- The pound recovered on Tuesday as the dollar weakened.

- BoE policymakers took a dovish stance last week.

- Investors will remain cautious as they await more data on US inflation.

GBP/USD price analysis shows bullish optimism as the pair begins a recovery boosted by a falling dollar. Beneath the surface, however, fundamentals hint at a potential downside for the pair.

-Are you interested in learning about the best AI trading forex brokers? Click here for details –

Following the dovish Bank of England policy meeting, the pound has recently hit new lows. Meanwhile, the dollar retreated from recent highs as investors took profits after last week’s rally. However, UK and US fundamentals are supporting further downside for the pair.

At last week’s meeting, BoE policymakers took a more dovish stance, raising bets that the central bank will cut rates in June. This is a significant shift from the previous perspective. Initially, investors expected the BoE to be among the last central banks to cut interest rates.

Furthermore, inflation in the UK has remained much higher than in other G10 economies. However, with inflation easing, policymakers are no longer calling for rate hikes. This sets the stage for a weaker pound.

On the other hand, US inflation remained stubborn, leading to caution among Fed policymakers. Consequently, there is less confidence that inflation is consistently falling, leading to uncertainty about the prospects for rate cuts. In this case, the dollar should strengthen. Therefore, the recent pause could be short before the rally resumes.

However, investors will remain cautious as they await more inflation data. On Friday, the US will release the core PCE price index. This report will play a significant role in shaping the outlook for Fed interest rates.

GBP/USD key events today

- Consumer Confidence USA CB

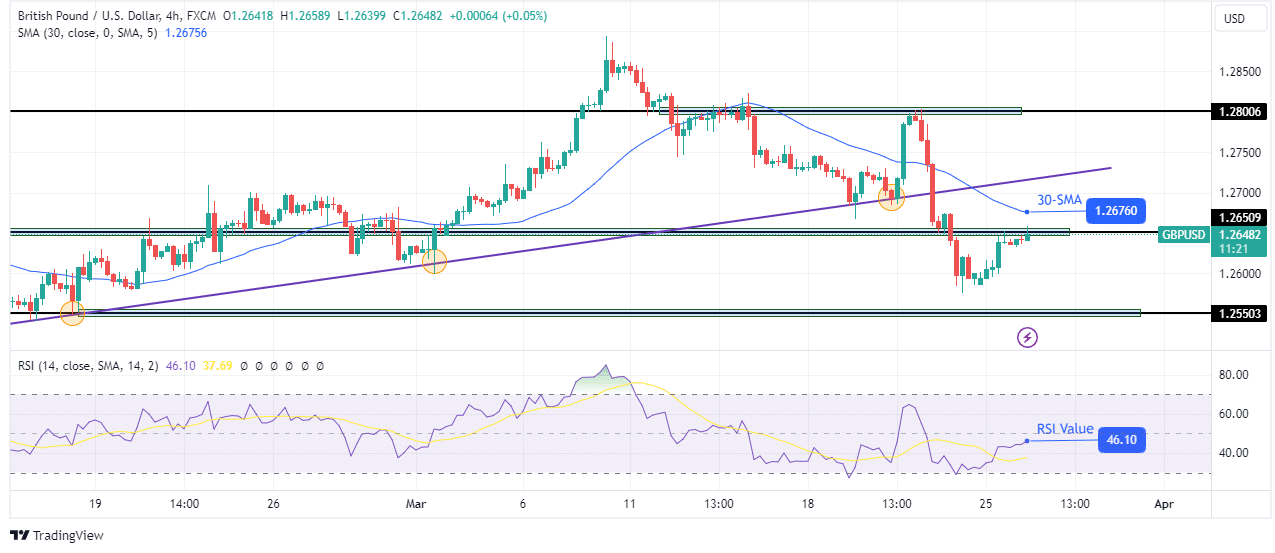

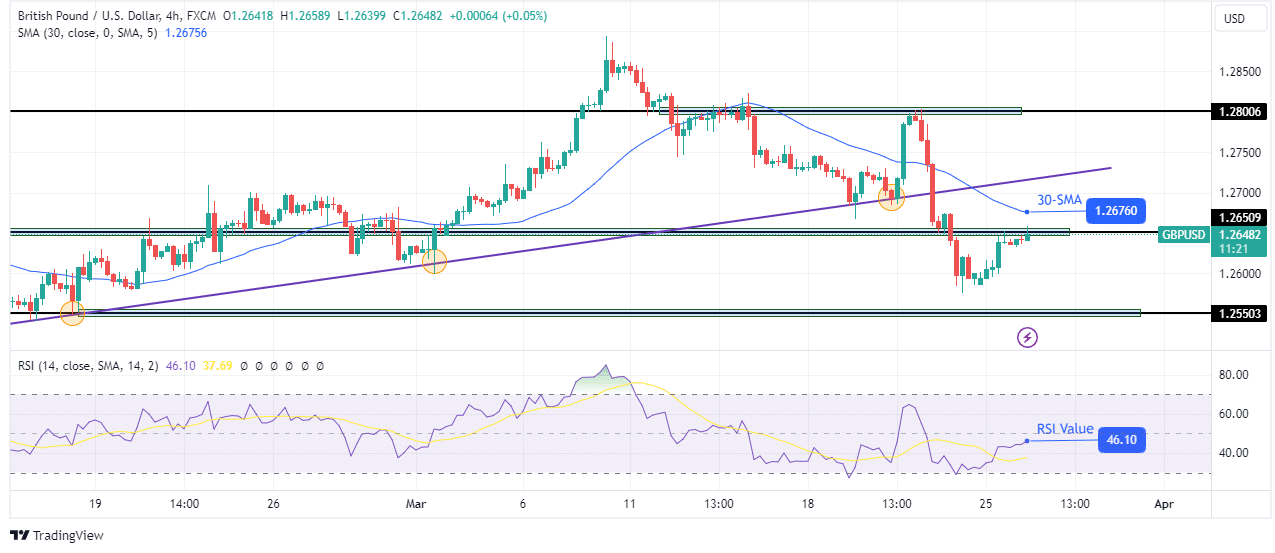

GBP/USD technical price analysis: The rebound stops at the 1.2650 barrier

On the charts, GBP/USD recovered to retest the recently broken key 1.2650 level as resistance. However, the bias remains weak as the price is trading below the 30-SMA with the RSI below the key 50 mark.

-Are you interested in learning more about forex indicators? Click here for details –

The price recently broke below the strong bullish trendline and key support at 1.2650, confirming a change in direction. Therefore, the downtrend will continue if the 1.2650 level holds firm as resistance. The next downside target is at the 1.2550 support level. However, there is a chance that the price will break above to retest the trend line before continuing lower.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.