- The Canadian dollar strengthened after a huge jump in oil prices on Wednesday.

- The EIA reported a stronger-than-expected increase in crude oil inventories last week.

- Traders await US data on wholesale inflation, retail sales and initial jobless claims.

The USD/CAD outlook is weak on Thursday as the Canadian dollar gains momentum, rallying higher on the back of a significant increase in oil prices from the previous session. Meanwhile, the US dollar is moving cautiously as investors prepare for key economic data

–Are you interested in learning more about forex earnings? Check out our detailed guide-

USD/CAD traded near the lows hit on Wednesday as oil prices rallied. Notably, the rise in oil prices came after the EIA reported a larger-than-expected increase in crude oil inventories last week. At the same time, gasoline inventories fell more than expected, reflecting increasing demand.

At the same time, the Canadian dollar remains strong amid a strong economy and somewhat hawkish policymakers. Last week, the Bank of Canada kept interest rates on hold and said it was too early to consider a rate cut. Meanwhile, other major central banks, including the Fed, are edging closer to cutting interest rates.

In addition, employment data from Canada revealed a strong labor market that will give the BoC plenty of room to keep interest rates higher. Investors are now looking forward to production sales data. This could give more clues about the state of the economy.

Meanwhile, the dollar was range-bound as traders stayed on the sidelines ahead of key economic data. Bets on a Fed rate cut in June fell from 71% to 65%. In particular, recent data has had little impact on the outlook for Fed policy. The US released mixed data showing a weaker labor market and still high inflation.

Traders are currently awaiting data on wholesale inflation, retail sales and initial jobless claims. These reports could change the outlook for Fed policy ahead of next week’s Fed meeting.

USD/CAD Key Events Today

- retail in the US

- US wholesale inflation

- US unemployment claims

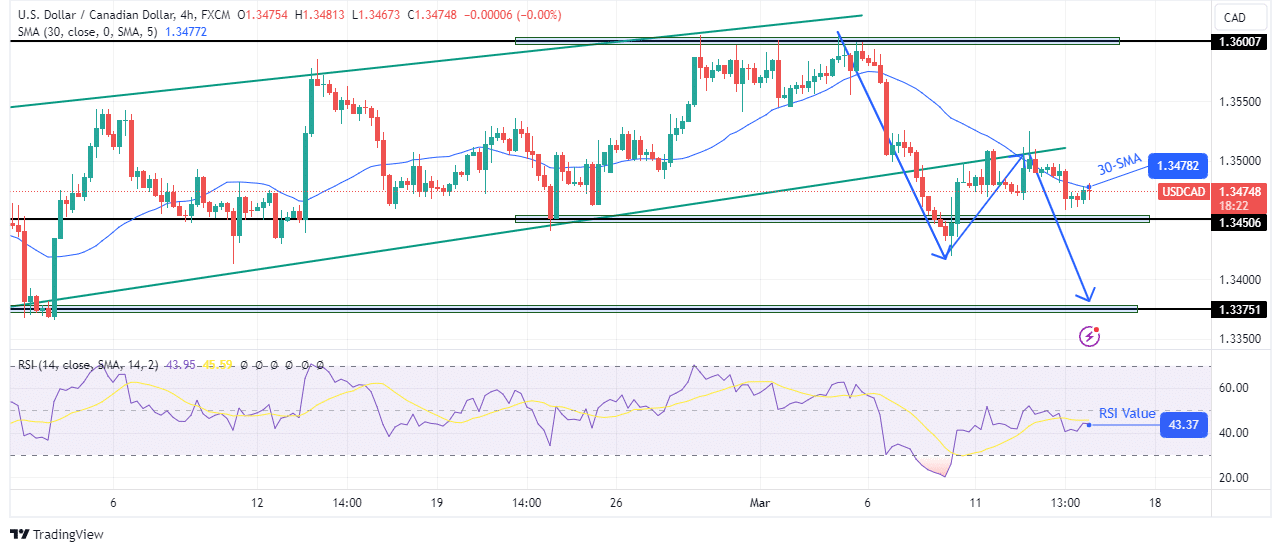

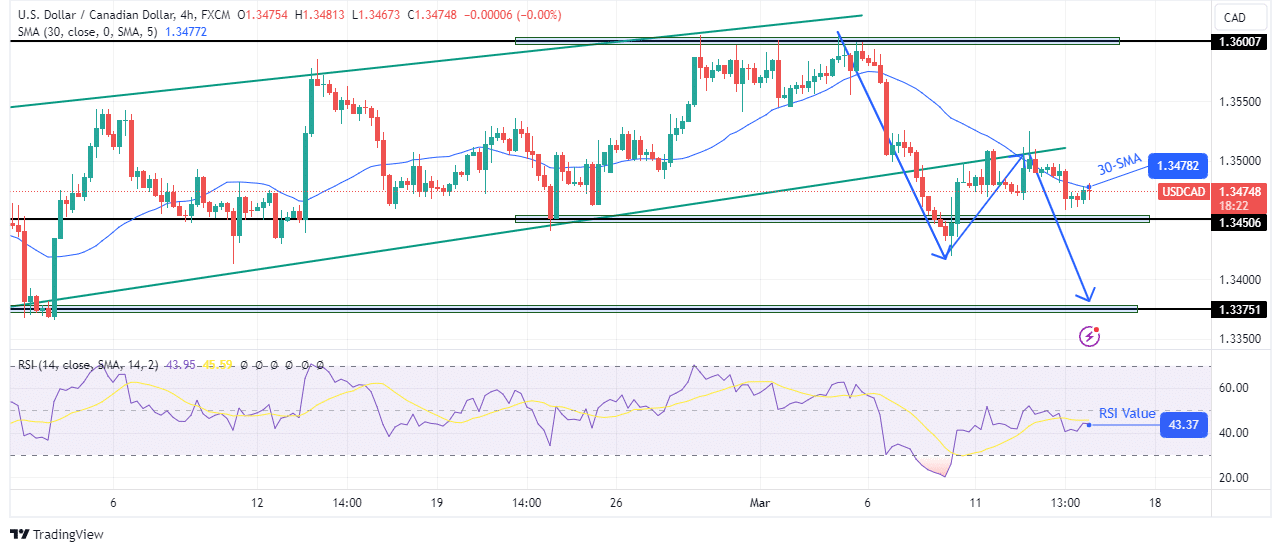

USD/CAD Technical Outlook: Price Reversal After Retesting Channel Support.

On the charts, USD/CAD is jumping lower after retesting the recently broken channel support. At the same time, the price retested and respected the 30-SMA resistance. Meanwhile, the RSI remained below the key 50 level, showing solid bearish momentum.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

However, the bears have yet to confirm the recent breakout of the channel. They need to push below the key support level of 1.3450 to make a lower low to do so. If this happens, the price is likely to retest the 1.3375 support level and start a downtrend.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money