- The data revealed an unexpected drop in US producer prices.

- Current market prices indicate a 78% probability that the US central bank will initiate a rate cut in March.

- Philip Lane said the ECB could start cutting rates in June.

The EUR/USD forecast tilted towards optimism on Monday, led by a weaker dollar, as investors raised their expectations for an early rate cut by the Fed. With a potential start in March, prospects for Fed tapering gained momentum after data on Friday showed an unexpected drop in US producer prices.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Chris Weston, head of research at Pepperstone, commented: “Following the US CPI and PPI releases, the market is increasingly confident that the Fed will taper starting in March. Furthermore, markets expect a 25 basis point cut at each meeting from that point.

Meanwhile, current market prices indicate a 78% probability that the US central bank will initiate a rate cut in March. This is up from 68% a week ago.

In contrast, the ECB plans to assess key data for a potential rate cut by June. However, the ECB’s chief economist, Philip Lane, warned against moving too quickly, as it could be counterproductive. Lane believes there will be a “series of rate cuts.” However, he noted that important wage data will not be fully available until the ECB meeting on June 6.

Meanwhile, investors speculate that the ECB could cut borrowing costs this year, starting in March. Money markets are currently predicting a cut of at least 150 basis points, which would bring the ECB deposit rate for banks to 2.5%.

EUR/USD key events today

There will be no major reports in the Eurozone. Meanwhile, the US is marking Martin Luther King Jr. Day, which could lead to weak trade.

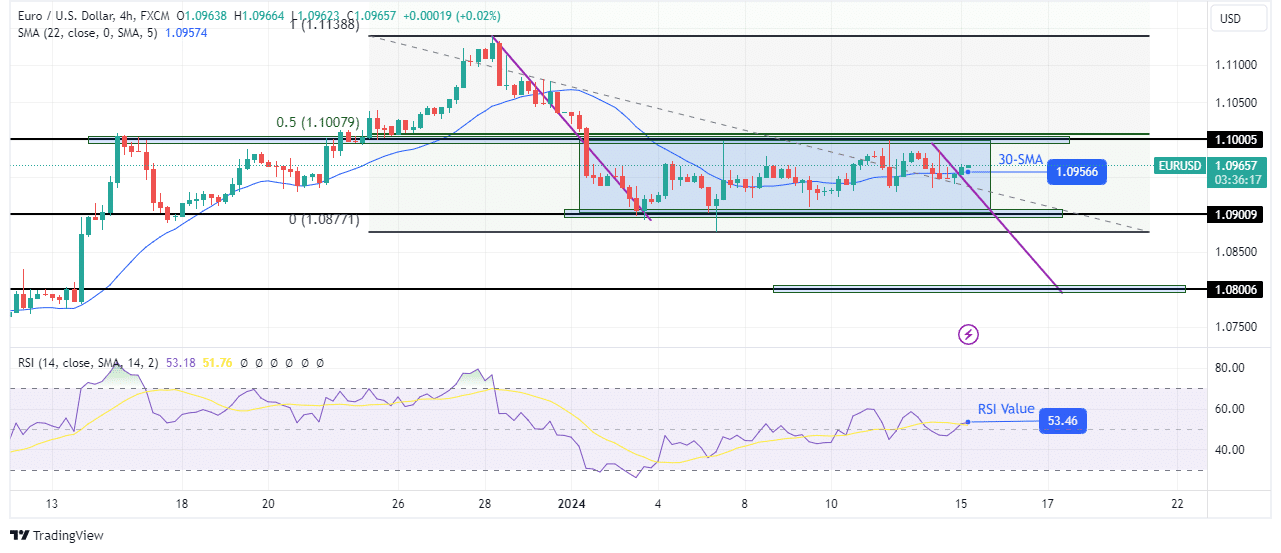

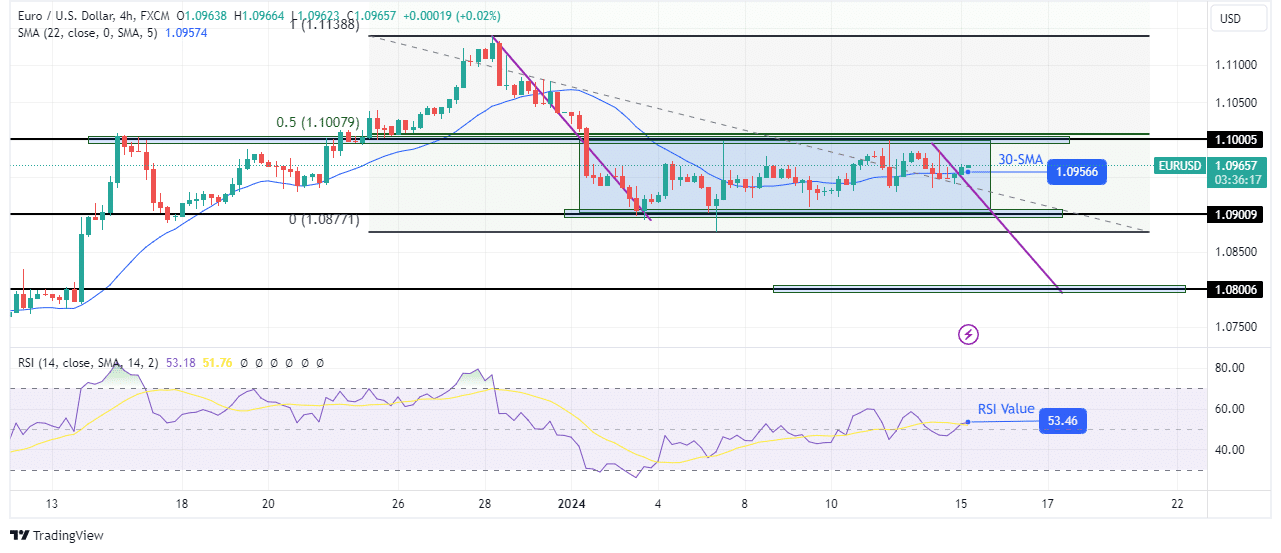

EUR/USD Technical Forecast: Corrective movement continues between 1.0900 and 1.1000

On the charts, the EUR/USD price is in a corrective move after pausing the decline at the 1.0900 support level. However, this corrective move failed to go beyond the strong resistance zone consisting of the key 1.1000 level and the 0.5 fib retracement level.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Furthermore, the price is mostly moving through the 30-SMA, which does not indicate a clear direction. This can also be seen in the RSI, which failed to meet the key level of 50. After a corrective move, the price is likely to make an impulsive leg. Furthermore, given that the previous impulse move was bearish, EUR/USD could soon break below the 1.0900 support to retest 1.0800.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.