- The US released an inflation report showing a higher-than-expected annual rate.

- Toyota has announced the largest wage increase for its workers in the last 25 years.

- Ueda said the Japanese economy is recovering, but there are pockets of weakness.

The USD/JPI forecast revealed bullish sentiment as the dollar was resilient following a surprise US inflation report. Meanwhile, the yen remained weak despite a significant wage increase in Japan.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

On Tuesday, the US released an inflation report showing a higher-than-expected annual rate. Consequently, there was doubt as to whether the Fed would cut rates in June. If inflation does not show a downward trend towards the 2% target, the Fed may decide to keep interest rates high. Consequently, the dollar would remain strong.

However, the outlook for a rate cut remains uncertain as the jobs report revealed weaker demand in the labor market. As a result, bets on a rate cut have increased. Additionally, Powell sounded more dovish in his testimony last week. However, the inflation report tells a different story. This confusion can also be seen in rate cut bets, which fell only slightly after the inflation report. Ideally, such an upbeat report would lead to a larger drop in rate cut expectations.

On the other hand, the yen remained weak on Wednesday despite positive wage news. Namely, Toyota announced the biggest salary increase for its workers in the last 25 years. This is bullish for the yen, as it paves the way for the BoJ to start raising interest rates as early as this month.

However, on Tuesday BoJ Governor Kazuo Ueda said the economy was recovering but there were pockets of weakness. This was a worse assessment than he gave in January, weighing on the yen.

USD/JPI Key Events Today

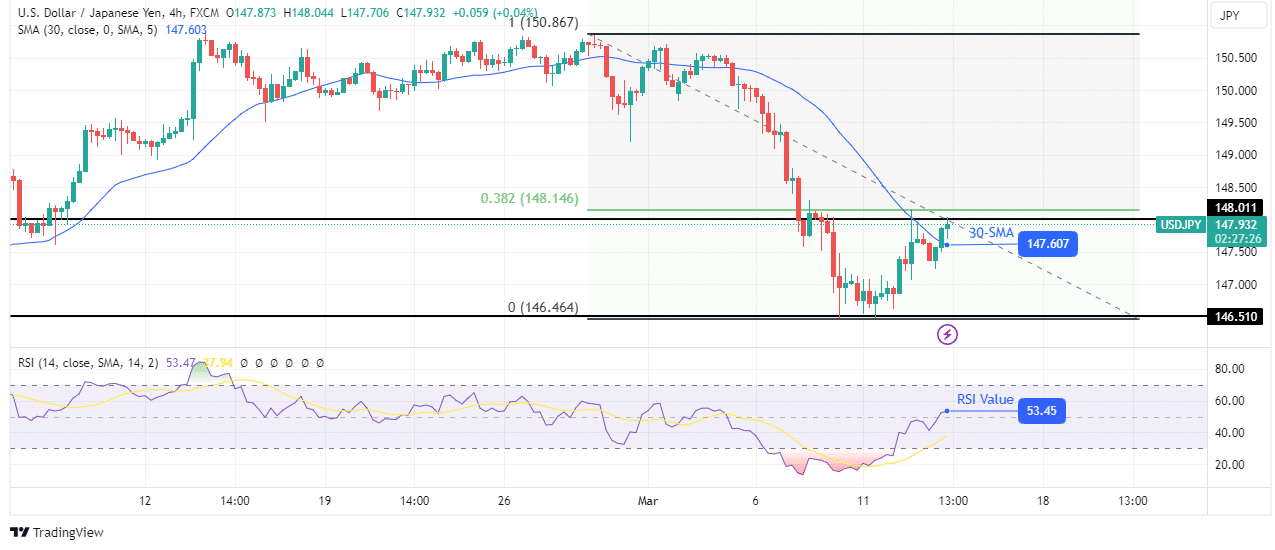

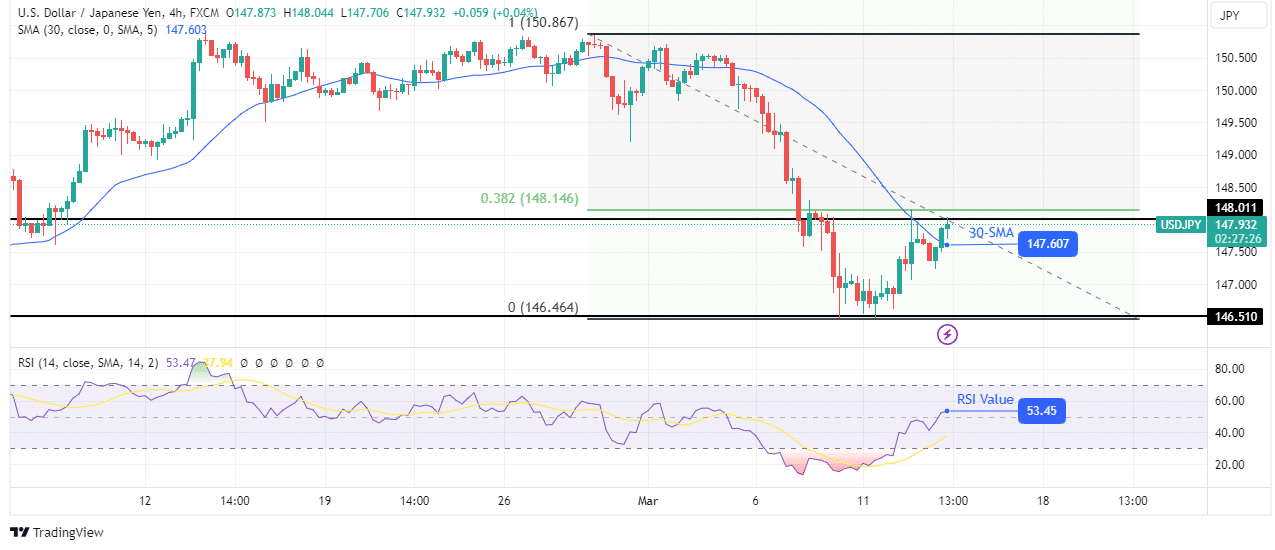

USD/JPI Technical Forecast: The bounce faces a strong resistance zone

On the technical side, the USD/JPY pair is recovering after a recent drop to the key 146.51 level. The bulls managed to break through the resistance above the 30-SMA, showing a change in sentiment to the bullish side. At the same time, the RSI crossed above 50 into bullish territory, showing stronger bullish momentum.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

However, the price is also facing a strong resistance zone that includes the 0.382 Fib retracement and 148.01 key level. A break above this zone would confirm a bullish reversal. However, if the price reverses to retest the 146.51 support level, the previous decline will continue lower.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money