- Markets expect employment data to show an additional 170,000 jobs in the US in December.

- The data revealed a seventh straight monthly contraction in Canada’s services sector.

- The Canadian dollar was weaker as oil prices fell.

USD/CAD price analysis on Friday showed bullish sentiment driven by a stronger dollar due to reduced expectations of Fed rate cuts this year. Moreover, the currency was on hold as the market eagerly awaited the much-awaited US payrolls data later in the day. Markets expect employment data to show an additional 170,000 jobs in December, down from 199,000 recorded in November.

If you are interested in automated Forex trading, check out our detailed guide-

Meanwhile, the currency was mostly flat in the previous session as the Canadian dollar gave up earlier gains amid concerns about a possible recession. Notably, the data revealed a seventh straight monthly contraction in Canada’s services sector. The decline in service sector activity in December was influenced by high borrowing costs that affected the real estate market.

The business activity index was at 44.6, well below the 50 threshold that separates expansion from contraction. Moreover, the index has been below 50 since June.

Further, the Canadian dollar was weaker due to lower oil prices. The decline came as a significant weekly increase in gasoline and distillate inventories overshadowed a larger-than-expected increase in crude oil inventories.

In addition, Canada’s December employment report, scheduled for Friday, could provide additional insight into the state of the economy.

Meanwhile, US data on Thursday revealed that private payrolls saw a significant increase of 164,000 jobs over the past month. It is the most significant monthly gain since August.

USD/CAD Key Events Today

- Changing employment in Canada

- Unemployment rate in Canada

- US Non-Farm Payrolls

- Unemployment rate in the US

- US ISM services PMI

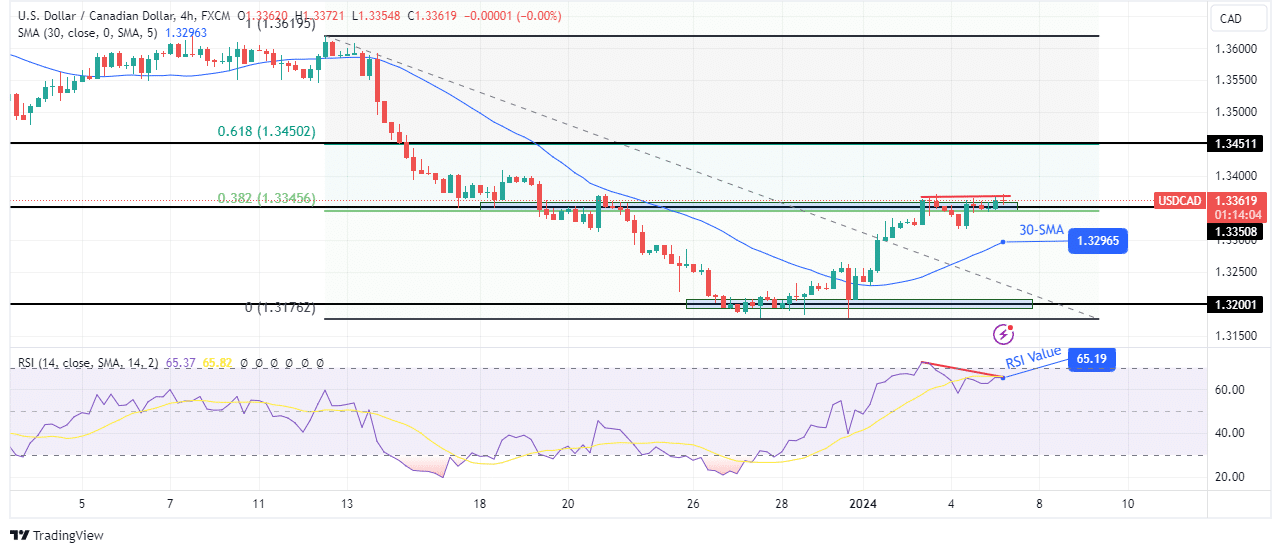

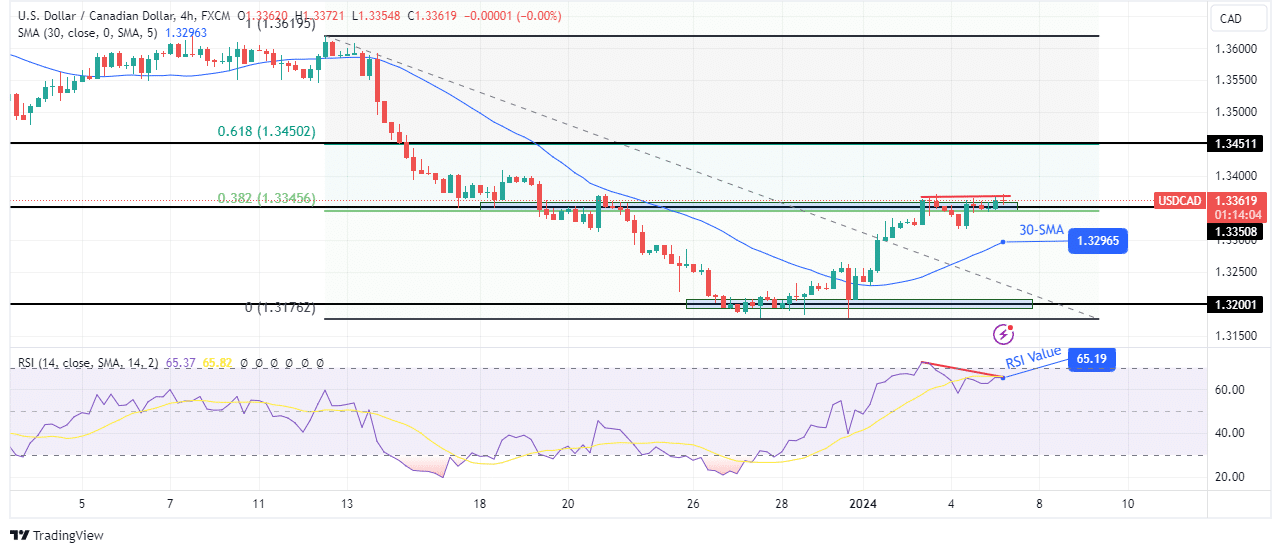

USD/CAD Technical Price Analysis: Momentum fades at stubborn resistance

On the technical side, USD/CAD has stalled in the resistance zone consisting of the 1.3350 resistance level and the 0.382 fib level. Indicators on the chart indicate a bullish bias, with the 30-SMA moving up and trading below the price and the RSI above 50.

If you are interested in guaranteed stop loss forex brokers, check out our detailed guide-

However, the bulls may be exhausted as the RSI has made a slight divergence. Although the price is stable in the resistance zone, the RSI is showing progressively weaker momentum. Consequently, we could get a dip to retest support at the 30-SMA or lower. Bulls can continue the uptrend only if they regain momentum and hold the price above the 30-SMA.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.