- USD/CAD bias is bullish despite minor pullbacks.

- False breakouts signaled exhausted buyers.

- Canadian inflation data should bring sharp developments.

USD/CAD is trading at 1.3567 at the time of writing. The pair looks overpriced in the short term. The dollar remains strong and dominates the currency market.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

The price rose even though Canada’s IPPI and RMPI were better than expected yesterday.

On the contrary, the US NAHB housing market index was also better than expected. The dollar appreciated against its rivals after the US reported higher inflation in February.

Today, Canadian inflation data could be decisive. The consumer price index is expected to register an increase of 0.6% in February, compared to an increase of 0.0% in January.

In addition, data on core CPI, median CPI, shortened CPI and composite CPI will also be released. Higher inflation could lift the CAD.

On the other hand, the US will release an indicator of building permits, which is expected at 1.50 million above 1.47 million in the previous reporting period, while housing starts could jump from 1.33 million to 1.43 million.

The Fed will keep monetary policy on hold tomorrow, but the FOMC press conference should shake up the markets.

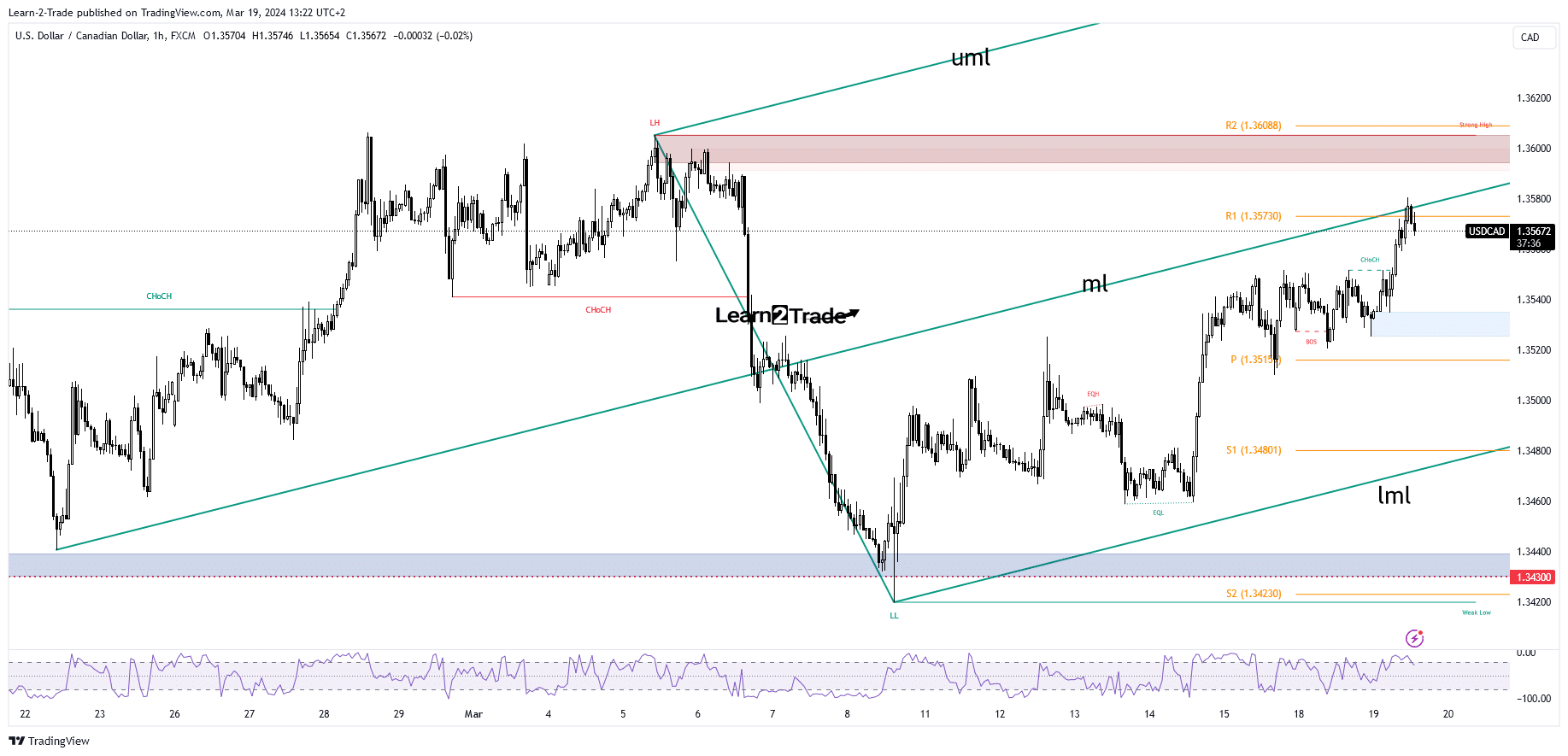

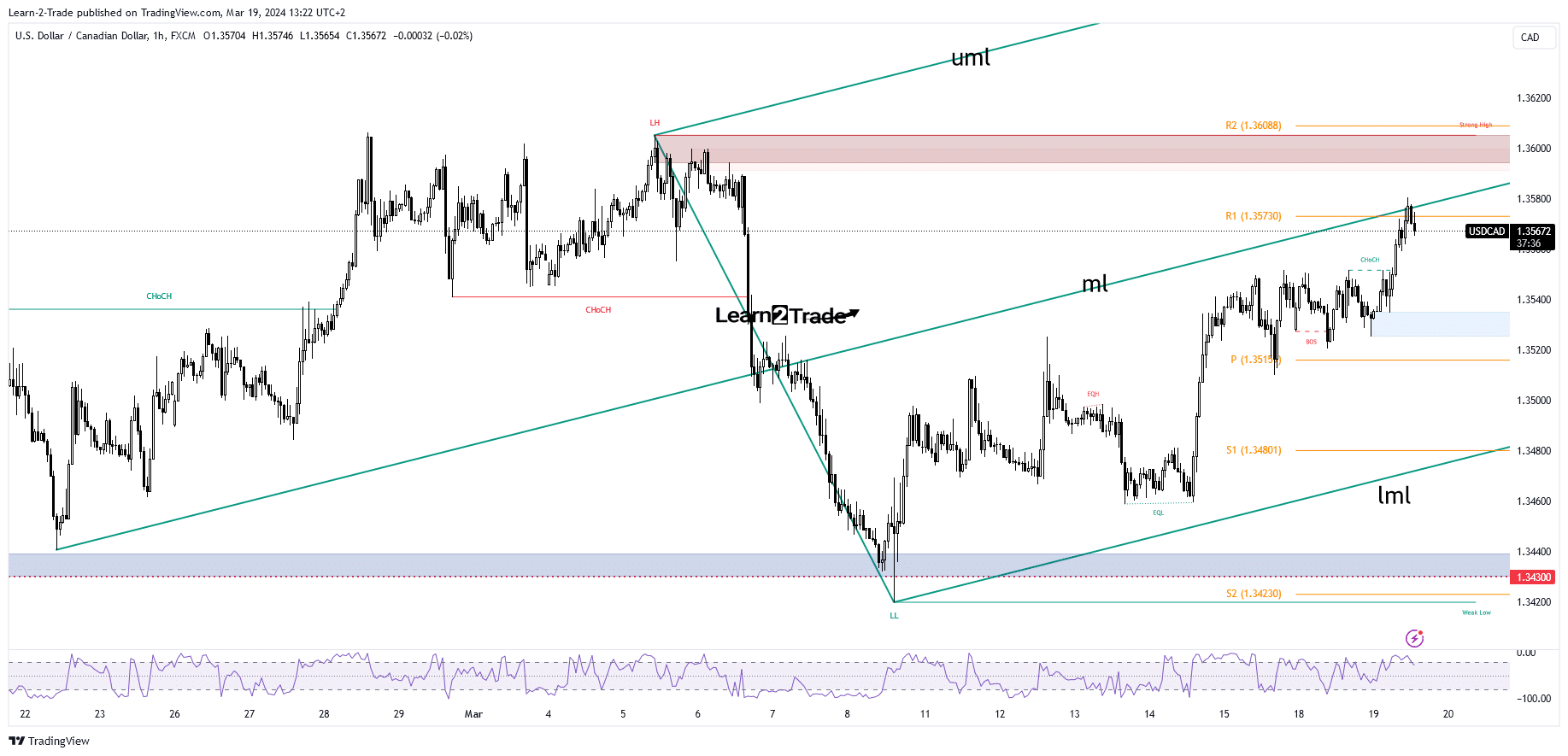

USD/CAD Price Technical Analysis: Swing Higher

Technically, the USD/CAD price developed a strong upward movement after registering a false breakout with a big drop below the static support at 1.3430.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

It has now reached the middle line (ml) of the ascending forks, which represents dynamic resistance. A false break through this line and above the weekly R1 of 1.3573 signaled exhausted buyers and indicated a potential sell-off.

After such impressive growth, a correction could be expected. Price could pull back, trying to accumulate more bullish energy before developing new bullish momentum. Removing the middle line (ml) and creating a new higher high activates a continuation to the upside. The bias is bullish in the short term despite minor pullbacks.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.