- The dollar retreated from recent highs as investors took profits.

- Australians have gained despite a significant decline in employment in Australia.

- Australia’s unemployment rate has risen to a two-year high.

The AUD/USD forecast was bullish on Thursday, with the dollar retreating from recent highs as investors took profits. Consequently, Australians have gained despite a significant decline in employment in Australia. Investors profit on rising dollar after US inflation report. As a result, major currencies around the world got some relief. However, this may only be a brief pause before the uptrend resumes.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

An upbeat US inflation report led to a change in the outlook for Fed policy. Notably, there was a big drop in rate cut expectations as traders eliminated the chance of the Fed cutting in March. Moreover, the odds of a May cut fell as markets expected the first cut in June. There is currently an 80% chance of a rate cut in June. In addition, markets expect three cuts of 25 basis points in 2024, compared to five similar cuts expected two weeks ago.

Meanwhile, the outlook for monetary policy in Australia changed on Thursday following the release of poor employment data. Employment missed forecasts in January, indicating a slowdown in the labor market. At the same time, the unemployment rate rose to a two-year high.

For RBA, this report is a good sign that demand on the labor market is slowing down. Consequently, the chance that the central bank will cut rates increases. In particular, policymakers said rate hikes are still possible. However, markets believe that the RBA’s next move will be a rate cut, especially as the economy slows down.

AUD/USD key events today

- US Core Retail m/m

- Empire State Index of Production

- USA retail m/m

- US unemployment claims

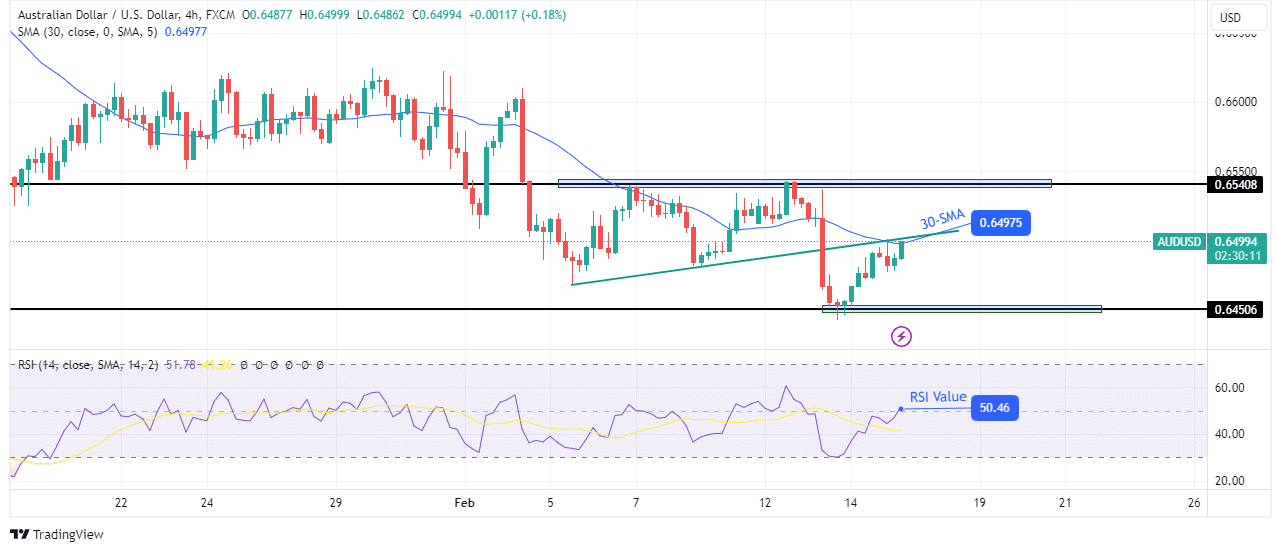

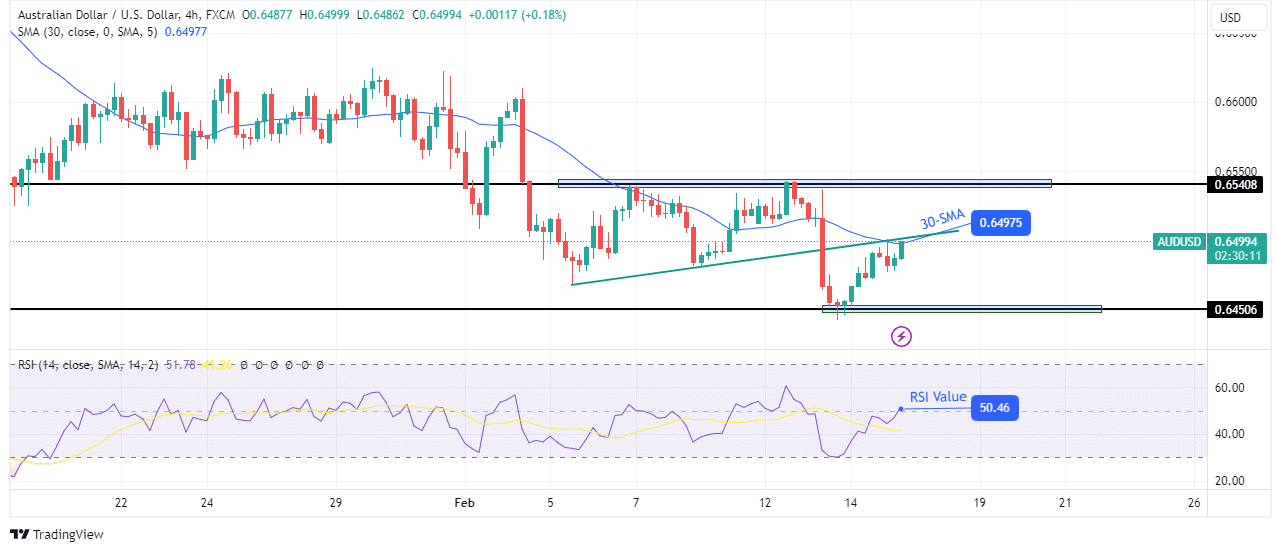

AUD/USD technical forecast: 30-SMA and trend line confluence

On the technical side, AUD/USD pulled back to retest the 30-SMA resistance and the recently broken trend line. At the same time, the RSI rose to the central level of 50 that separates bearish from bullish momentum.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

Notably, the price has been in a downtrend and recently made a new low near the key level of 0.6450. Therefore, if the bears are still strong, it could reverse at the current resistance zone or slightly higher to retest the 0.6450 support level. A break below this level would confirm the continuation of the downtrend.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.