- The pound extended Friday’s gains on upbeat retail sales data.

- The dollar was weaker as US markets closed for the President’s Day holiday.

- This week, traders will focus on minutes from the FOMC meeting and speeches from Fed policymakers.

Monday’s GBP/USD forecast showed a bullish outlook, led by continued gains in the pound following Friday’s impressive retail sales data. Meanwhile, the dollar was weaker as US markets were closed for the President’s Day holiday.

–Are you interested in learning more about automated Forex trading? Check out our detailed guide-

The dollar rallied last week as inflation data showed the Fed has more work to do. Accordingly, investors now expect interest rate cuts to begin in June. In addition, experts now believe that the chances of a soft landing by the Fed have decreased. Therefore, the chances of a recession are high.

This week, traders will focus on minutes from the FOMC meeting and speeches from Fed policymakers. This will continue to shape the outlook for US monetary policy.

Meanwhile, the pound rose on Friday after the UK released an upbeat retail sales report. However, there was little impact on the outlook for a rate cut in the UK. Investors still see the Bank of England cutting rates by 64bps in 2024.

Interest rate cut expectations in the UK remain the lowest among major central banks such as the Fed and the ECB. Markets believe the BoE will take time before cutting rates. Moreover, they will taper by much less than the Fed in 2024. As a result, the pound has remained largely stable against the dollar this year.

GBP/USD key events today

It’s likely to be a slow session for the couple in the middle of their US vacation. Furthermore, there will be no key reports from the US or the UK.

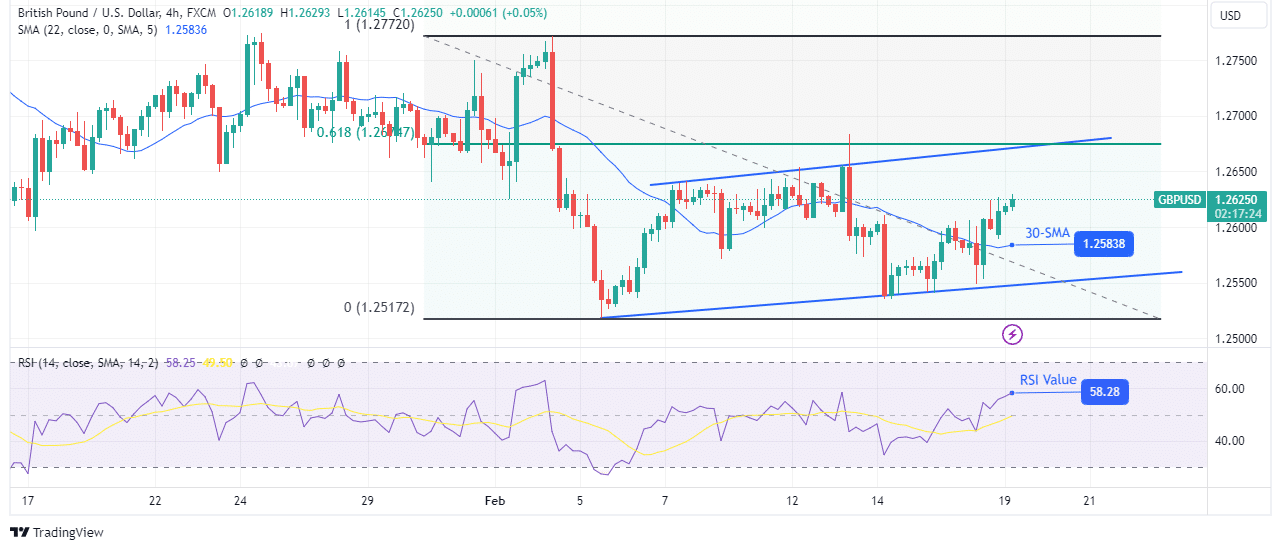

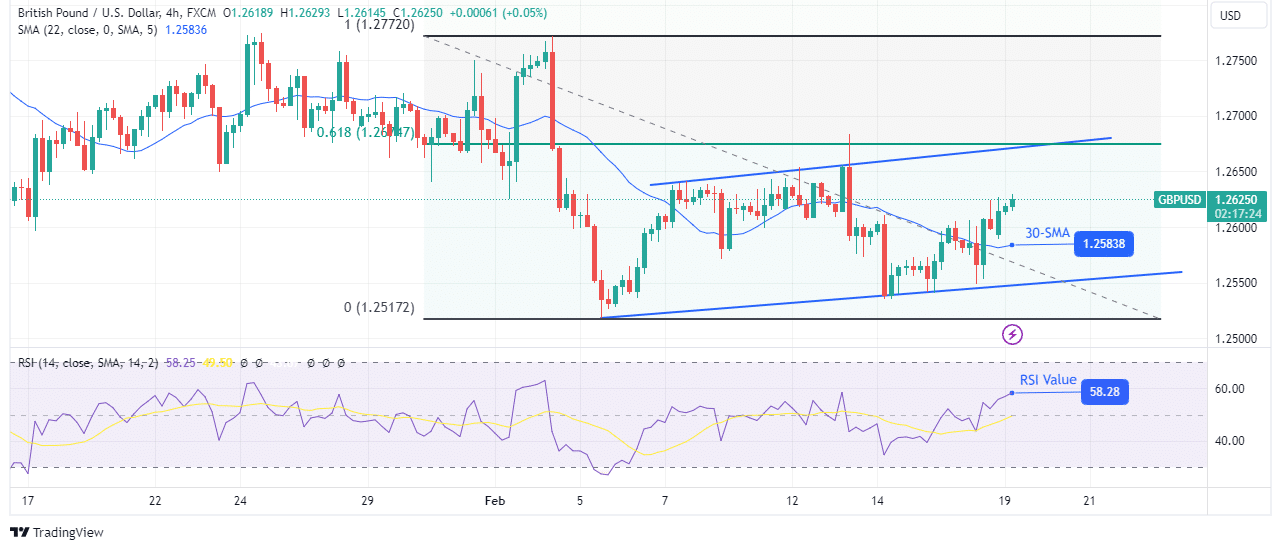

GBP/USD Technical Forecast: Aim to test resistance

On the charts, the pound is trading in a shallow bullish channel, with price currently approaching channel resistance. The price is trading above the 30-SMA while the RSI is above 50, making the bias bullish. However, the shallow trend indicates that the price may be in a corrective move right now.

–Are you interested in learning more about forex signals? Check out our detailed guide-

Moreover, a shallow trend comes after a sharp decline, indicating that momentum has fallen. Therefore, if this is a break in the decline, the price could reverse at the nearest resistance. At this point, it could be a resistance zone containing channel resistance and the 0.618 Fib level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.