- There is a better chance that the Fed will cut rates by the end of the year.

- There is a difference in policy outlook between the Fed and the BoE.

- The dollar weakened after a mixed jobs report.

The GBP/USD weekly forecast is bullish as market participants expect the Fed to cut rates much earlier than the Bank of England.

GBP/USD Ups and Downs

The pair had a bullish week as the dollar weakened following Powell’s congressional testimony. On Wednesday and Thursday, Powell reiterated the Fed’s commitment to reducing inflation to its 2% target. However, he also said there was a good chance the Fed would cut rates by the end of the year.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

Significantly, there is a difference in policy outlook between the Fed and the BoE. As the Fed’s rate cut approaches, the BoE could be the last major central bank to cut rates. As a result, the pound hit new highs for the week.

In addition, the dollar weakened after a mixed jobs report showing a large increase in employment and a higher-than-expected unemployment rate.

Next week’s key events for GBP/USD

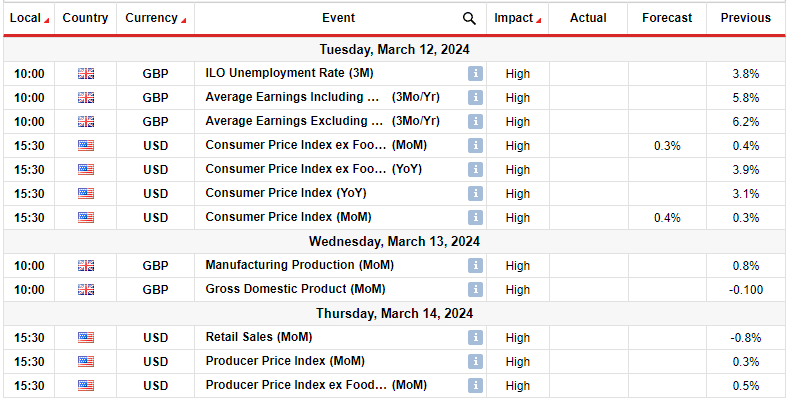

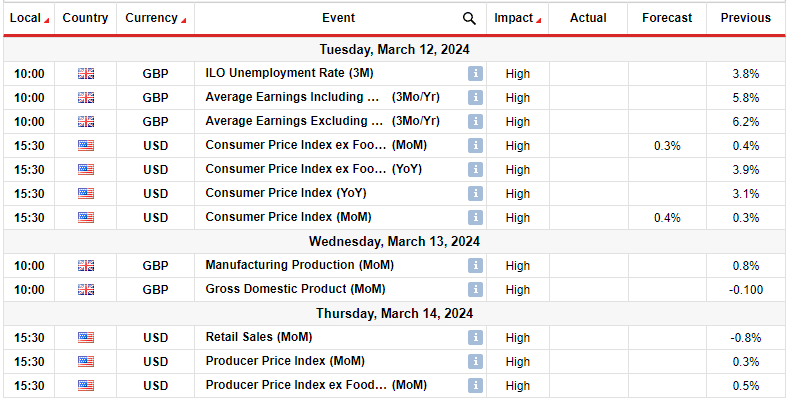

Big impact data from the UK next week will include data on employment, output and economic growth. Meanwhile, investors will focus on inflation and sales data from the US. The UK economy performed better than expected in 2024. Therefore, if the economy shows strength next week, it could lift the pound to new highs.

Meanwhile, the US dollar weakened last week amid expectations of a rate hike. The inflation report will also have a big impact on the outlook for a rate cut. Consequently, an over or under estimate figure can cause a lot of volatility.

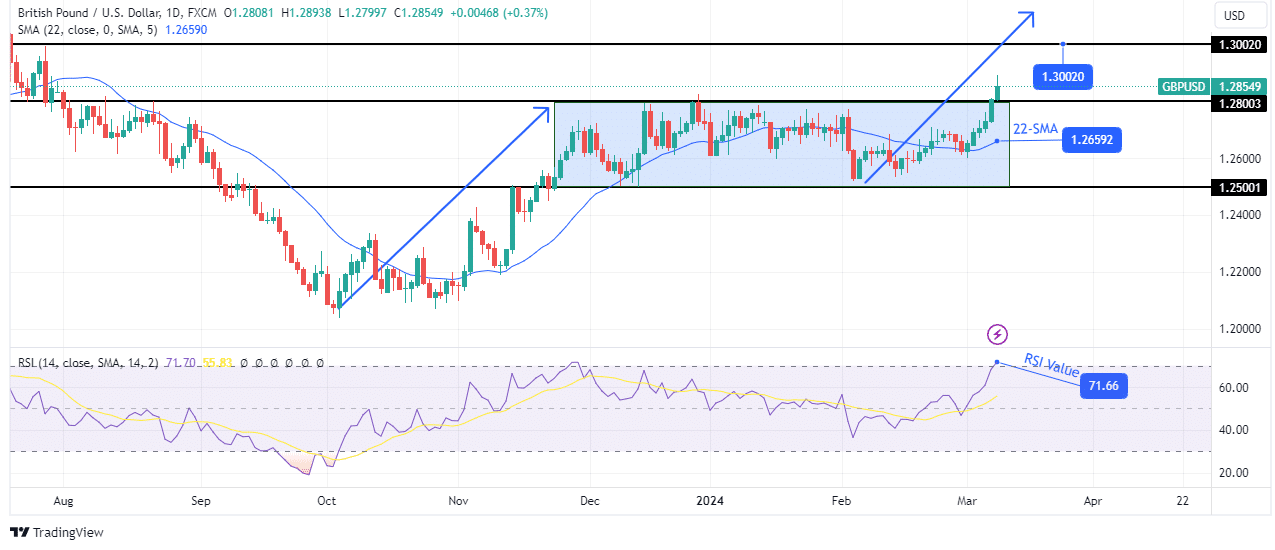

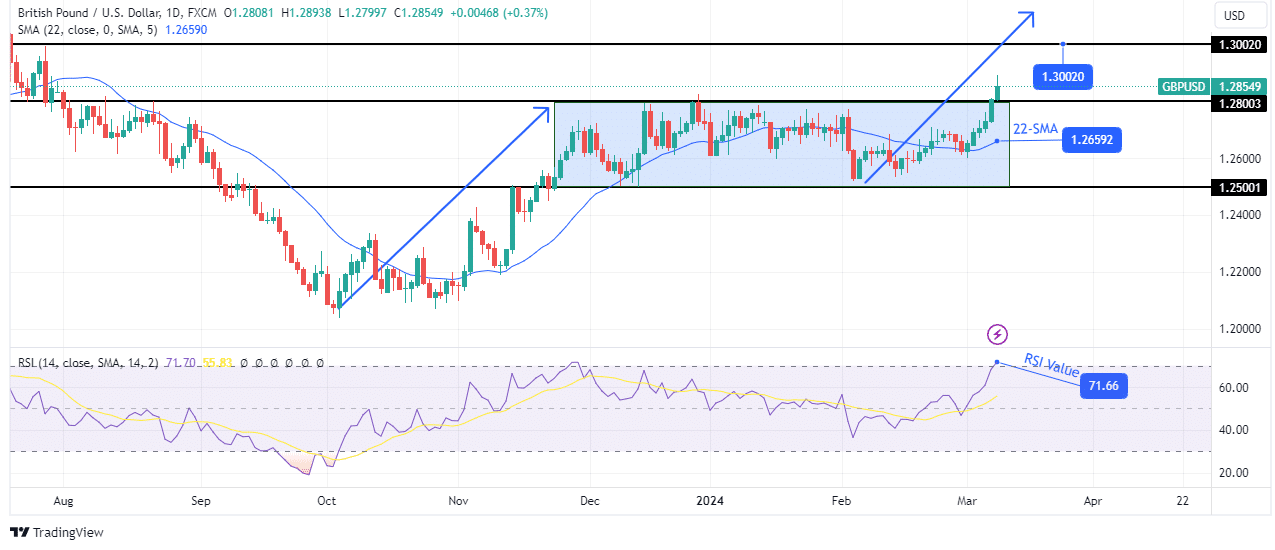

GBP/USD Weekly Technical Forecast: Bulls break above resistance at 1.2800

On the technical side, GBP/USD is bullish and has made a new high above the key resistance level of 1.2800. After taking control from the bears and reversing the trend, the bulls pushed the price to the key level of 1.2800, where it paused. Furthermore, there were signs of weaker bullish momentum. Consequently, the bears got an opportunity to challenge the bullish trend. The price broke below the 22-SMA and the RSI fell below 50.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

However, the bears could not go below the key support level of 1.2500. At this point, the bulls regained momentum, regaining control and breaking above 1.2800. There is a good chance that this bullish move will continue next week. Therefore, GBP/USD could retest the key psychological level of 1.3002.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money