- KSAU/USD seems determined to bounce back and recover after registering false breakouts below the midline.

- US data should move the price today.

- S1 is seen as a potential upside target.

The price of gold has turned upside down and is trading in 1996 at the time of writing. A weaker dollar helped buyers of KSAU/USD to push it higher in the short term.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

After a significant drop, the yellow metal could try to bounce back and recover. Gold prices fell after the United States reported higher-than-expected inflation in January.

The UK CPI rose just 4.0% yesterday against an estimate of 4.1%, while the core CPI rose 5.1%, down from a forecast of 5.2%.

Australian data released poor numbers today, while the UK posted mixed economic figures. Later, US data should be decisive.

Retail sales are expected to report a 0.2% decline, Core Retail Sales could report a 0.2% gain, the Empire State Manufacturing Index could be reported at -13.7 points, while jobless claims could jump from 218 thousand to 219 thousand.

Furthermore, data on the Philly Fed manufacturing index, industrial production, capacity utilization rate and business inventories will also be released. Poor economic figures should weaken the USD and may push KSAU/USD to register a bigger recovery.

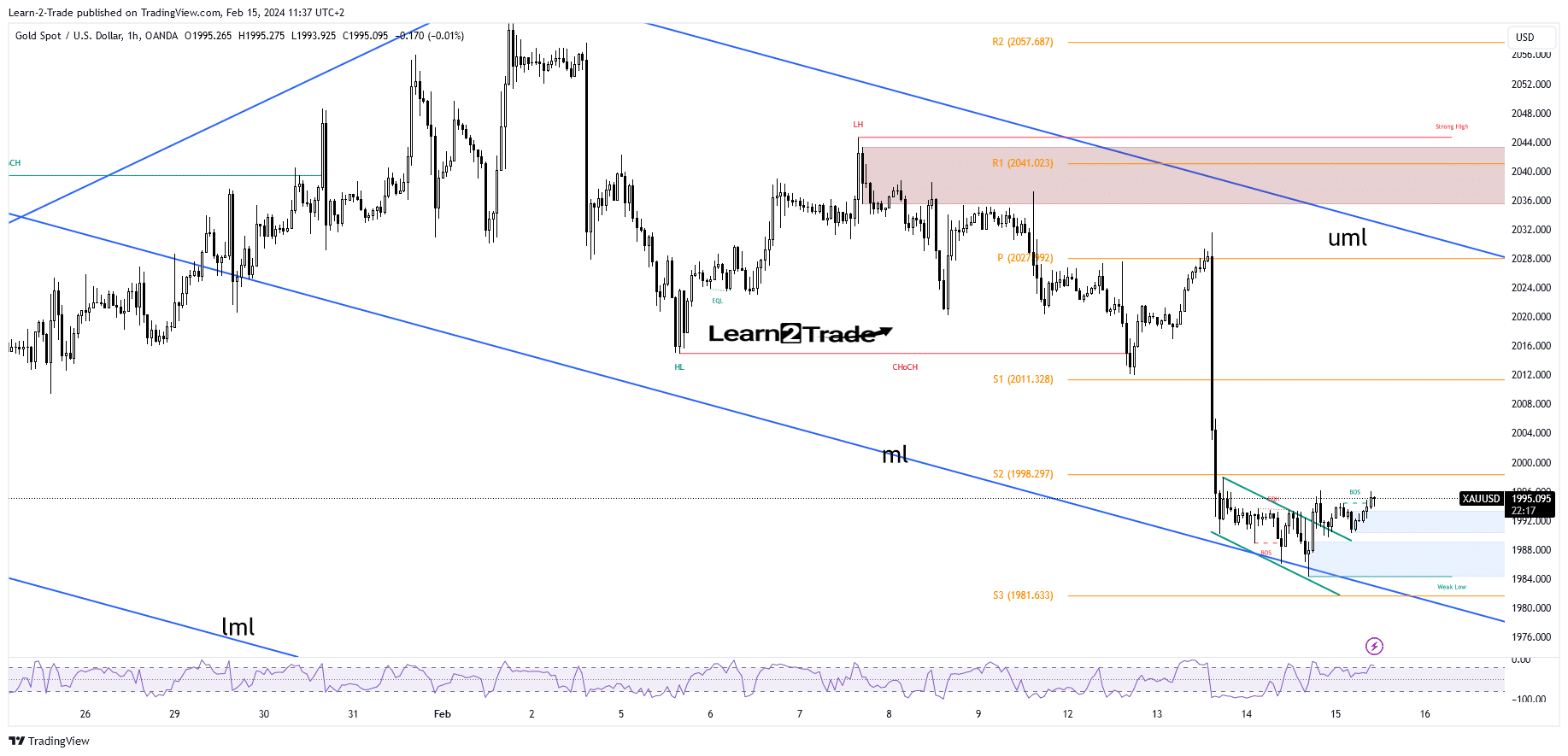

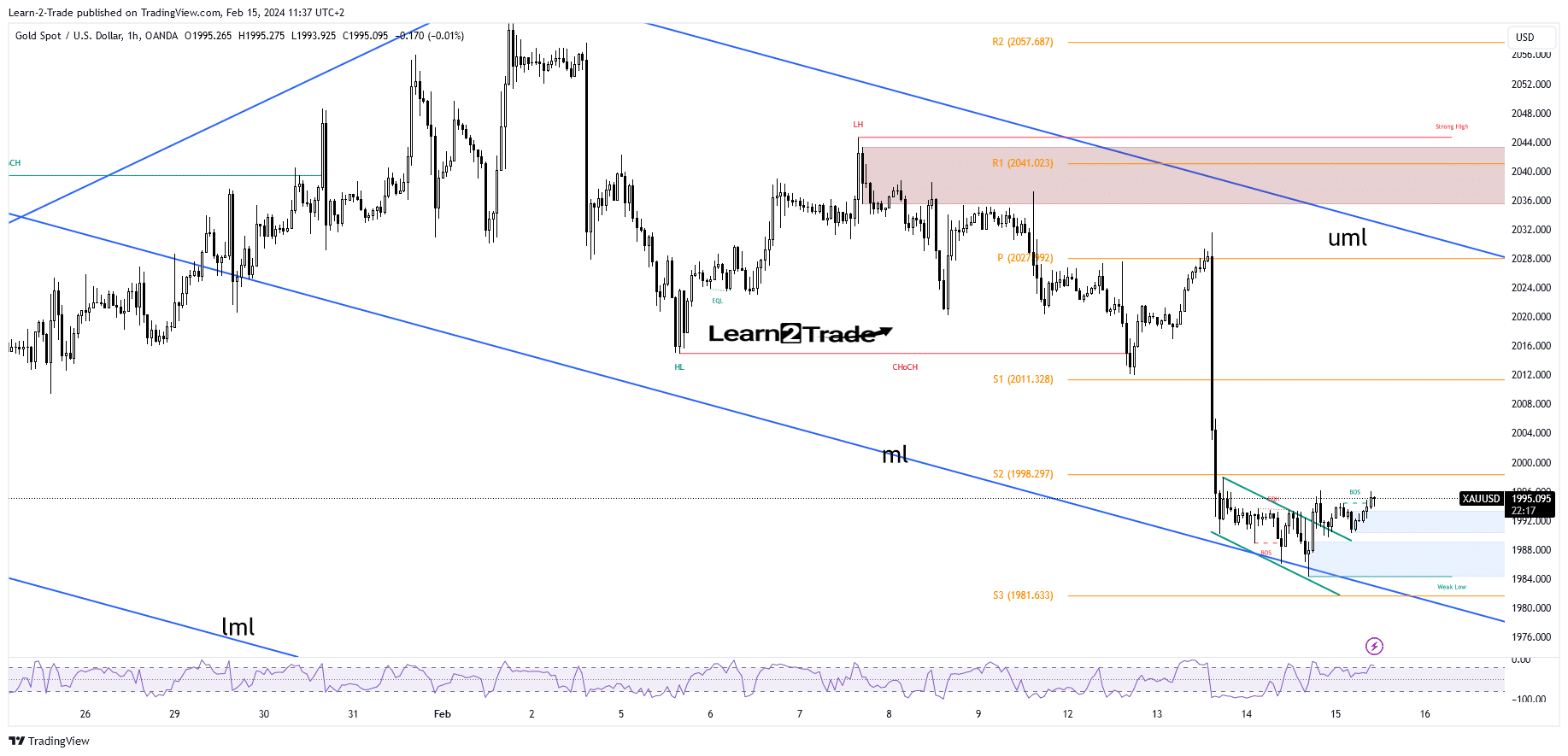

Technical analysis of the price of gold: A leg up

From a technical point of view, KSAU/USD found support at the falling middle line of the villas (ml). This presents a dynamic obstacle: false failures herald exhausted sellers. The first upward obstacle is represented by the weekly S2 from 1998.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

The removal of this resistance and the creation of a new higher high activates further growth towards S1 (2011). If the DXI develops a bigger decline, the price of gold could approach the upper middle line (uml). However, it is premature to talk about such a bigger jump.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.