- The data revealed a slowdown in British wage growth during November.

- Markets expect a significant rate cut by the Bank of England this year.

- Money markets are currently pricing in a BoE interest rate cut of approximately 130 basis points by the end of the year.

On Tuesday, the GBP/USD outlook took a turn as the pound faced a decline, boosted by data revealing a fall in British wage growth during November. This development has increased the expectation that the Bank of England will significantly reduce interest rates this year.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Official data on Tuesday revealed UK wage growth, excluding bonuses, fell to 6.6% in the September-November period compared with the same period a year earlier. Meanwhile, economists had expected a 6.6 percent increase in regular earnings.

Namely, the Bank of England is worried about the rapid increase in wages. Accordingly, the bank has been working to reduce inflation to its 2% target despite the recent slowdown in the headline rate of price growth. However, there is less pressure now due to the slowdown in wage growth.

Markets are awaiting insights into UK inflation to gauge the BoE’s timeframe for starting monetary policy easing. At the same time, money markets are currently pricing in a cut in BoE interest rates of approximately 130 basis points by the end of the year, with the likely initial cut in May.

The central bank is concerned about persistent inflation and the potential risk of more fiscal easing in the March UK budget. Moreover, recent data revealed that the UK economy beat expectations in November but remains vulnerable to a mild recession. This poses a challenge for Prime Minister Rishi Sunak ahead of the expected 2024 elections.

GBP/USD key events today

- Empire State Index of Production

- BOE Gov. Bailey Speaks

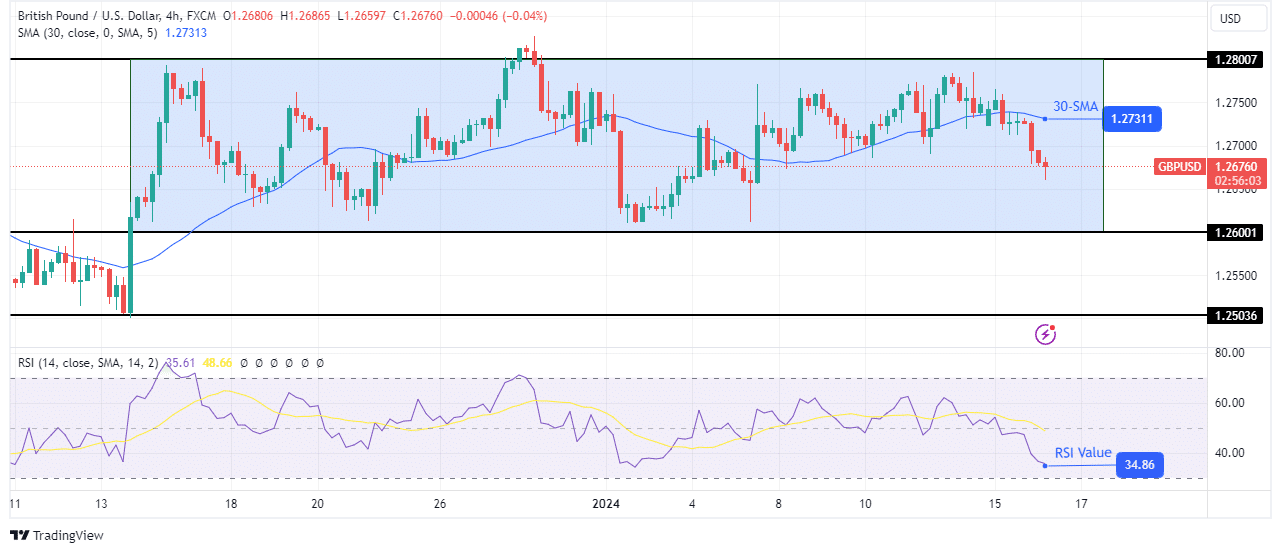

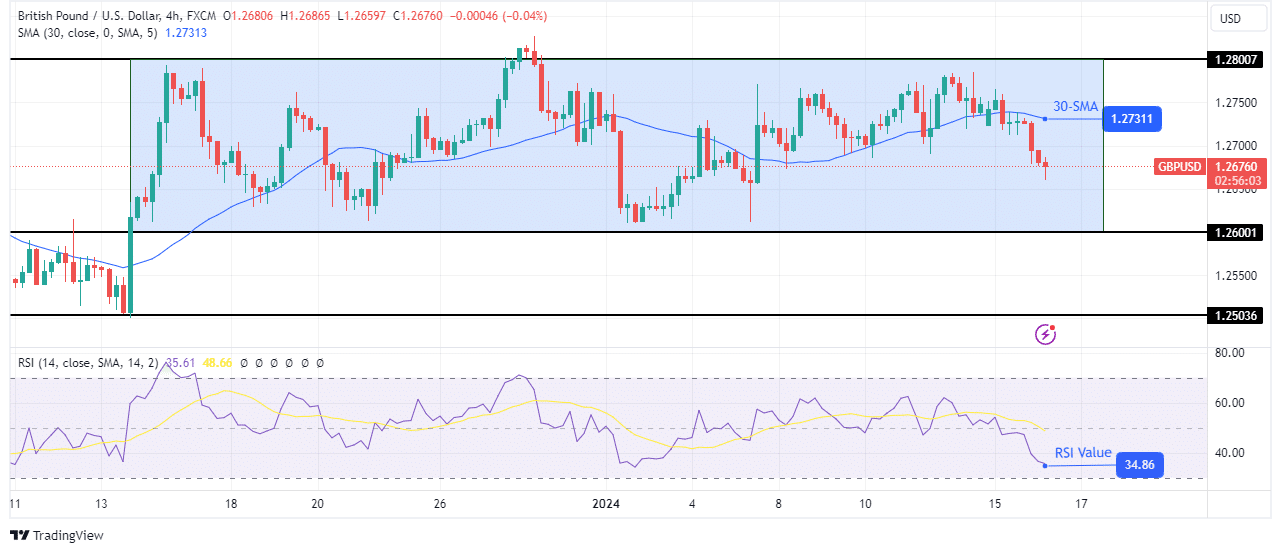

GBP/USD Technical Outlook: Eyes on 1.2600 as bears gain momentum

On the technical side, the GBP/USD price is bearish as the price is falling well below the 30-SMA. At the same time, the RSI is falling rapidly towards the oversold region, which is a sign that the bears are gaining momentum. Therefore, the price may soon retest the 1.2600 support level.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

However, on a larger scale, the price is still stuck in a sideways move between the resistance level at 1.2800 and the support level at 1.2600. As such, a bearish trend can only emerge if the price breaks below the 1.2600 support level. The bears would then retest the 1.2503 support level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.