- Officials in Japan were concerned when USD/JPI crossed the $150 level.

- Data from Japan on Thursday revealed a recession in the latter part of 2024.

- Economists expect the BoJ rate hike to begin in April.

On Thursday, the USD/JPI outlook eased after Japanese officials sounded the alarm over the yen’s recent decline. Officials in Japan were concerned on Wednesday when the pair broke above the $150 level after the US inflation report. Meanwhile, data from Japan on Thursday revealed a recession in the latter part of 2024. As a result, some experts believe the BoJ may be hesitant to raise rates.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

USD/JPI’s recent jump above the $150 level came after the US released a high inflation report. Consequently, the dollar surged as investors pulled back bets on a rate hike by June. Top Japanese officials became concerned when the yen broke above $150.

In particular, Finance Minister Suzuki warned that he is carefully monitoring the movement of currencies. However, he did not comment on whether he would intervene to stop the yen’s decline. Meanwhile, currency diplomat Masato Kanda said the country will do whatever is necessary if necessary.

Germany officially became the world’s third-largest economy on Thursday, taking over from Japan. Notably, the data revealed that Japan’s economy experienced a second quarter of contraction in economic growth. As a result, the BoJ may take longer to move away from negative interest rates.

However, some experts believe the stage is set for a policy shift as corporate spending remains robust and the labor market tight. Moreover, a Reuters poll showed economists expect rate hikes to begin in April.

USD/JPI Key Events Today

- US Retail Sales Report

- Empire State Index of Production

- First jobless claims in the US

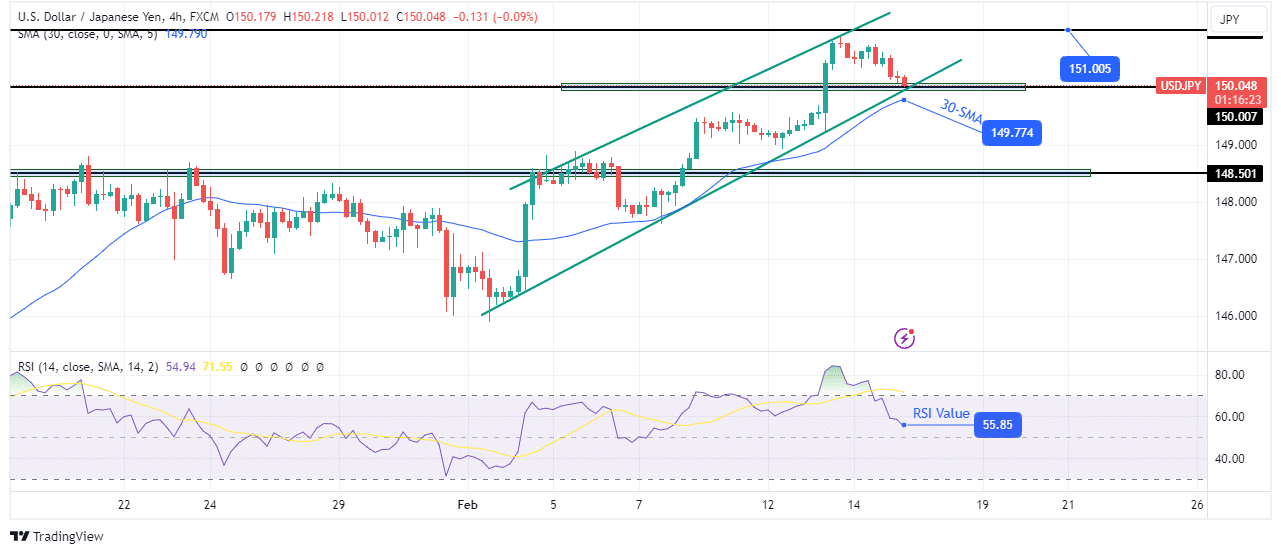

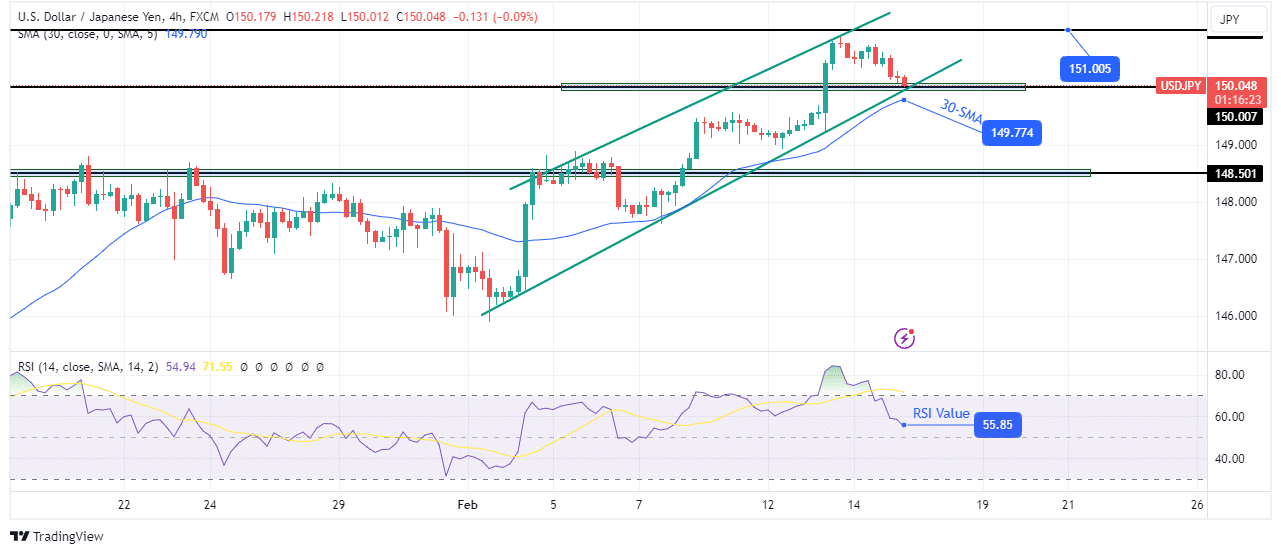

USD/JPI Technical Outlook: Price returns to bullish channel support.

On the charts, the price pulled back to its channel support after making new highs. USD/JPI is trading in a bullish channel, above the 30-SMA, showing a strong bullish bias. Furthermore, the RSI recently reached an oversold region and is still in bullish territory.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

The price broke above the key resistance level of 150.00 and has now pulled back to retest this level and channel support. Additionally, there is support at the 30-SMA line. If the bulls continue to be strong, the price will bounce off this support zone and likely reach the resistance level of 151.00. However, a break below the zone would indicate a change in bearish sentiment.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.