- US data should move the rate today.

- Taking out a pivot point activates a larger drop.

- The middle line could attract the price.

The price of gold has turned lower and is trading at $2,168 at the time of writing. The recovery of the US dollar weighed on the precious metal.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

However, the bias remains bullish despite minor pullbacks. A major correction is far from confirmed. The US reported higher inflation in February, but gold prices were little changed as the USD appeared indecisive.

Today, fundamentals should once again be decisive. The US will release high-impact data. Retail sales are expected to post a 0.8% increase after a 0.8% decline in the previous reporting period, while core retail sales could post a 0.5% increase.

Moreover, the PPI could register a growth of 0.3% in the second month of February. Core PPI could register an increase of 0.2% last month compared to an increase of 0.5% in January, while the unemployment claims indicator is expected to be at 218 thousand in the last week. Positive US data should boost the dollar and could push KSAU/USD lower again.

Gold Price Technical Analysis: Overbought

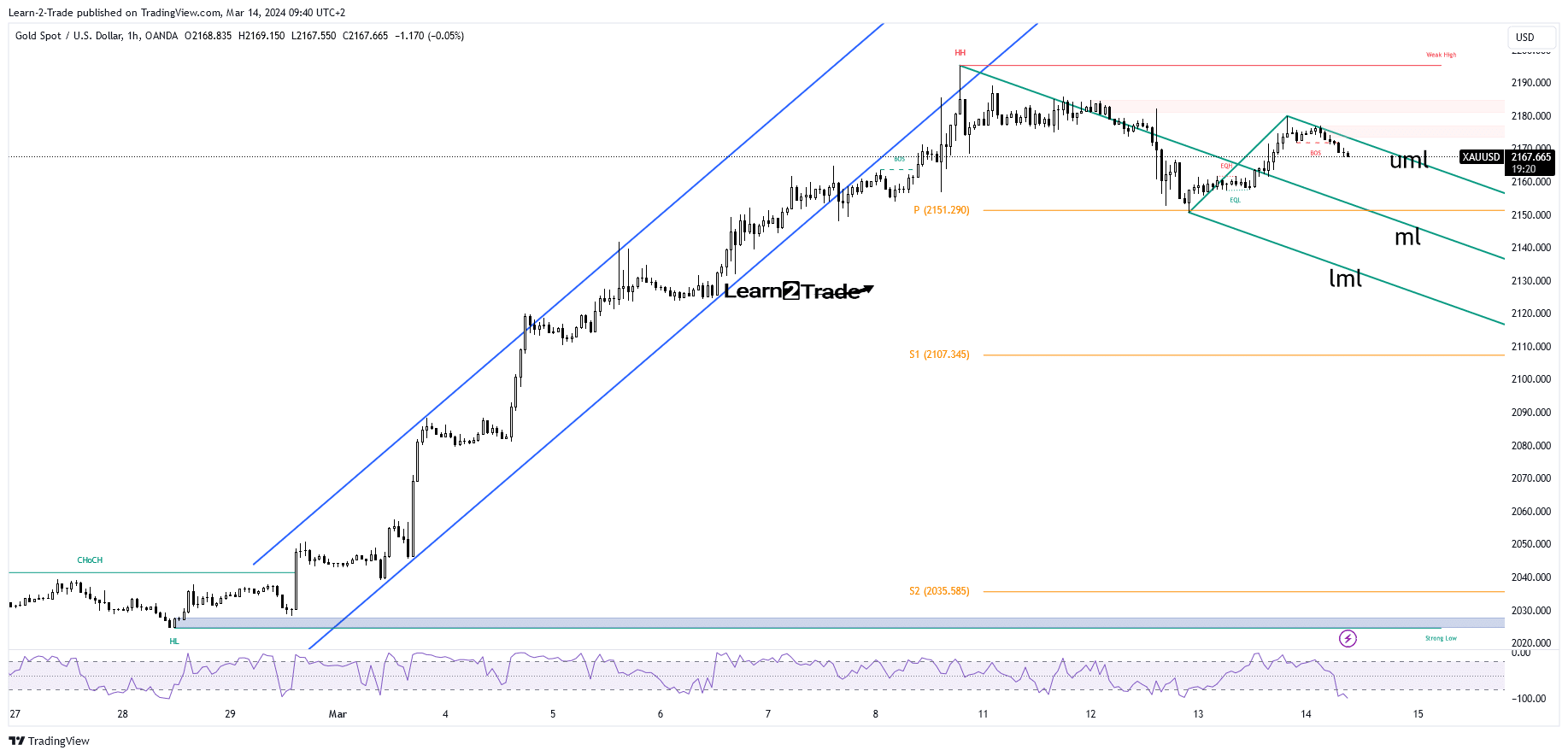

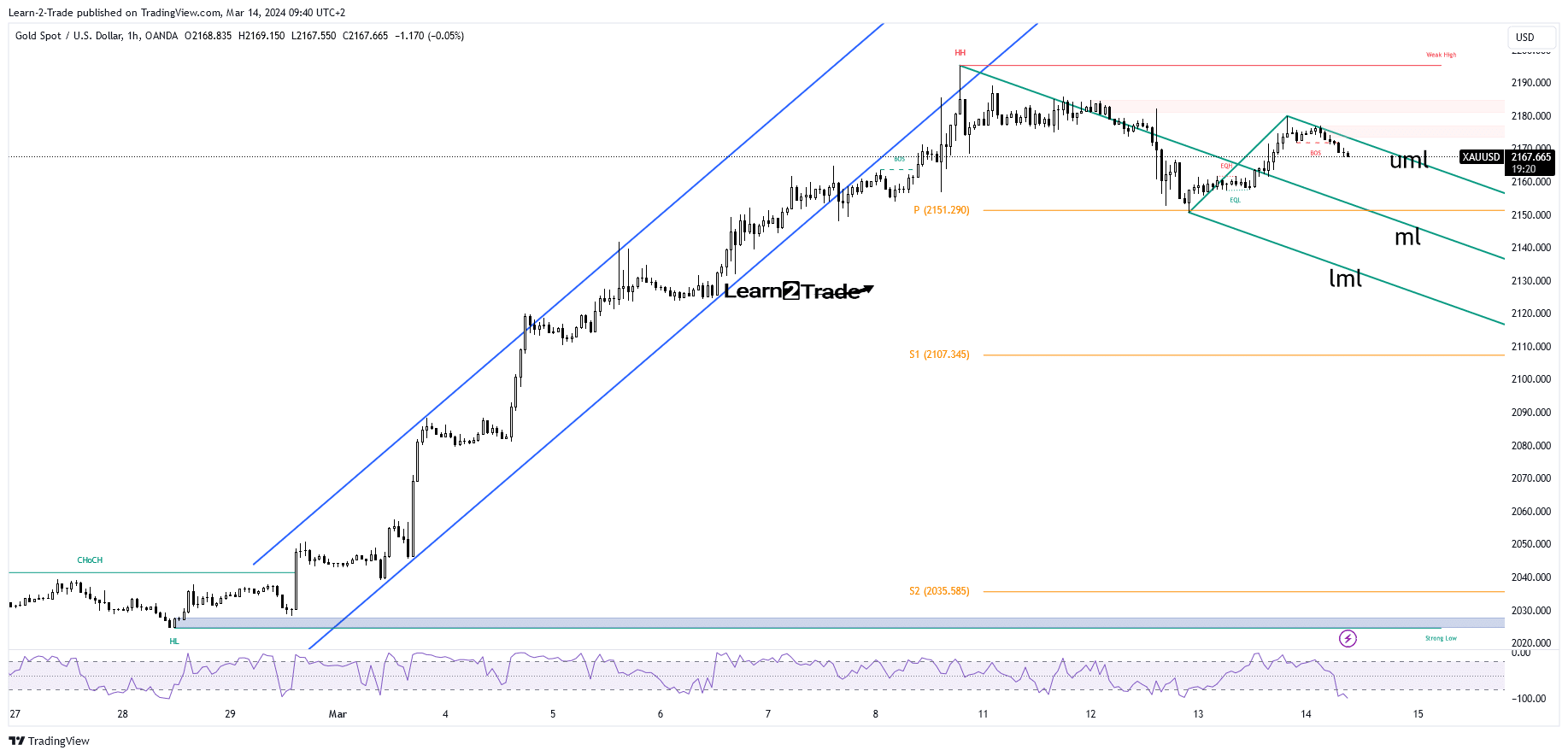

From a technical point of view, KSAU/USD is moving sideways in the short term. Escaping the ascending channel pattern, the price signaled a potential corrective phase. However, the outlook remains bullish as long as it remains above the weekly pivot point of $2,151.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

After the latest drop, a small bounce was in the cards as the metal needed to retest a new supply zone before going lower. I have drawn descending forks, so gold could slide lower if it stays below the upper middle line (uml). The middle line (ml) could attract price if it stays within the body of the fairies.

However, a major downward move could be triggered only after a valid break below the pivot point (2.151) and through the midline (ml).

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.