- The rebound could only be temporary.

- A return below the pivot point indicates further declines.

- ECB and US figures should move the course today.

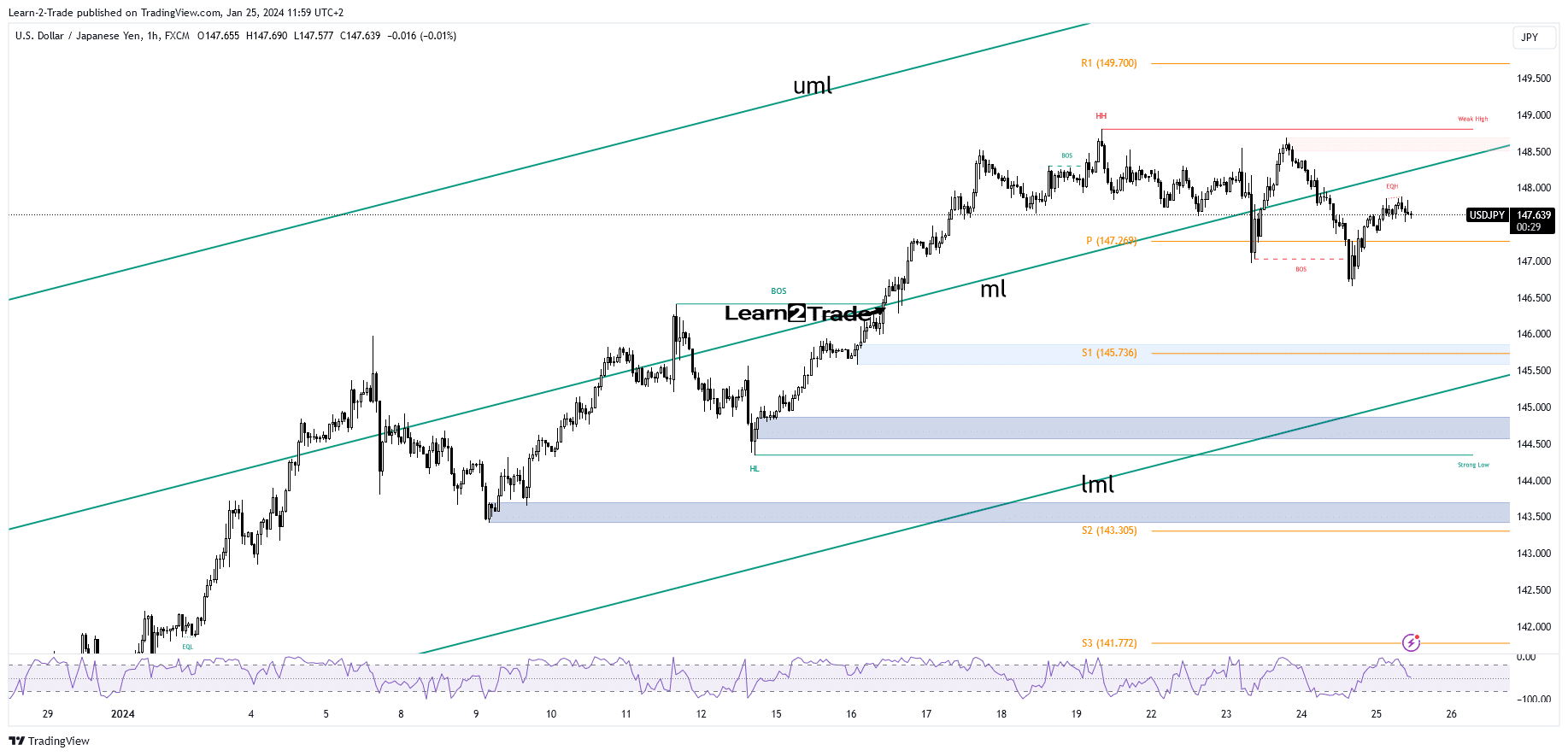

The price of USD/JPI turned higher after reaching yesterday’s low of 146.65. The pair rose to 147.87 today, failing to test the psychological level of 148.00.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Yesterday, the dollar received a helping hand from optimistic US economic data. The price recovered as the US Flash Manufacturing PMI came in at 50.3 points versus the expected 47.6 points, confirming the expansion. Meanwhile, the Flash Services PMI jumped from 51.4 points to 52.9 points, heralding further expansion.

Today, the European Central Bank should be driving the markets. The main refinancing rate should remain at 4.50%, but the ECB’s Monetary Policy Statement and press conference could change the mood.

Moreover, the US will release key economic data, so the fundamentals could be decisive. Advance GDP can announce a growth of 2.0%, lower than the growth of 4.9% in the previous reporting period. Furthermore, data on jobless claims, forward GDP price index, durable goods orders, core durable goods orders and new home sales will be released. Tomorrow, Japan’s CPI in Tokyo, the minutes of the monetary policy meeting and the US core PCE price index should move the price.

USD/JPI price technical analysis: New wave of selling

Technically, the price of USD/JPI failed to stay below the psychological level of 147.00. The pair tried to retest the psychological level of 148.00 and the middle line (ml). After the recent sell-off, a bounce is widely expected.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

The rate could only retest the key level before falling again. A retracement and stabilization below the weekly pivot point of 147.26 indicates more downside towards S1 (145.73).

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.