- ECB policymakers have tried to discourage traders from speculating on an impending rate cut.

- Traders raised their bets on lower ECB rates after lower UK inflation.

- Investors await final estimates of US GDP in the third quarter.

ECB policymakers failed to reduce interest rate cut expectations, resulting in a drop in the EUR/USD forecast on Thursday. Two influential ECB hawks tried on Wednesday to discourage traders from speculating on an impending rate cut. However, their efforts did not yield any results. Furthermore, investors remained cautious ahead of the US GDP report.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Bundesbank President Joachim Nagel and his Dutch counterpart Klaas Knot emphasized the need for the ECB to take time before signaling victory over historically high inflation.

Nagel said: “We need to stay on the current plateau of interest rates initially so that monetary policy can fully develop its inflation dampening effect.” In addition, he warned speculators to expect an imminent cut in interest rates, advising them to be cautious as some have already miscalculated.

However, Nagel acknowledged that rates have probably reached their peak. This sentiment was echoed by Knott. However, traders kept their expectations. Notably, after inflation in Britain was weaker than expected, they raised their bets on lower ECB rates.

Furthermore, money markets fully expect a 150 basis point cut for next year. That would raise the ECB’s deposit rate to 2.5%. Moreover, there is little risk that ECB rates will end the year at 2.25%.

At the same time, investors eagerly awaited more US economic data for additional insight into the global interest rate path. Final estimates of US third-quarter GDP and the weekly jobless claims report will provide clues about the Fed’s rate cut.

EUR/USD key events today

- US Gross Domestic Product Report

- First US Jobless Claims Report

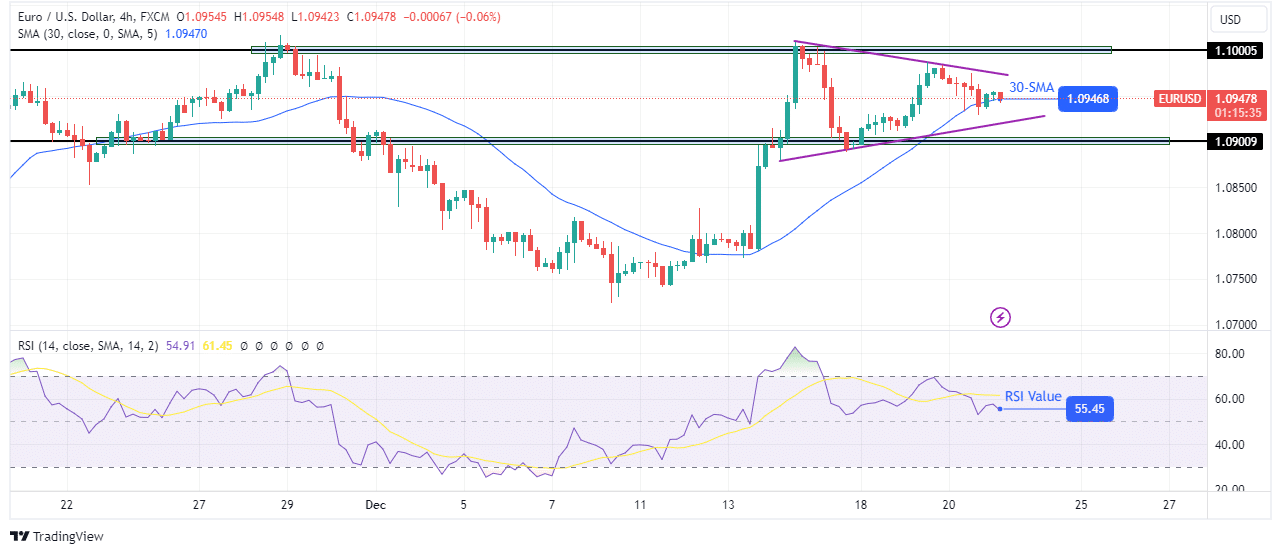

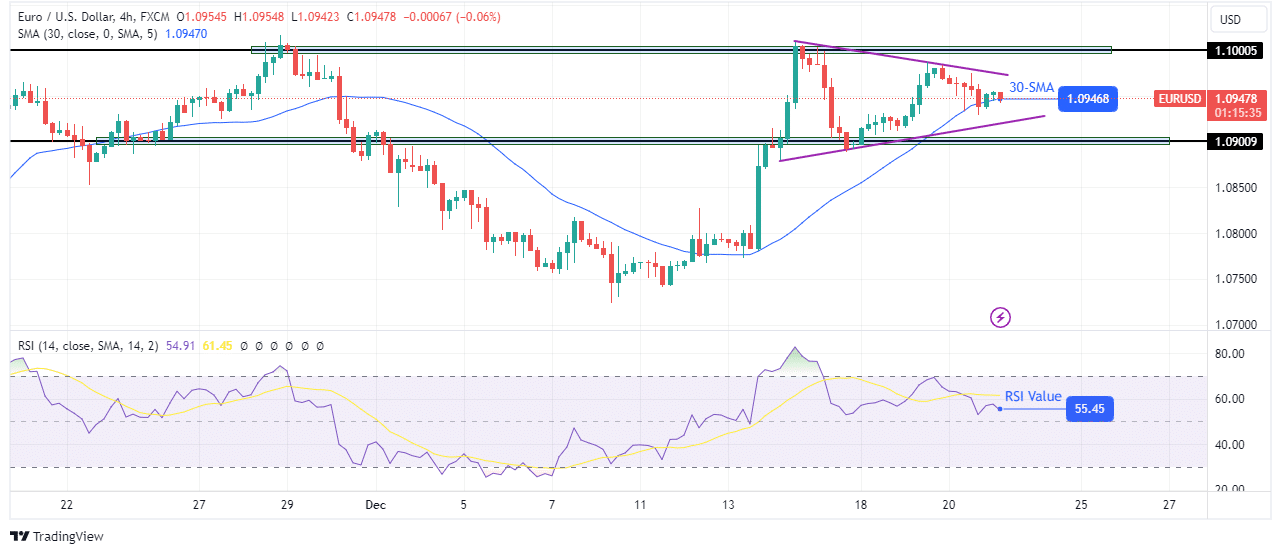

Technical outlook for EUR/USD: Price is consolidating after strong resistance

On the charts, the EUR/USD uptrend paused to consolidate after encountering strong resistance at the key 1.1000 level. The price is now trading between the resistance level of 1.1000 and the support level at 1.0900. Moreover, the price respects the clear support and resistance levels of the trend line, forming a wedge pattern.

–Are you interested in learning more about forex tools? Check out our detailed guide-

Looking at the indicators, the RSI is above 50, while the 30-SMA is below the price, indicating a bullish bias. Therefore, the bulls could get another opportunity to retest the key resistance level of 1.1000. However, if the price breaks below the SMA, it could continue to consolidate between the key levels of 1.1000 and 1.0900.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.