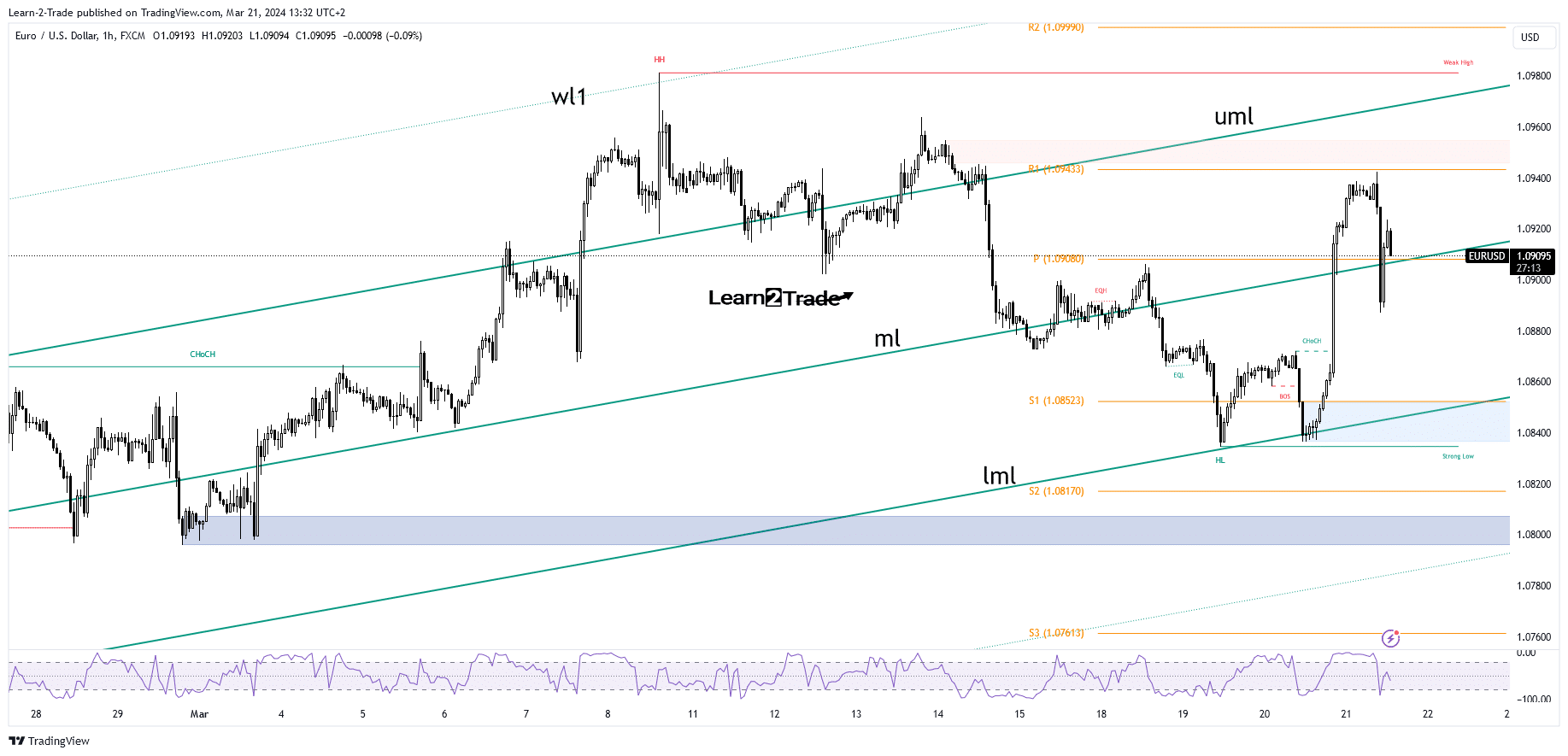

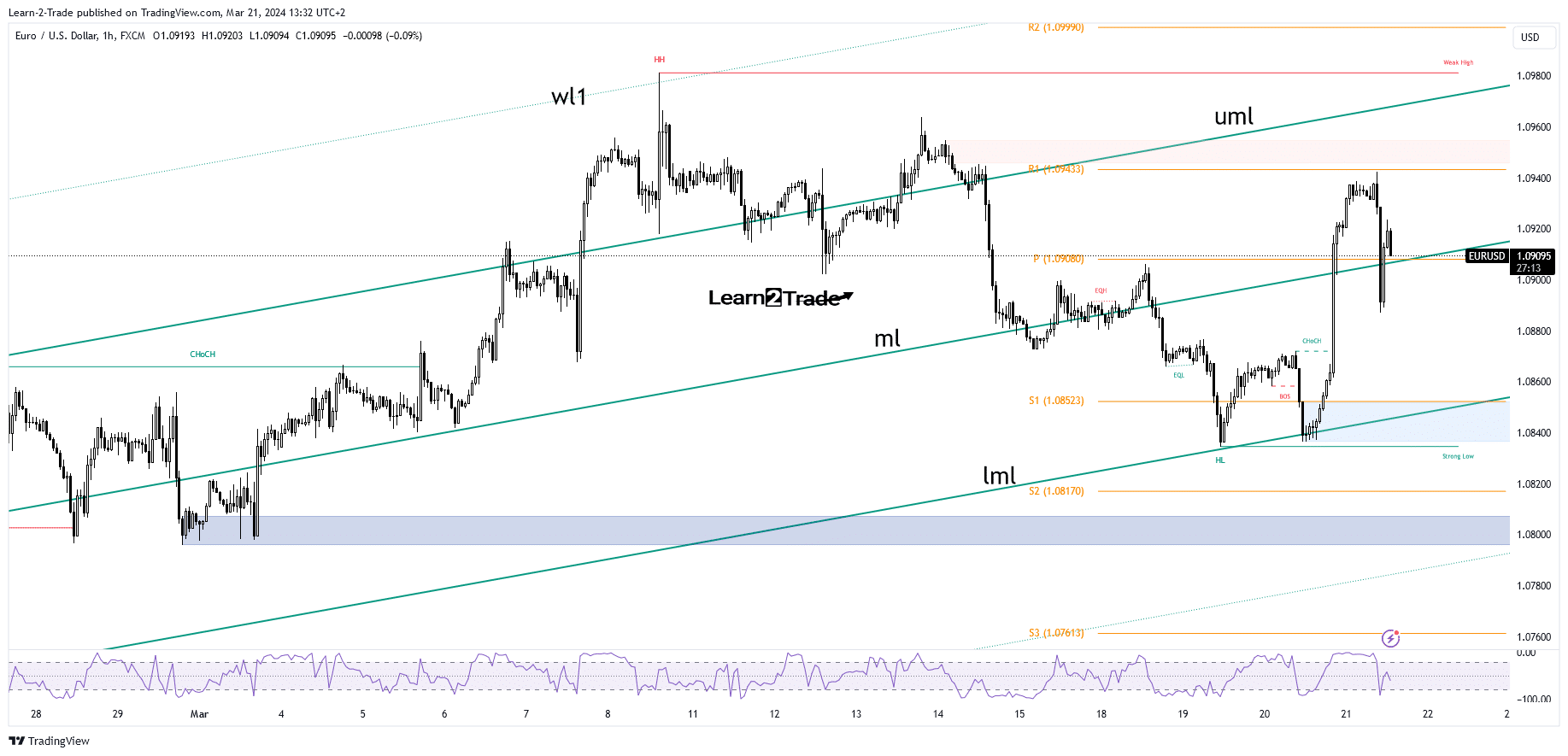

- The EUR/USD price could continue to rise if it stays above the midline.

- US manufacturing and services data should move the rate up.

- A new lower low triggers a deeper decline.

EUR/USD is trading in the red at 1.0907 at the time of writing. The pair is under mild selling pressure amid the dollar’s recovery.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

The dollar is struggling to recover after last night’s massive post-FOMC selloff. The Federal Reserve left monetary policy unchanged and the federal funds rate at 5.50%. However, the dollar depreciated against all its rivals as the Fed confirmed a 75 bps rate cut for the year.

As expected, the FOMC press conference brought strong volatility. Today, the fundamentals should also affect the price.

The Eurozone Flash Services PMI came in at 51.1 versus the expected 50.5, confirming further expansion. The Flash Manufacturing PMI fell from 46.5 to 45.7 points, confirming further contraction.

Meanwhile, the German and French manufacturing and service sectors remain in shrinking territory. Later, American data could be decisive. Flash Manufacturing PMI may fall from 52.2 to 51.8, signaling a slowdown in expansion. At the same time, the Flash Services PMI is expected to fall to 52.0 points from 52.3 points in the previous reporting period.

In addition, data on existing home sales, CB leading indexes, checking accounts, the Philly Fed manufacturing index, and jobless claims will also be released.

Technical analysis of EUR/USD price: Corrective downside

Technically, the currency pair found support at the lower middle line (lml) of the ascending fork, which represents dynamic support. It has now passed above the middle line, a dynamic resistance.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

The pair is struggling to stay above the midline (ml) and the weekly pivot point of 1.0908 after falling to the right below R1 of 1.0943. Stabilization above these broken levels may signal further upside in the short term. Only a new lower low could trigger a deeper decline.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.