- The US manufacturing PMI showed an increase in domestic demand.

- US job vacancies rose slightly in February as the labor market remained tight.

- There are fears of a possible intervention to support the yen.

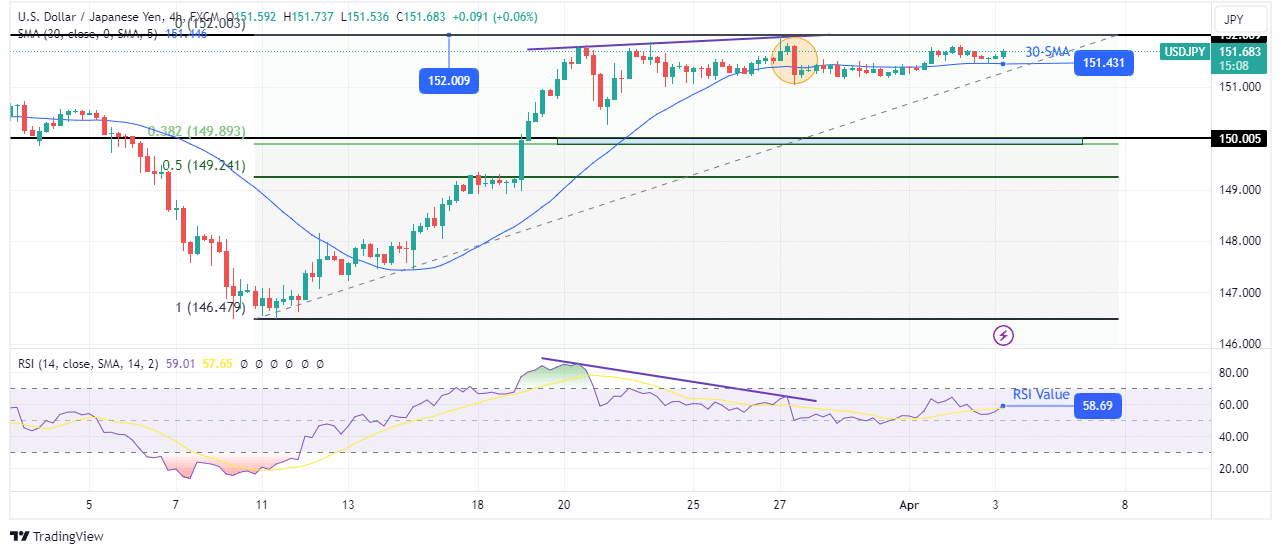

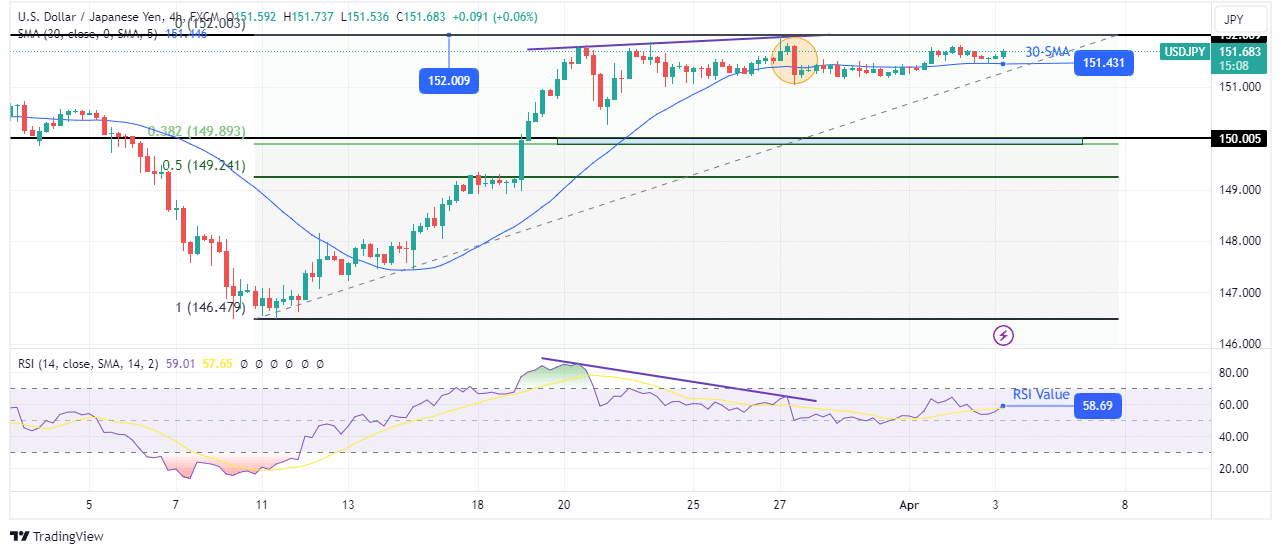

A peek at the USD/JPI forecast reveals a promising upside outlook, as the dollar holds close to a four-month high, weighing on the yen. However, fear of a possible Japanese intervention prevented the USD/JPY pair from rising too much.

–Are you interested in learning more about low spread forex brokers? Check out our detailed guide-

The dollar strengthened this week after the US released better-than-expected economic data. Manufacturing PMI, released on Monday, showed a rise in domestic demand that led to an expansion in March. Meanwhile, US job vacancies rose slightly in February as the labor market remained tight. These reports highlighted a strong economy that led investors to lower expectations of a rate cut. The next big report arrives on Friday and shows the state of employment in the economy. The higher-than-expected figure could further reduce rate-cut bets, boosting the dollar.

Meanwhile, the market was cautious due to fears of a possible intervention to support the yen. Consequently, this created a strong barrier at $152. However, analysts believe that any intervention will only cause a temporary drop in the USD/JPI pair. Significantly, fundamentals support a weak yen as the yield gap between the US and Japan remains wide. Moreover, the Bank of Japan is in no rush to raise interest rates, keeping this gap wide. Therefore, the yen will only appreciate significantly if there is a change in BoJ policy. A more aggressive rate hike cycle would strengthen the yen more than a one-off intervention.

USD/JPI Key Events Today

- Private sector employment change in the US

- US ISM services PMI

- Fed Chairman Powell is speaking

USD/JPI Technical Forecast: Thin trading precedes strong move

On the technical side, the USD/JPI price is trading slightly above the 30-SMA, showing that the bulls are in the lead. At the same time, the RSI is above 50, favoring bullish momentum. However, the price remained in a solid sideways movement near the SMA, showing indecision. Moreover, it made small-bodied candles, which indicates that neither the bears nor the bulls are ready to make big moves.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

The price will only start moving when there is a big push above the 152.00 level or below the 30-SMA. Notably, the bearish RSI divergence and the bearish engulfing candle support a bearish breakout. If that happens, the price is likely to fall to the 150.00 support level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.