- Futures indicate the market expects a cut of 140 basis points (bps) this year.

- Real wages for Japanese workers fell again in November.

- Consumer inflation in Tokyo fell further.

The USD/JPI forecast turns slightly bearish on Thursday as traders await US inflation data to shape their expectations for Fed rate cuts this year. Meanwhile, futures indicate that the market expects a cut of 140 basis points (bps) this year. Moreover, they can start as early as March. This means that markets are sensitive to unexpected data.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Notably, the pair rose sharply after data on Wednesday revealed a 20th straight monthly contraction in real wages for Japanese workers in November. BoJ policymakers had hoped for a rise in wages before tightening policy.

Japan’s salary trend is attracting a lot of attention globally. That’s because the Bank of Japan sees wages and the outlook for inflation as key when discussing whether to end its negative interest rate policy.

In November, real earnings adjusted for inflation, a key factor in determining consumer purchasing power, decreased by 3.0% compared to last year. Moreover, it exceeded October’s decline of 2.3%. Meanwhile, the government’s rate of consumer inflation, which is used to calculate real wages, fell to 3.3%. This value was the lowest level since July 2022. In addition, the decline was due to lower fuel costs and higher food prices.

However, data on Tuesday revealed that consumer inflation in Tokyo, a key indicator of price movements across the country, fell further. Accordingly, there is still optimism that real wages will eventually recover. This would provide the basis for the normalization of the Bank of Japan’s monetary policy.

USD/JPI Key Events Today

- Core US consumer price index m/m

- Consumer Price Index in the USA m/m

- US Consumer Price Index y/y

- US unemployment claims

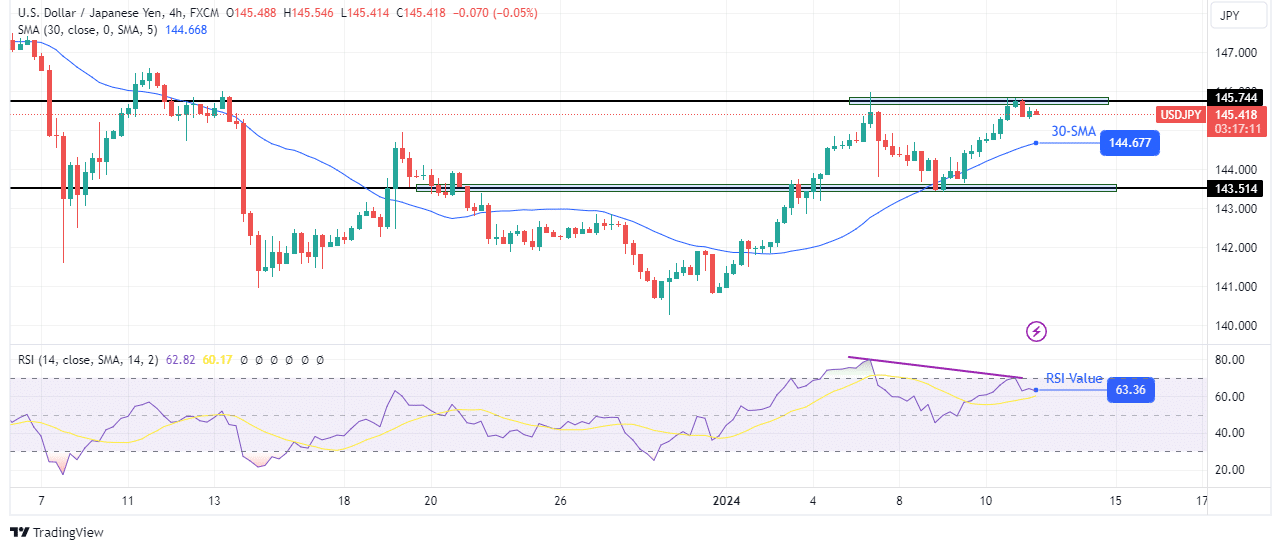

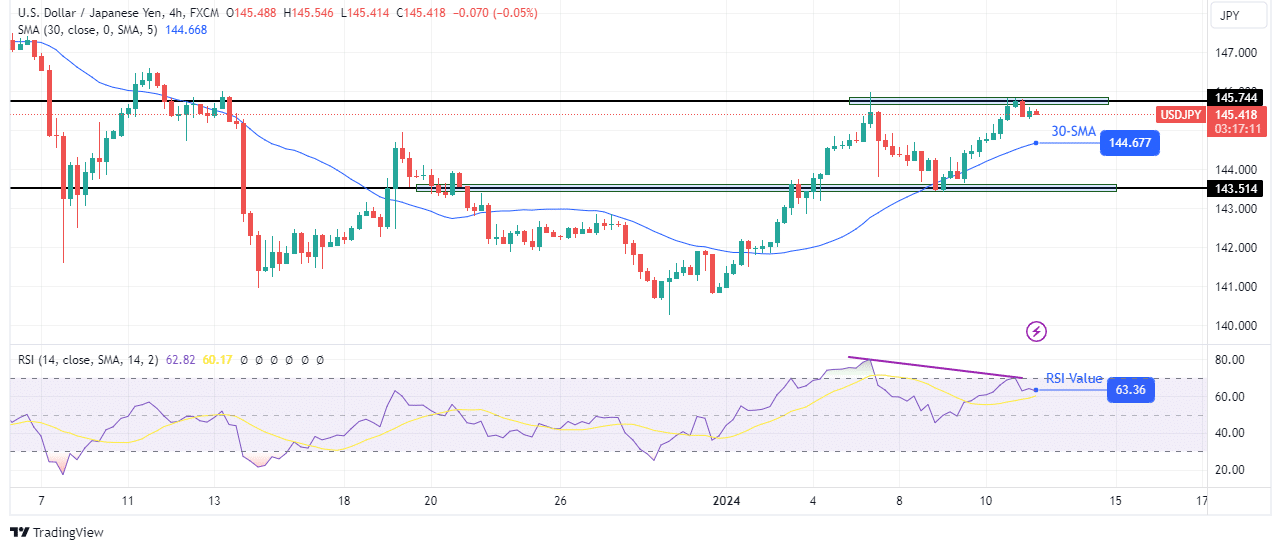

USD/JPI Technical Forecast: Price retests the 145.74 barrier

On the charts, the USD/JPI price rose to retest the key resistance level of 145.74 after pulling back to retest the 30-SMA and support level of 143.51. This is the second time the bulls have tried to push above 145.74 and they could fail again.

–Are you interested in learning more about Telegram Groups for Forex Signals? Check out our detailed guide-

For the first time, the price made a fuse at the level before making a bearish candle and retreating. This time, the bears have again created a engulfing candle that could lead to a collapse below the 30-SMA. Furthermore, the bearish divergence in the RSI shows that the second attempt at 145.74 is weaker. Accordingly, USD/JPI could retest the 143.51 support level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money