- The dollar is on track for its most significant monthly gain since September.

- Investors will be watching closely for any hints from Fed Chairman Jerome Powell about the possibility of a rate cut in March.

- Analysts forecast that Canada’s GDP will show growth of 0.1% in November.

In today’s USD/CAD price analysis, the scales are tipping slightly in favor of the bulls as the dollar rises in anticipation of the upcoming FOMC policy meeting. The dollar is poised for an impressive monthly surge, marking its biggest gain since September.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

Meanwhile, the Canadian dollar hit a two-week high against the US dollar on Tuesday. However, the gains were modest and came a day before domestic GDP data.

According to Kyle Chapman, foreign exchange analyst at Ballinger & Co in London, the Canadian currency was positively impacted by stronger equities and improved sentiment throughout the week. However, it faced resistance at the 1.34 level. Especially, with the upcoming Fed decision and GDP data, traders were wary of a hike.

Markets expect the Fed to keep rates unchanged after a two-day policy meeting on Wednesday. Moreover, investors will be watching closely for any hints from Fed Chairman Jerome Powell regarding the possibility of a rate cut in March. Interest rate futures show a roughly 43% chance of a Fed rate cut in March. That’s down from 73% at the start of the year.

Meanwhile, analysts forecast Canada’s GDP to show an increase of 0.1% in November. As the domestic economy slows, the Bank of Canada is now shifting its focus to the timing of a potential rate cut.

USD/CAD Key Events Today

- US ADP Employment change excluding agriculture

- Canada GDP m/m

- Fed monetary policy meeting

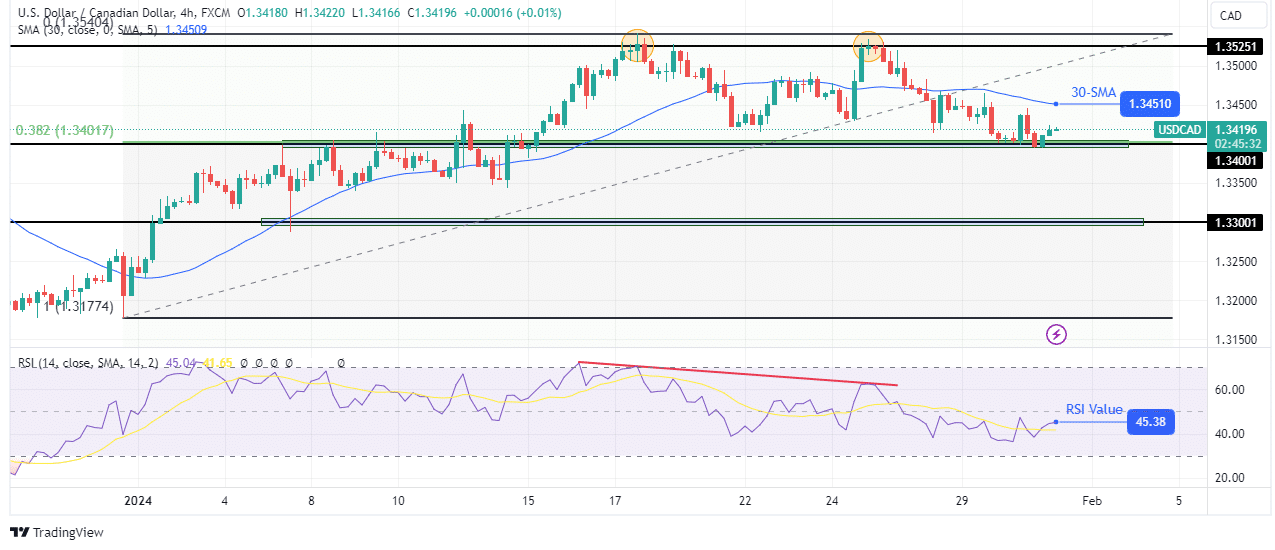

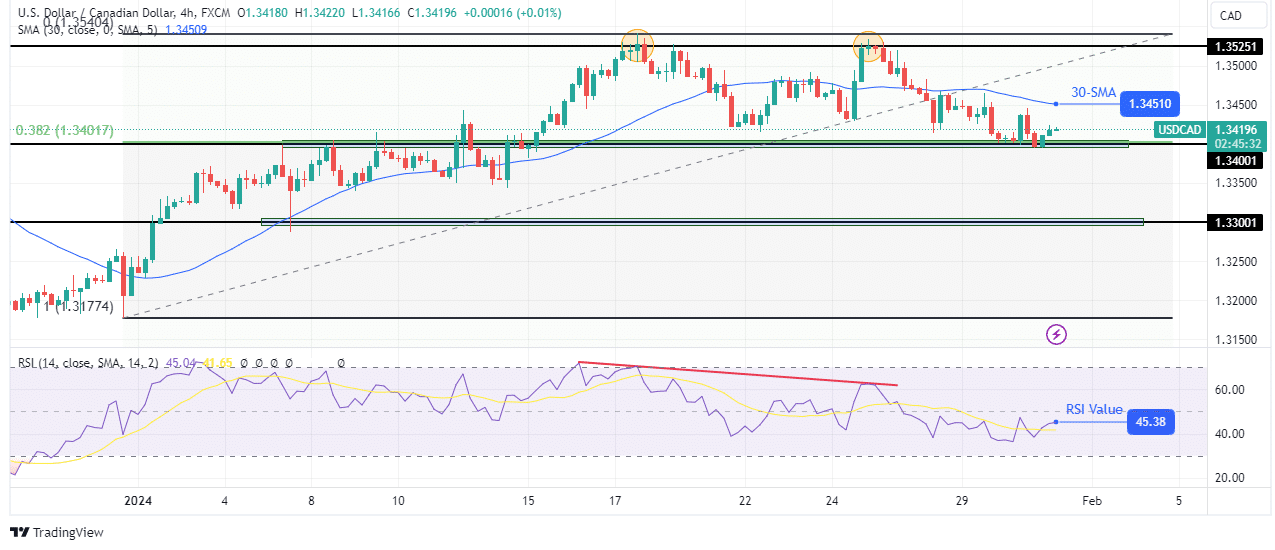

USD/CAD Technical Price Analysis: Bears struggle to reverse trend

On the technical side, the USD/CAD price has fallen to the 1.3400 support level as the bearish RSI divergence plays out. The bias is bearish, with price below the 30-SMA and RSI in bearish territory.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

Bears took over after the previous bullish trend paused at the 1.3525 resistance level. However, they have yet to find their foothold below the 30-SMA. Furthermore, to confirm the bearish trend, the bears need to start making lower lows and highs by breaking below the 1.3400 support level. However, if they fail to break below 1.3400, the price is likely to rise to retest the resistance at 1.3525.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money