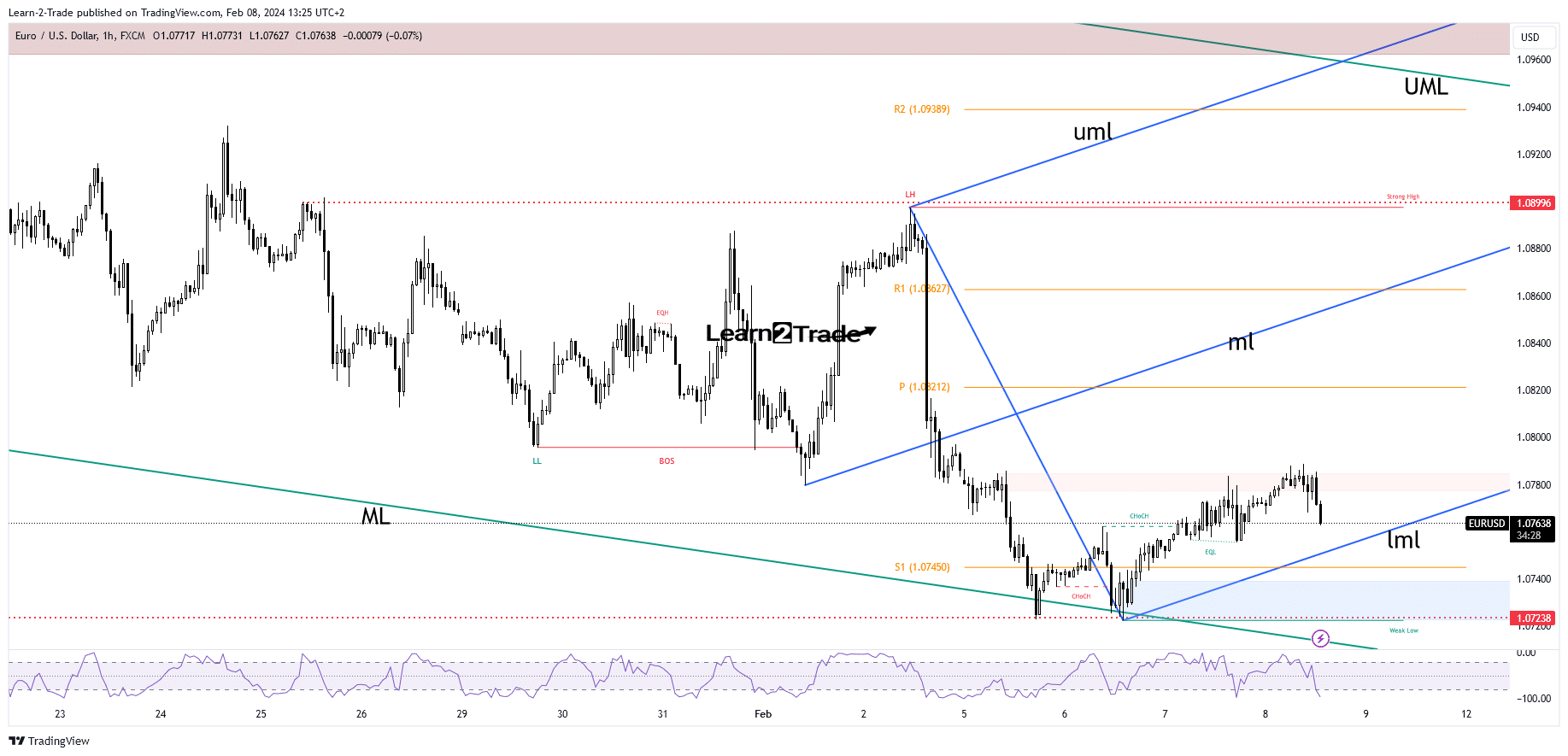

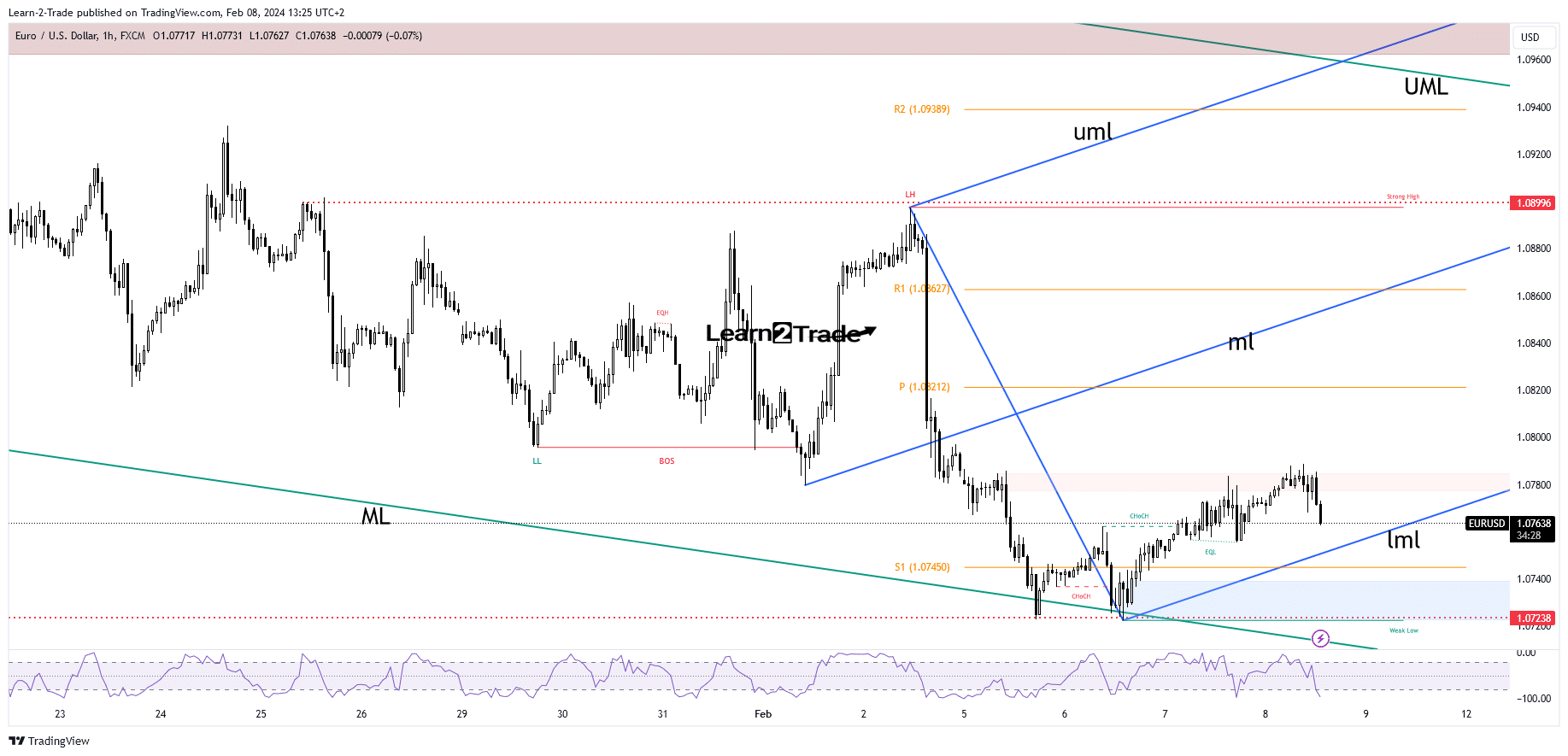

- Taking 1.0784 activates more gains.

- The lower middle line (LML) represents dynamic support.

- US jobless claims could trigger high measures.

EUR/USD fell like a rock on Thursday, trading at 1.0762 at the time of publication. Today it climbed to 1.0788, where it encountered resistance.

German industrial production yesterday reported a 1.6% decline vs. an expected 0.4% decline, while the US trade balance came in at -62.2B vs. -62.0B expected.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

Today, US economic data could bring some action. The unemployment claims indicator could fall from 224 thousand to 221 thousand in the last week.

This situation may help the Greenback appreciate relative to its rivals. In addition, ending wholesale inventories are expected to report a 0.4% increase for the second month in December.

Also, FOMC member Barkin speaking could have an impact in the short term. Germany’s final CPI could report an increase of 0.2% tomorrow. Moreover, the change in Canadian employment and the unemployment rate can move the dollar.

Technical Analysis of the EUR/USD Price: Selling Bias

From a technical point of view, the EUR/USD price turned to the downside after failing to clear the static resistance at 1.0784. False breakouts heralded exhausted buyers.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

It could now approach the lower middle line of the rising villa (LML), representing dynamic support. Price could still extend its recovery despite minor pullbacks as long as it remains above it.

S1 at 1.0745 stands as static support. Testing the lower median line and registering only false breakouts signals a new bullish momentum.

A bullish close above 1.0784 opens the door for more gains. A new higher high, removing immediate obstacles to the downside, should herald further declines.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money