- Prices in UK chain stores rose at their slowest pace in a year and a half.

- Food price inflation in Britain fell to 6.7%.

- British output and employment fell sharply in December.

On Wednesday, the GBP/USD forecast is tipping bearish, boosted by a recovering dollar and promising signs of easing inflation in Britain. Moreover, the currency’s decline is a reversal from a recent rally in December when it jumped to a near 5-month high on dollar weakness.

If you are interested in automated Forex trading, check out our detailed guide-

Meanwhile, 2023 rose nearly 6% as economic data came in better than expected. Namely, the markets expected the BOE to keep interest rates high for longer. However, the economy is weakening, and the upcoming elections mean uncertainty. Therefore, the pair may not recover as much this year.

Meanwhile, prices at UK chain stores rose at their slowest pace in a year and a half in December, it was reported on Tuesday. On the other hand, food price inflation fell to 6.7%.

However, Monaco analysts sounded a note of caution for bearish pounds.

“Although the margin data is disinflationary, market expectations for a UK rate cut remain aggressive,” they said. Significantly, markets are fully appreciating the BoE’s 25 basis point rate cut in May and nearly 140 basis points this year.

In addition, investors processed data on global factory activity on Tuesday. Britain’s manufacturing sector has faced obstacles in its efforts to return to growth. In December, a larger decline in production and employment was recorded compared to the previous month.

GBP/USD key events today

- US ISM manufacturing PMI

- US JOLTs job openings

- FOMC meeting minutes

GBP/USD Technical Forecast: Break below key support triggers reversal

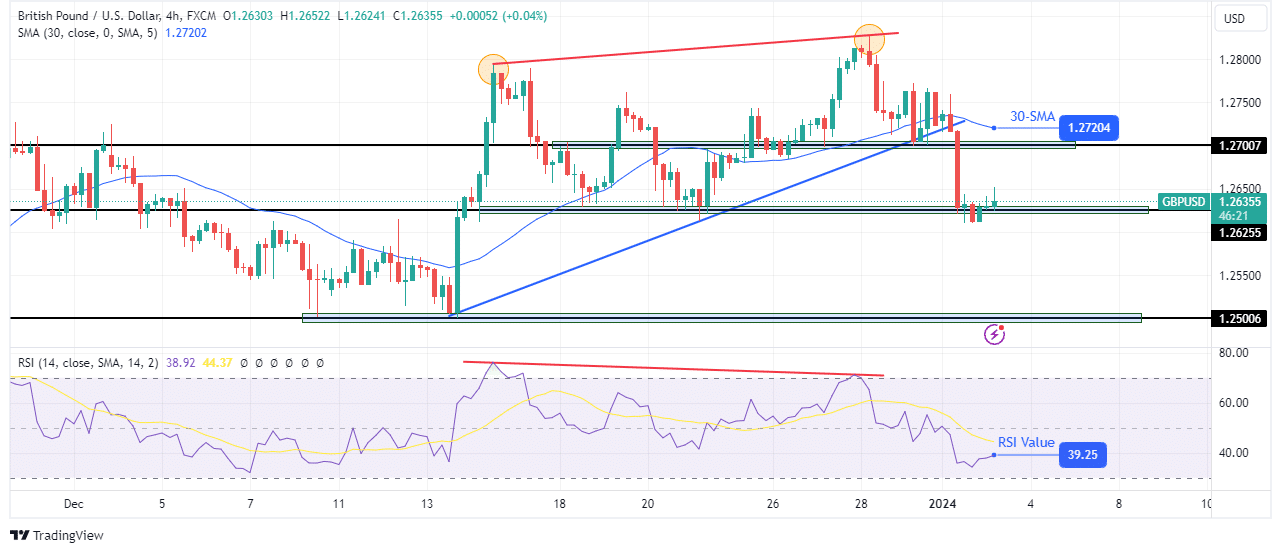

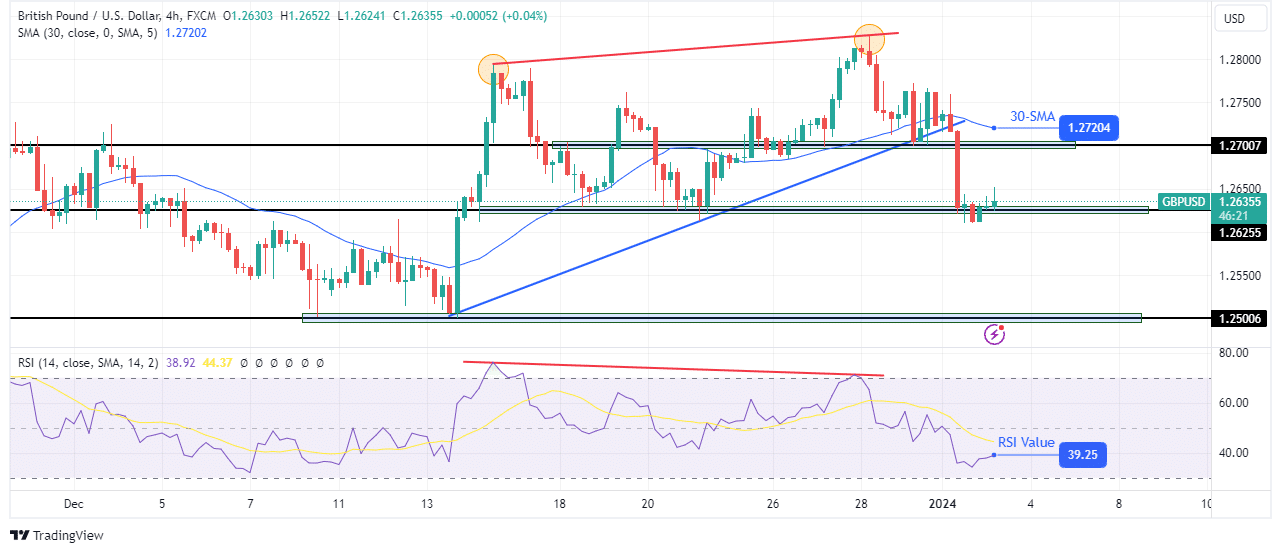

On the charts, the pound broke below a key support zone, signaling a reversal in the downtrend. Accordingly, there has been a bearish divergence in the RSI. Sellers have taken a break below the 30-SMA, the support trendline and key level of 1.2700.

If you are interested in guaranteed stop loss forex brokers, check out our detailed guide-

Moreover, the price formed a strong bearish candle with hardly any wicks, showing solid bearish momentum. The decline is halted at the key level of 1.2625 as bears prepare to make lower lows. There is a good chance that the decline will continue to the support level of 1.2500, as the RSI shows that the price is not yet oversold.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.