gold rose after a break from yesterday’s low of $1,973. The precious metal climbed as high as $2,040 today.

It has now pulled back a bit and is trading at 2,035 at the time of writing. KSAU/USD strengthened as the USD depreciated against its rivals after the FOMC.

–Are you interested in learning more about ECN brokers? Check out our detailed guide-

The US dollar fell after the release of the federal funds rate, the FOMC statement and the FOMC economic projections. However, the FOMC press conference was decisive, punishing the dollar. The Fed announced a potential tapering of 75 bps in 2024.

Fundamentals should move the rate again today. As expected, the SNB left the monetary policy unchanged. The policy rate of the SNB remained at 1.75%.

Later, the Bank of England is expected to keep the official bank rate at 5.25%, but the Monetary Policy Summary and MPC official rate vote could have an impact.

In addition, the ECB should maintain monetary policy. Only an ECB press conference could change the mood.

Also, don’t forget that the US will release retail sales data. Retail sales and core retail sales indicators could herald a 0.1% decline, while jobless claims could be reported at 219k in the latest week.

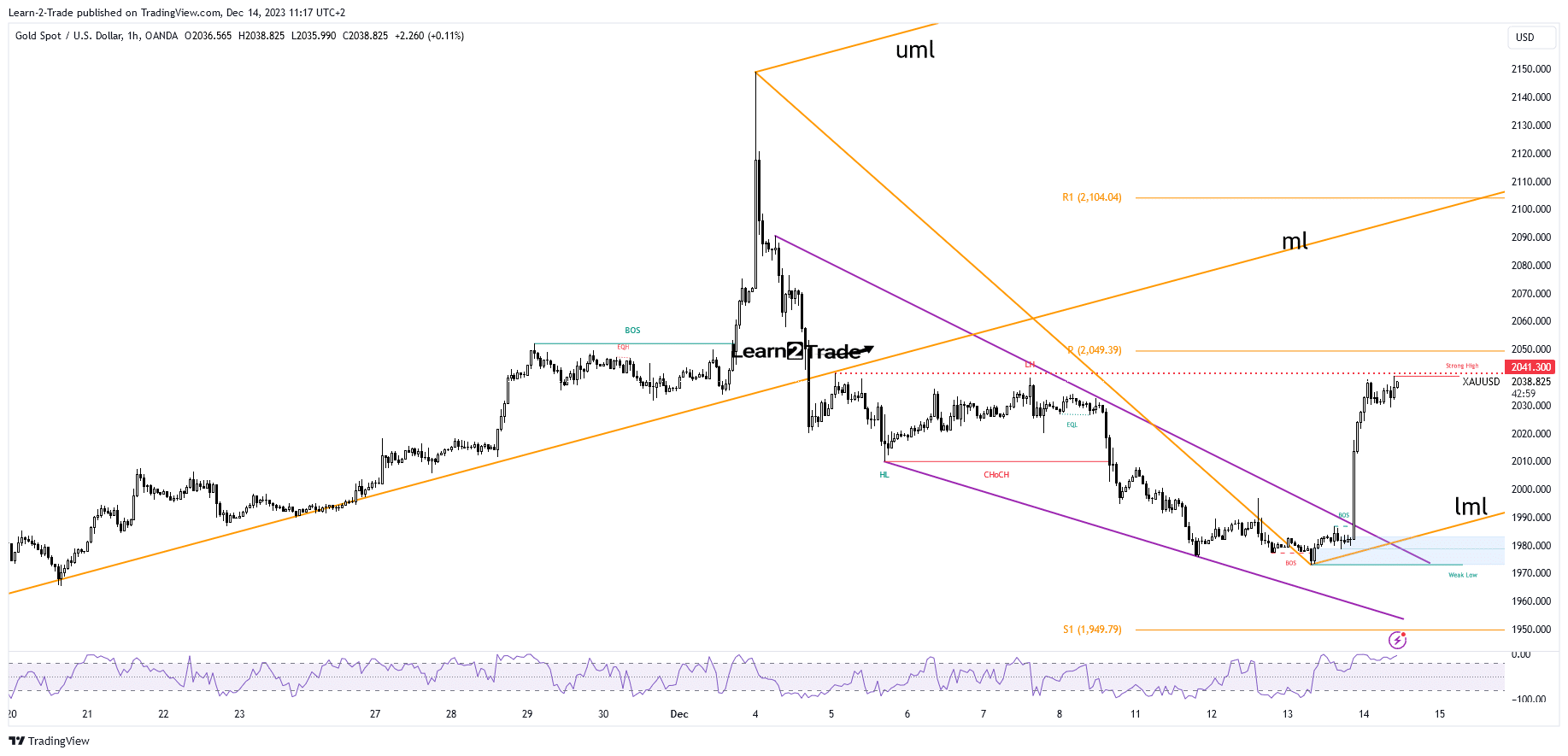

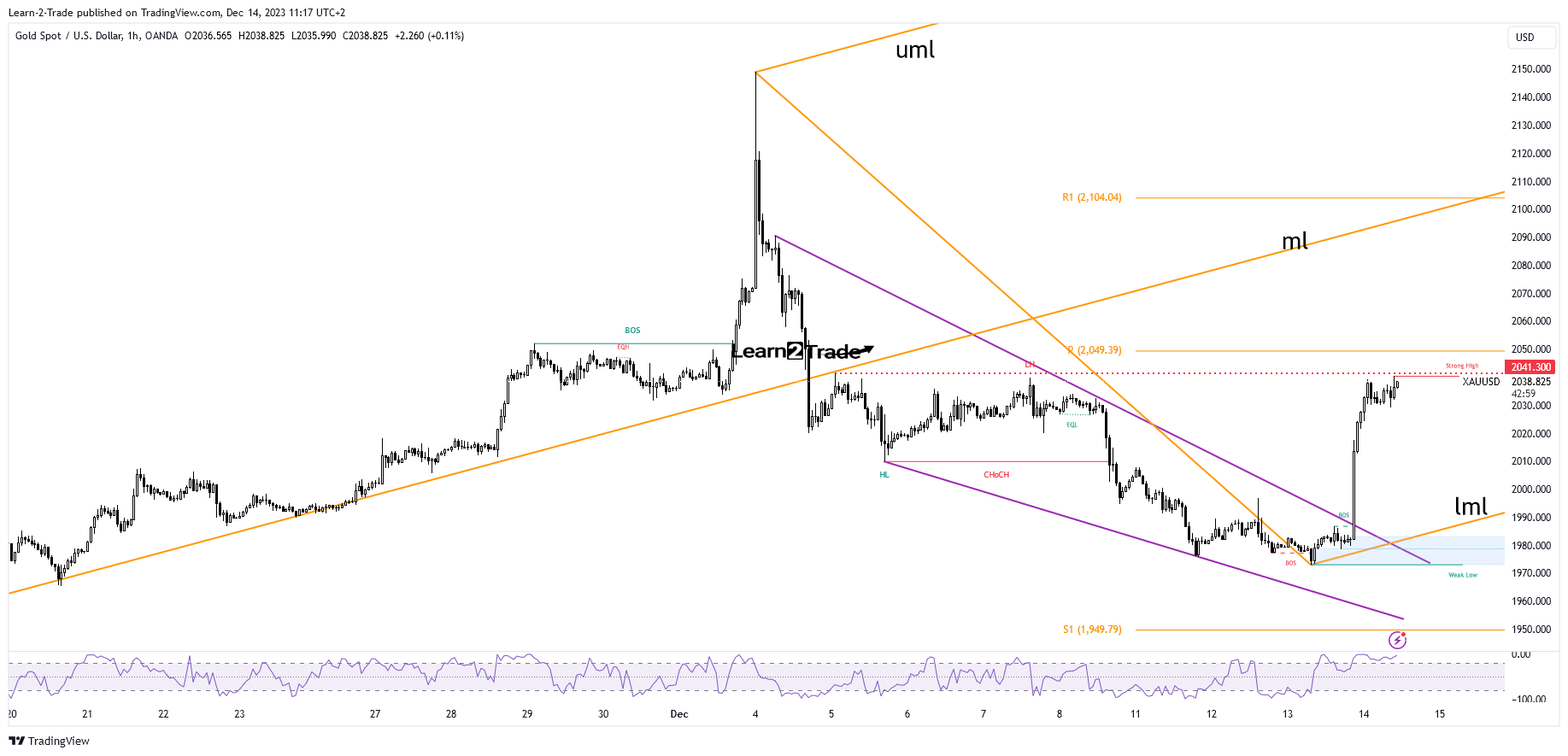

Gold price technical analysis: 2.041 static resistance

Technically, KSAU/USD rallied after breaking the falling wedge pattern. The price action revealed exhausted sellers.

It was now almost at its former high of $2,041. This represents the static resistance. It remains to be seen how they will react on that, as false breakouts could lead to another sell-off in the short term.

–Are you interested in learning more about day trading brokers? Check out our detailed guide-

The weekly pivot point of $2,049 is also an important roadblock. I have drawn ascending forks where the middle line (ml) is seen as the main target if the rate continues to rise. KSAU/USD confirms more gains clearing current resistance levels.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.