- US jobless claims rose more than expected last week.

- The data revealed a slowdown in the US services sector.

- Oil prices rose on Thursday amid supply concerns.

The USD/CAD outlook points to a bearish trend, with the greenback weakening as a rise in jobless claims bolstered expectations for a June Fed rate cut. At the same time, the Canadian dollar is firm, buoyed by the upward momentum in oil prices.

–Are you interested in learning more about low spread forex brokers? Check out our detailed guide-

US jobless claims rose more than expected last week, showing signs of easing in the labor market. Claims for the unemployed increased to 221 thousand from 212 thousand. This report follows another bad one from the previous session, showing weaker economic activity.

Data on Wednesday revealed a slowdown in the US services sector. Although activity levels held above 50, indicating expansion, there was a slowdown, indicating a decline in demand in the services sector. Consequently, price increases in this sector could also decrease. Recent bad reports have given traders more confidence to bet on a June Fed rate cut.

Canada’s services sector also slowed in March, further contracting due to higher interest rates. This could pressure the Bank of Canada to start cutting interest rates in June. Investors are eyeing the BoC’s policy meeting next week for more guidance on the outlook for a rate cut. However, they expect the central bank to keep rates at 5% in April.

Meanwhile, oil prices rose on Thursday on supply concerns after the OPEC group decided to continue production cuts. Moreover, the group called on member countries to improve their compliance with production cuts. Consequently, oil hit a five-month high, boosting the Canadian dollar.

USD/CAD Key Events Today

After the US jobless claims report, investors will be waiting for more labor market data tomorrow.

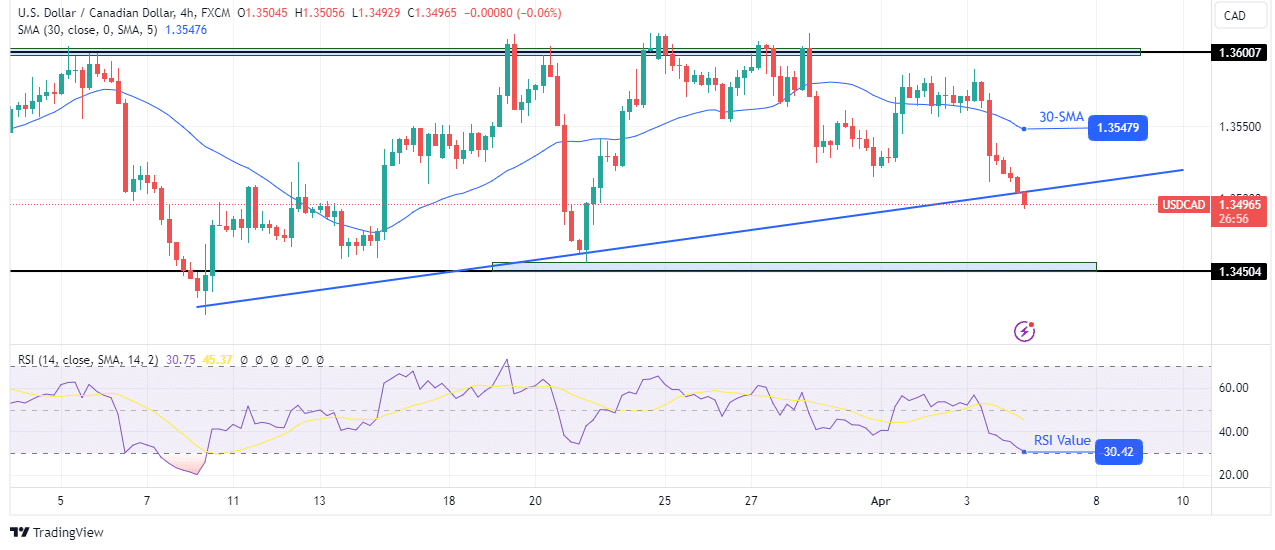

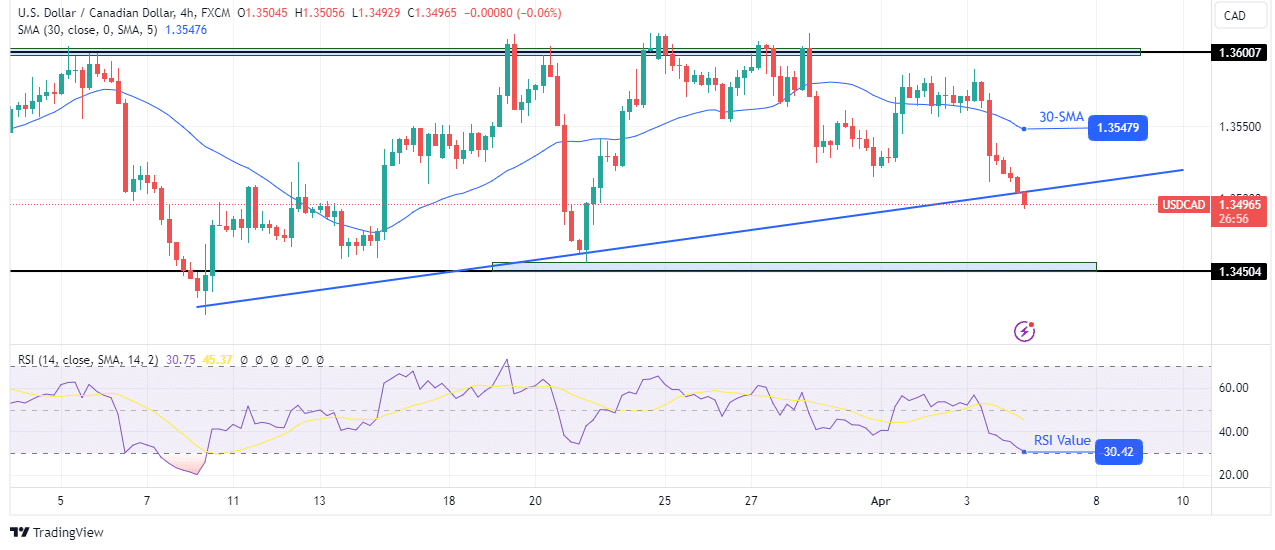

USD/CAD Technical Outlook: Price is poised to break below a key trend line

On the technical side, the USD/CAD price is on the verge of breaking below a strong support trend line. The bearish bias is strong as the price is trading well below the 30-SMA and the RSI is about to enter the oversold region.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

For some time now, the price has reached higher lows. However, it failed to make new highs above the critical resistance level of 1.3600. This is a sign that there are plenty of sellers at 1.3600. And now, the trend could change when the price closes below the support trend line. However, bears need to break below 1.3450 to make lower lows and confirm the new direction.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.