- The lower pressure remains high after failing to make a new higher high.

- A new lower low triggers more dips.

- Positive US data should lift the dollar.

The EUR/USD price lost its luster again on Friday. The pair is at 1.0913 at the time of writing. Basically, the US dollar got a helping hand from upbeat US data in the last session.

If you are interested in automated Forex trading, check out our detailed guide-

ADP Nonfarm Employment Change, Jobless Claims and Final Services PMI were better than expected.

Today, the Eurozone CPI Flash Estimate reported growth of 2.9%, less than the expected growth of 3.0%. The core CPI estimate was in line with expectations, with the PPI reporting a 0.3% decline, more than an estimate of a 0.1% decline, while German retail sales fell 2.5% compared to a forecast decline of 0. 5%.

Later, US economic figures should weigh on the price. Non-farm payrolls are expected to be 168 thousand compared to 199 thousand in the previous reporting period. Average hourly earnings could post a 0.3% rise in December, up from 0.4% in November, while the unemployment rate could jump from 3.7% to 3.8%.

Furthermore, the US will release ISM Services PMI and Factory Orders, while Canada will release Employment Change and the Unemployment Rate. Positive US data should lift the dollar.

Price EUR/USD Technical analysis: 1.0900 Buyer protection

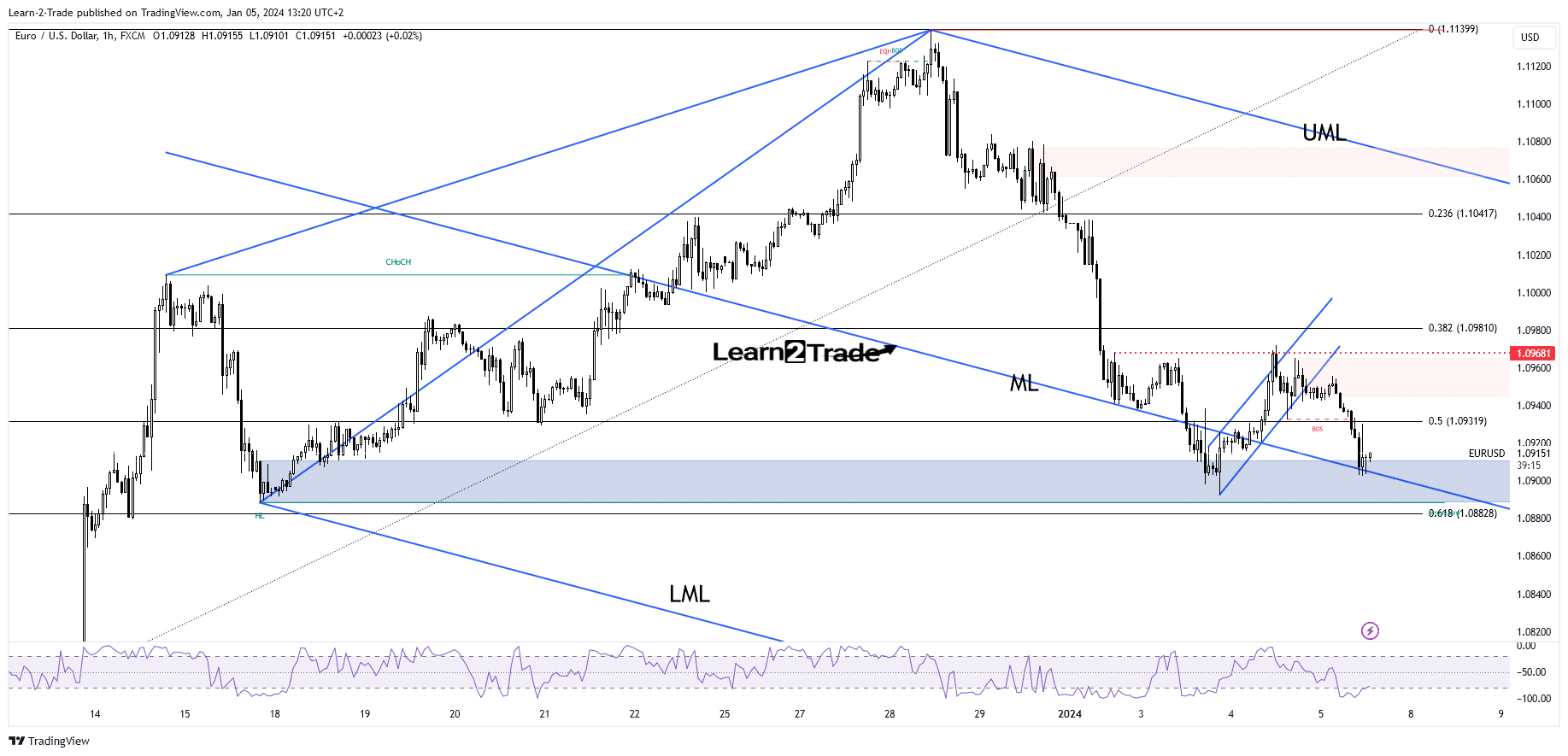

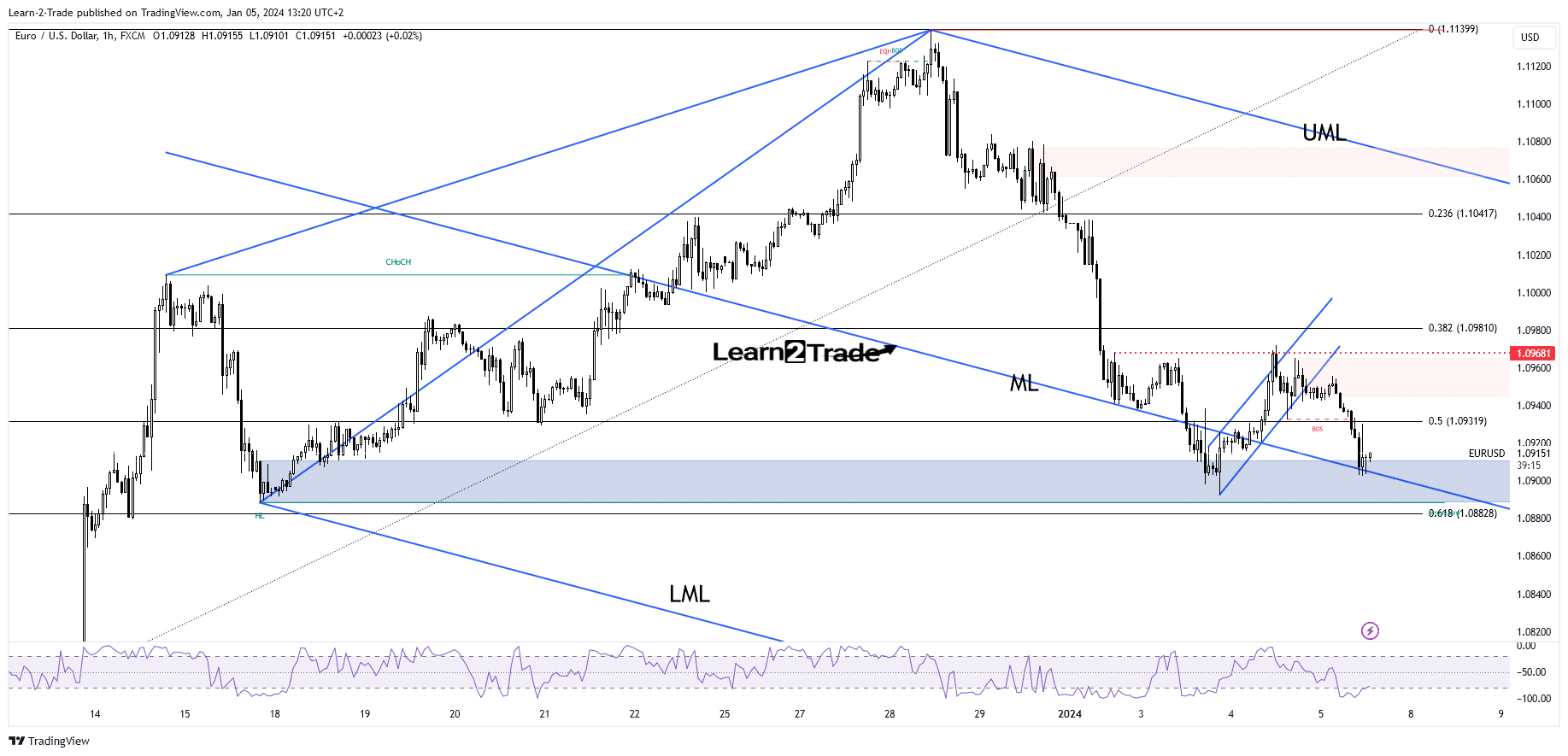

As you can see on the H1 chart, the price found resistance at 1.0968, and now it has reached the middle line (ML) of the descending villa again. This represents dynamic support, while the psychological level of 1.09 represents a static barrier to the downside.

If you are interested in guaranteed stop loss forex brokers, check out our detailed guide-

Technically, the lower pressure remains high after failing to make a new higher high. Making a new lower low and canceling the demand zone confirms more declines. A valid break below 61.8% (1.0882) could confirm a reversal. However, a break above the 1.09 level and only a false break below the current support level could herald a new move higher.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.