- The recovery in US Treasury yields supported the rise of the dollar.

- Data showed stronger-than-expected growth in US employment and wages in December.

- The Canadian economy added just 100 jobs in December.

The USD/CAD forecast points to the north as investor sentiment leans towards caution with all eyes on the key US inflation report due later in the week. Furthermore, traders adjusted their expectations for the number and size of Fed tapering this year. Accordingly, there was a recovery in US Treasury yields, which gave more support to the dollar.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Thursday’s upcoming US inflation reading could further weigh on views on a Fed rate cut. Current market prices point to a 64% chance the Fed could initiate a rate cut as early as March, compared with nearly 90% a week ago, according to the CME FedWatch Tool.

Meanwhile, data on Friday showed stronger-than-expected growth in US employment and wages in December, signaling a resilient labor market. However, a separate survey on the same day revealed a significant slowdown in the US services sector last month. It is significant that the number of employees reached the lowest level for almost three and a half years.

The Canadian dollar was little changed against the US dollar on Friday after a mixed report on jobs from the US and Canada.

The Canadian economy added just 100 jobs in December. However, wages of permanent employees increased at the fastest pace in the last three years. As a result, money markets are leaning towards April due to the Bank of Canada’s first rate cut. Furthermore, a Reuters poll suggests that if the Fed moves to cut interest rates before the Bank of Canada, the Canadian dollar will trade stronger than expected throughout the year.

USD/CAD Key Events Today

It will be a quiet session for USD/CAD as neither the US nor Canada will release high-impact economic reports.

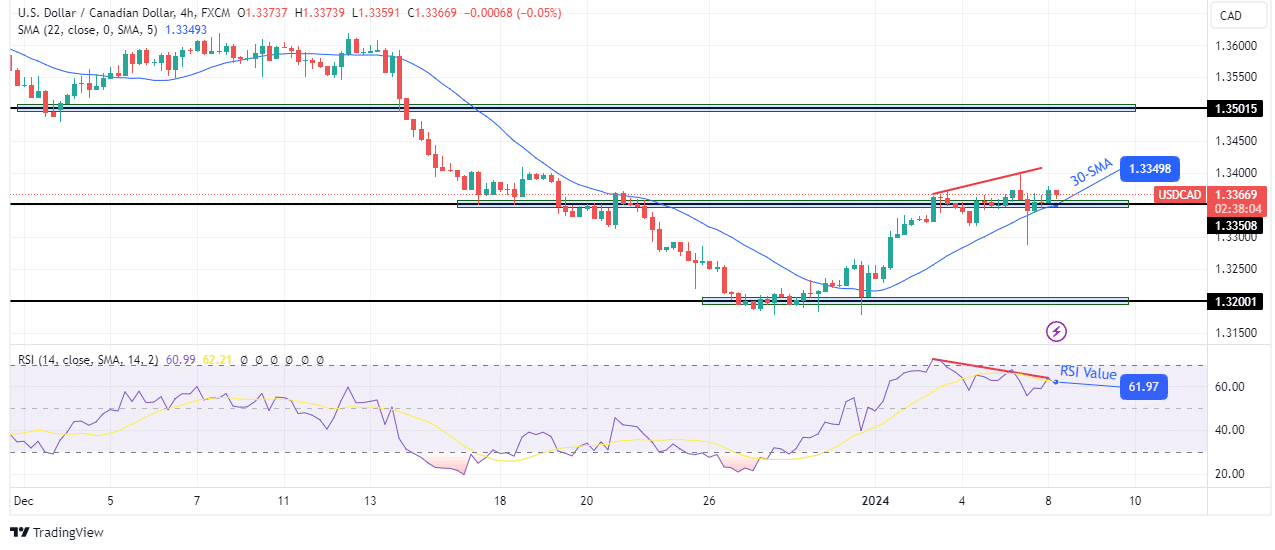

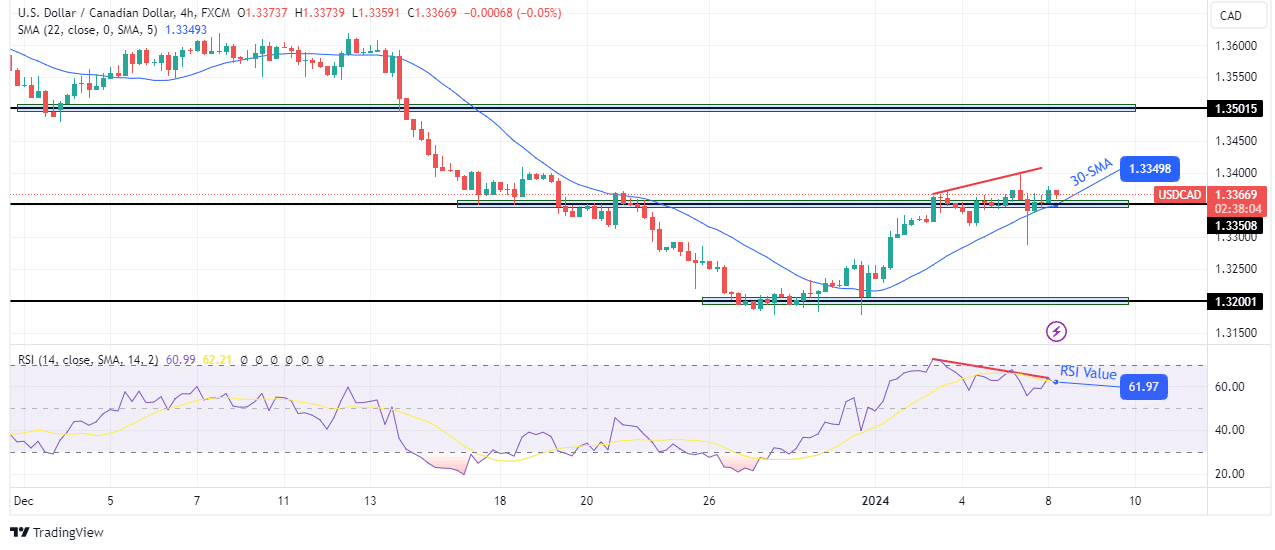

USD/CAD Technical Forecast: Bullish momentum falters near 1.3350

The USD/CAD bullish movement weakened near the key 1.3350 level. It is noticeable that the price does not fluctuate too much from the 30-SMA, which shows that the buyers are weak. At the same time, even though the price is moving higher, the RSI is moving lower, indicating a bearish divergence.

–Are you interested in learning more about Telegram Groups for Forex Signals? Check out our detailed guide-

If buyers regain momentum, the price is likely to bounce off the 30-SMA to retest the resistance level at 1.3501. On the other hand, if the divergence plays out, there will be a change in sentiment as the price will break below 1.3350 and the 30-SMA. Consequently, the price could fall to the support level of 1.3200.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money