- Investors were largely on the sidelines ahead of the US inflation report

- Investor morale in the eurozone reached its highest level since May.

- US consumers’ short-term inflation expectations fell to their lowest level in nearly three years.

On Tuesday, EUR/USD price analysis revealed a subtle bearish tone, with investors opting to stay on the sidelines as the market prepares for the upcoming US inflation report. Furthermore, there was little reaction to US and Eurozone data on Monday.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

The survey showed that investor morale in the eurozone reached its highest level since May. However, a full recovery for the 20-nation currency bloc is uncertain.

In January, the Sentix index for the Eurozone rose to -15.8 points from December’s -16.8. However, Sentix warned that this may not mean a turnaround for the eurozone, mainly due to Germany’s ongoing recession.

Meanwhile, the index of expectations rose to -8.8 points in January from -9.8 in December. An index reflecting the current situation in the Eurozone also rose, reaching -22.5 in January.

Meanwhile, in the US, the New York Fed reported that short-term consumer expectations in the US fell to their lowest level in nearly three years in December. According to the Survey of Consumer Expectations, inflation a year from now is likely to be at 3%, the lowest reading since January 2021. According to the report, inflation three years from now will be at 2.6%, down from 3% in November. In addition, price pressures are projected to be 2.5% five years from now, down from 2.7% in November.

EUR/USD key events today

The pair is likely to consolidate as investors do not expect big news from the Eurozone or the US.

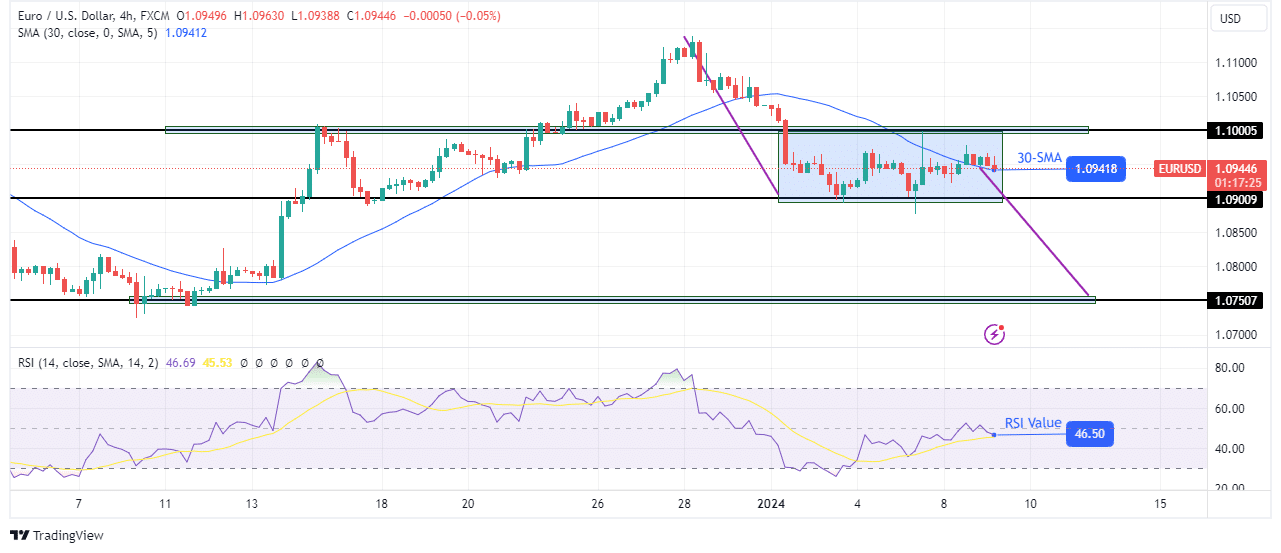

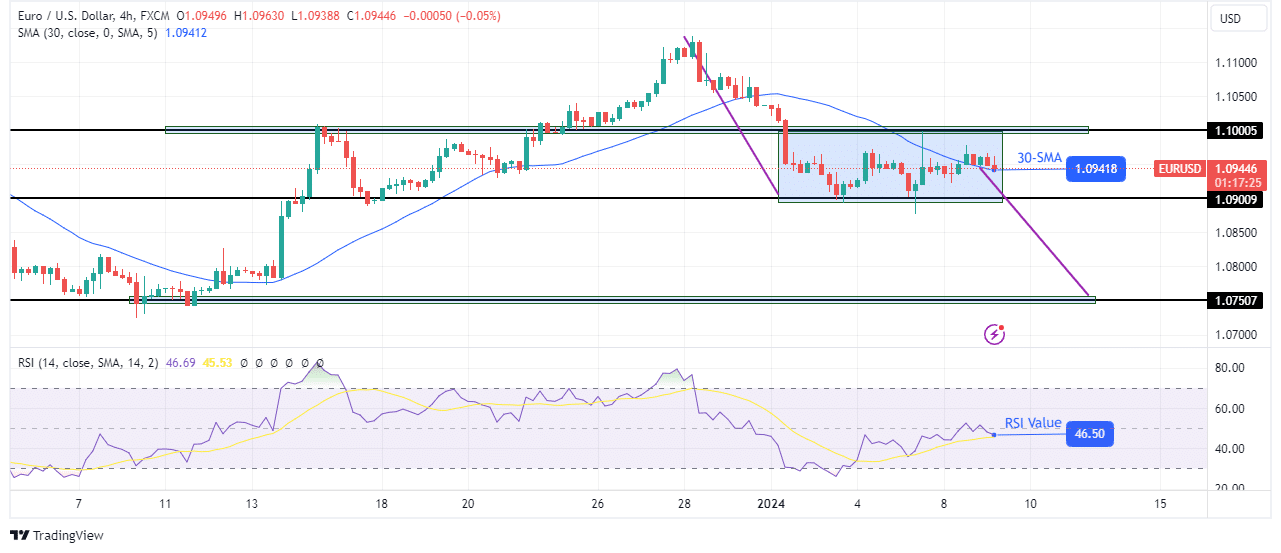

Technical analysis of EUR/USD prices: The price fluctuates between 1.1000-1.0900

On the technical side, EUR/USD is moving between the resistance at 1.1000 and the support level at 1.0900. This consolidation comes after a solid bearish leg to the key support level of 1.0900.

–Are you interested in learning more about Telegram Groups for Forex Signals? Check out our detailed guide-

Although the price has gone above the 30-SMA, it seems ready to go back below. However, for the bulls to reverse the trend, the price must break above 1.1000 to start making higher highs. Otherwise, it will continue to consolidate until the previous downtrend continues with another lower leg. If the price breaks below the support at 1.0900, it is likely to retest 1.0750.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money