- ECB policymakers acknowledge an eventual rate cut.

- Market analysts predict five cuts by the ECB in the coming year.

- JP Morgan now expects the ECB to start cutting interest rates earlier in June.

The EUR/USD outlook tipped modestly bearish on Monday, with investors positioning ahead of the ECB meeting later this week. As the ECB’s policy meeting approaches, the discussion has shifted among policymakers, acknowledging an eventual rate cut. However, they expect it later and to a lesser extent than the markets expected.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

Market analysts are challenging the ECB’s inflation outlook, predicting five cuts in the coming year. According to NatVest Markets, some believe the balance of risks is tipping towards a more dovish ECB stance.

JP Morgan on Friday revised its forecast for the ECB to start cutting interest rates, moving the expected start from September to June. However, he maintained a “cautious” stance on inflation and wage growth trends. Moreover, JP Morgan forecasts a rate cut of 100 basis points by the end of the year. This is an increase from the last expectation of 75 bps.

Meanwhile, the dollar struggled to hold on to its gains. The dollar’s gains have been uncertain all year as investors struggle to determine when the Fed will begin cutting interest rates. Recently, data revealing resilient US economic activity has led to a reassessment of rate cut expectations. Markets have moved the potential start date from March to May. However, there is a 100 basis point gap between market expectations and the Fed’s rate projections.

EUR/USD key events today

No significant US or Eurozone economic reports are scheduled for today. Therefore, it could be a slow day for the couple.

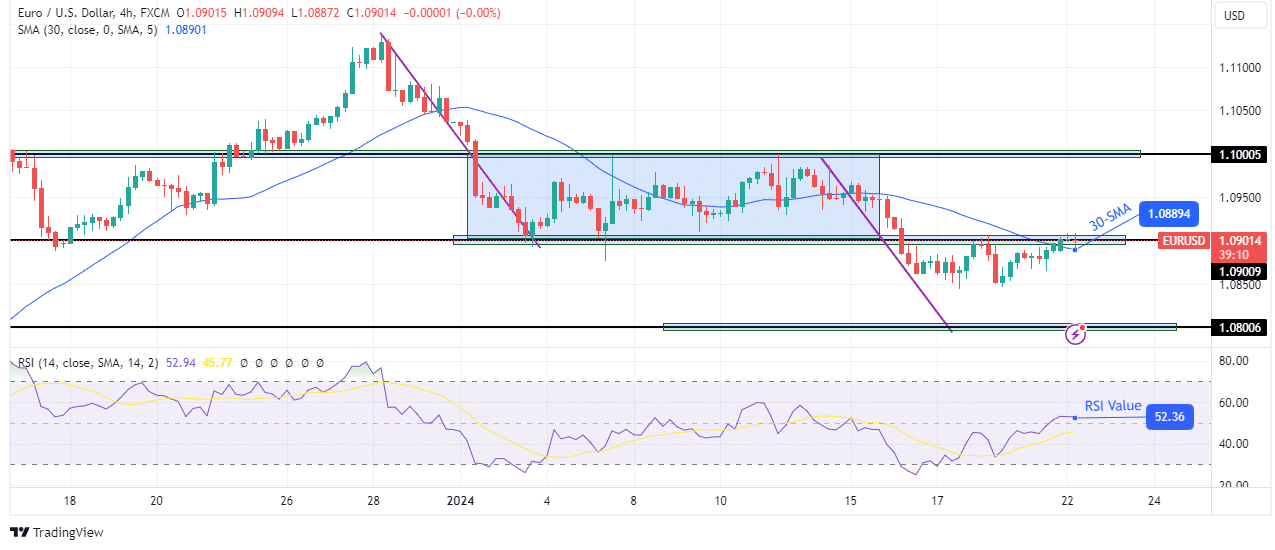

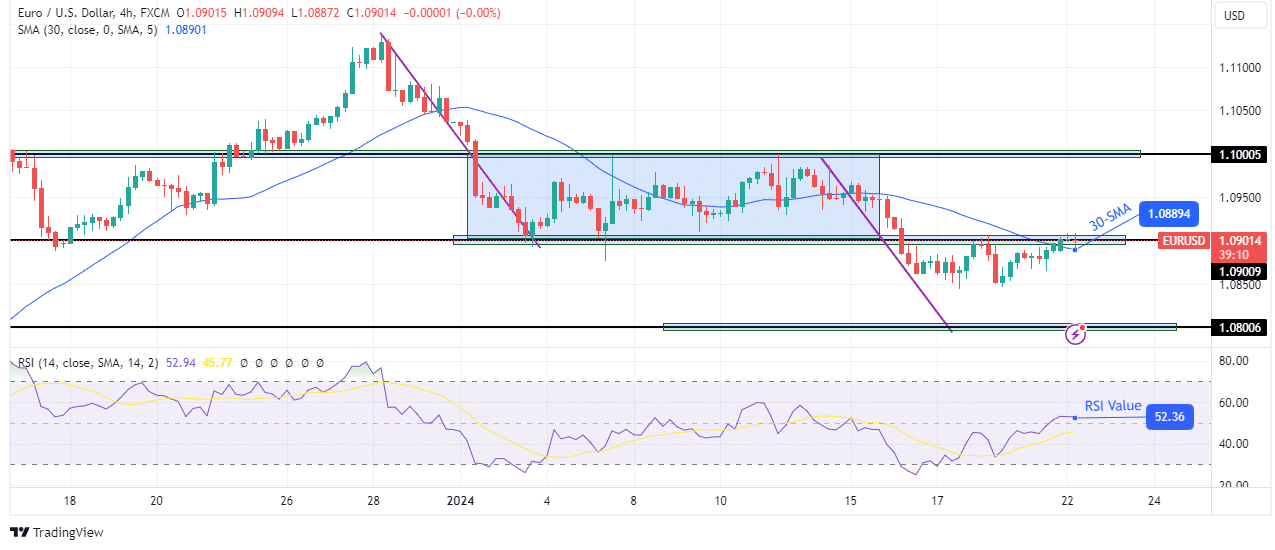

Technical Outlook for EUR/USD: Break is stalling, but bears are targeting support at 1.0800

After consolidating between support at 1.0900 and resistance at 1.1000, EUR/USD broke below the range support. However, the decline has been paused to retest the support of this range as resistance. Moreover, the price remained close to the key level of 1.0900 as the 30-SMA caught up.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

If the bears are willing to push prices lower, the pound will bounce lower from the key 1.0900 level to retest the 1.0800 support level. This would end an impulse leg similar to the one before the consolidation. However, since the price is slightly above the 30-SMA with RSI above 50, the bulls could take over if the price breaks above 1.0900.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.