- The BoJ decided to keep its ultra-easy monetary settings.

- There is an increasing likelihood that Japan will sustainably meet the bank’s 2% inflation target.

- Japan’s spring wage increase could exceed last year’s 30-year high of 3.58%.

USD/JPI price analysis showed a bearish tone on Tuesday as the Japanese yen reversed course, gaining strength. The momentum was fueled by hints suggesting the Bank of Japan could make policy adjustments at its upcoming meeting.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

Earlier, the yen weakened following the central bank’s policy decision. Namely, the Bank of Japan conducted its ultra-easy monetary policy. However, he signaled growing confidence that the conditions for a gradual withdrawal of his massive stimulus are aligning. Therefore, the prospect of ending negative interest rates is approaching.

BOJ Governor Kazuo Ueda mentioned that many companies have already set wages, and unions are pushing for higher wages. Moreover, he expressed a growing likelihood that Japan will sustainably meet the bank’s 2% inflation target. This is due to the recent steady increases in service prices.

Market participants expect the Bank of Japan to end negative rates sometime this year. Meanwhile, a Reuters poll suggests such a move could come in April. However, Ueda stressed the importance of delaying rate hikes until there is evidence that inflation will remain around 2% and that there will be strong wage growth.

Polls and statements from business lobbies show a growing likelihood that spring wage increases in Japan will exceed last year’s 30-year high of 3.58% for large companies. This is what the BoJ needs to start moving away from ultra-loose monetary policy.

USD/JPI Key Events Today

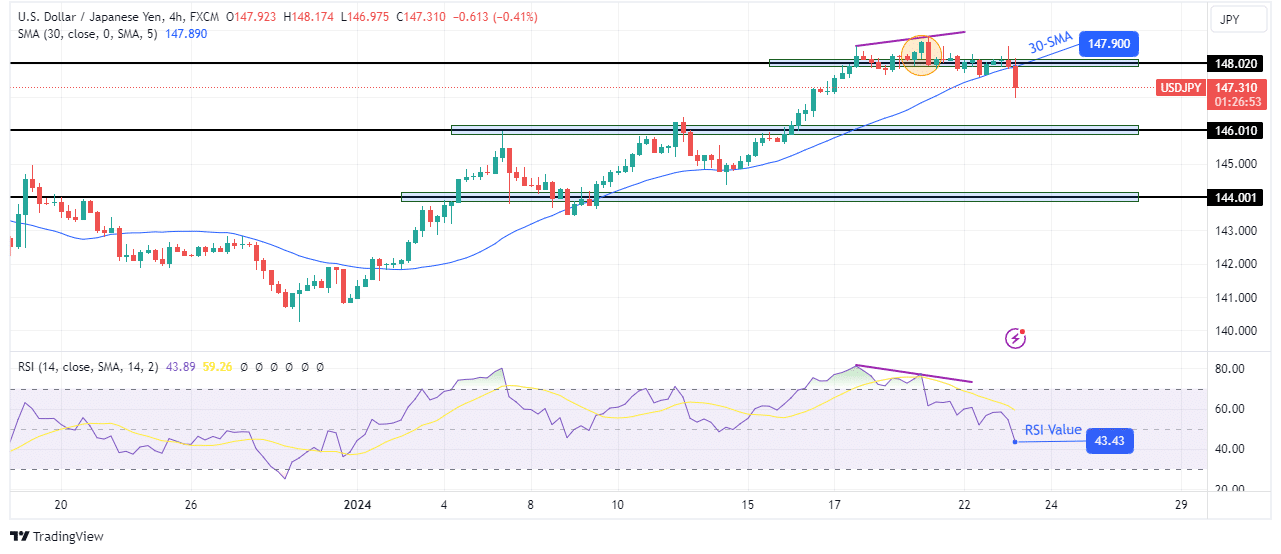

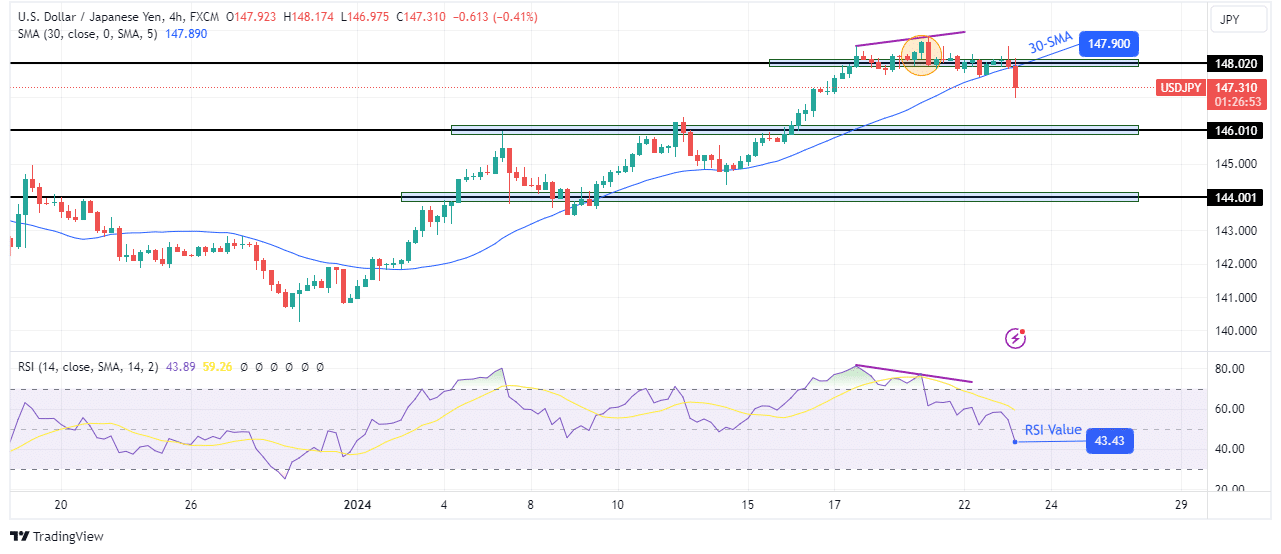

USD/JPI price technical analysis: 30-SMA indicates a change in sentiment

On the charts, there was a change in sentiment from bullish to bearish as the price broke below the 30-SMA. At the same time, the RSI moved into bearish territory. However, to confirm this change, the price must close below the SMA.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

The first sign that the bulls were ready to relinquish control came when the RSI made a bearish divergence. The price made a fresh high above the 148.02 resistance level, but the bullish momentum was weaker. At the same time, the bears showed strength when they made a engulfing candle, pushing the price back below 148.02. A reversal will allow the bears to retest the support levels at 146.01 and 144.00.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.