- Inflation in Tokyo accelerated again in February, surpassing the Bank of Japan’s targets.

- Policymakers in Japan noted that the economy is recovering moderately and that the wage outlook is improving.

- The US service sector had weaker growth in February.

USD/JPI price analysis reveals a bearish tone on Wednesday, led by an impressive yen rally on signs of accelerating inflation. Adding to the downward pressure on the currency pair, the dollar softened after data in the previous session revealed weaker growth in the services sector.

–Are you interested in learning more about CFD brokers? Check out our detailed guide-

Inflation in Tokyo accelerated again in February, according to data on Tuesday, beating the Bank of Japan’s targets and supporting an upcoming policy shift. However, core inflation has slowed, indicating that the policy shift may not be as aggressive as markets expect.

Authorities in Japan noted that the economy is recovering moderately and the wage outlook is improving. Namely, Deputy Chief Cabinet Secretary Hideki Murai said on Tuesday that Japan is on the way to achieving rising inflation and wages. Furthermore, the government is working to expand wage increases in the country.

On the other hand, the dollar was weak after overnight losses due to poor economic data. The U.S. service sector experienced weaker growth in February due to a drop in employment. As a result, investors are more confident that the US economy is slowing, allowing the Fed to consider a rate cut in June.

In addition, there was caution in the market ahead of Powell’s testimony to Congress, which could have clues about the policy outlook. However, there is a good chance that the Fed chairman will maintain his hawkish tone. Therefore, any dovish message could lead to a big drop in the dollar.

USD/JPI Key Events Today

- ADP Non-agricultural employment change

- Fed Chairman Powell testifies

- JOLTS Job Opens

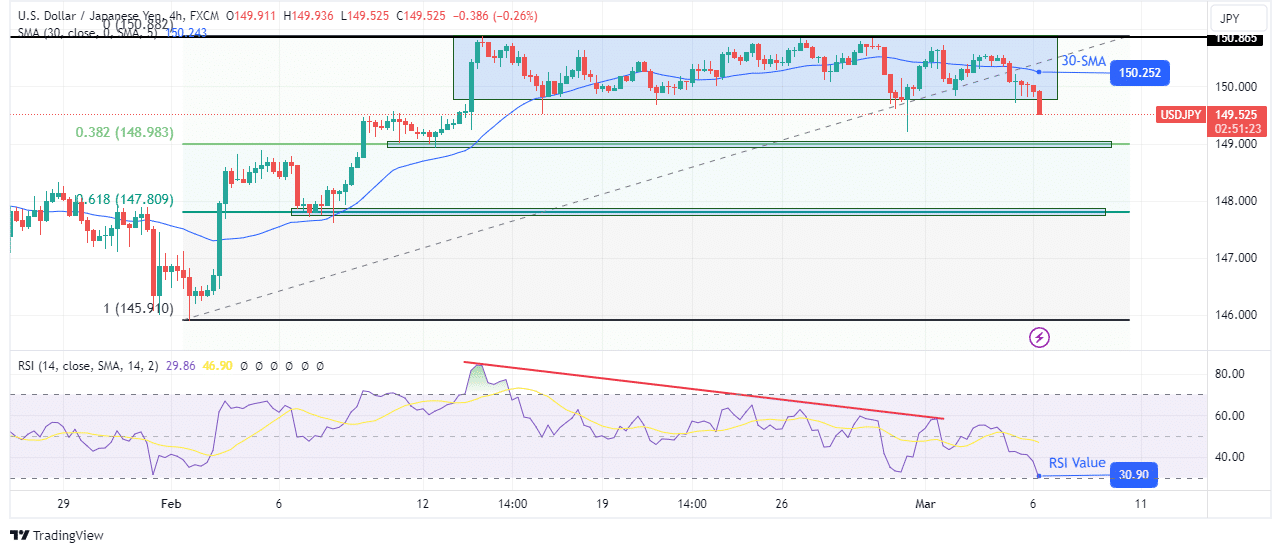

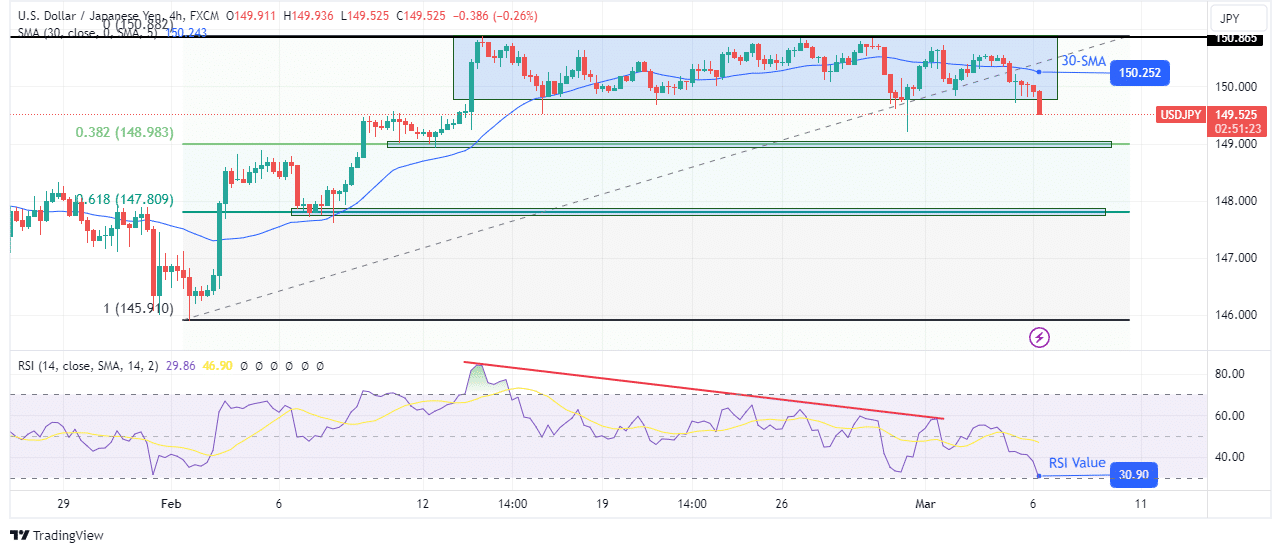

USD/JPI technical price analysis: Range support is breaking down in a solid bearish decline

On the technical side, USD/JPI is finally breaking below its range support with a solid bear candle. This is a sign that the bearish divergence in the RSI is finally playing out. In addition, the price has broken below the previous low and is trading well below the 30-SMA, indicating the beginning of a decline.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Meanwhile, the RSI is poised to dive into oversold territory, supporting solid bearish momentum. With this new decline, the price is likely to retest the 0.382 Fib retracement level soon. If the downtrend continues lower, the bears will reach a second target at the 0.618 Fib retracement level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.