- The bias is bullish, so further upside is possible.

- US data should be decisive tomorrow.

- Only taking out the psychological level of 151.00 activates the correction.

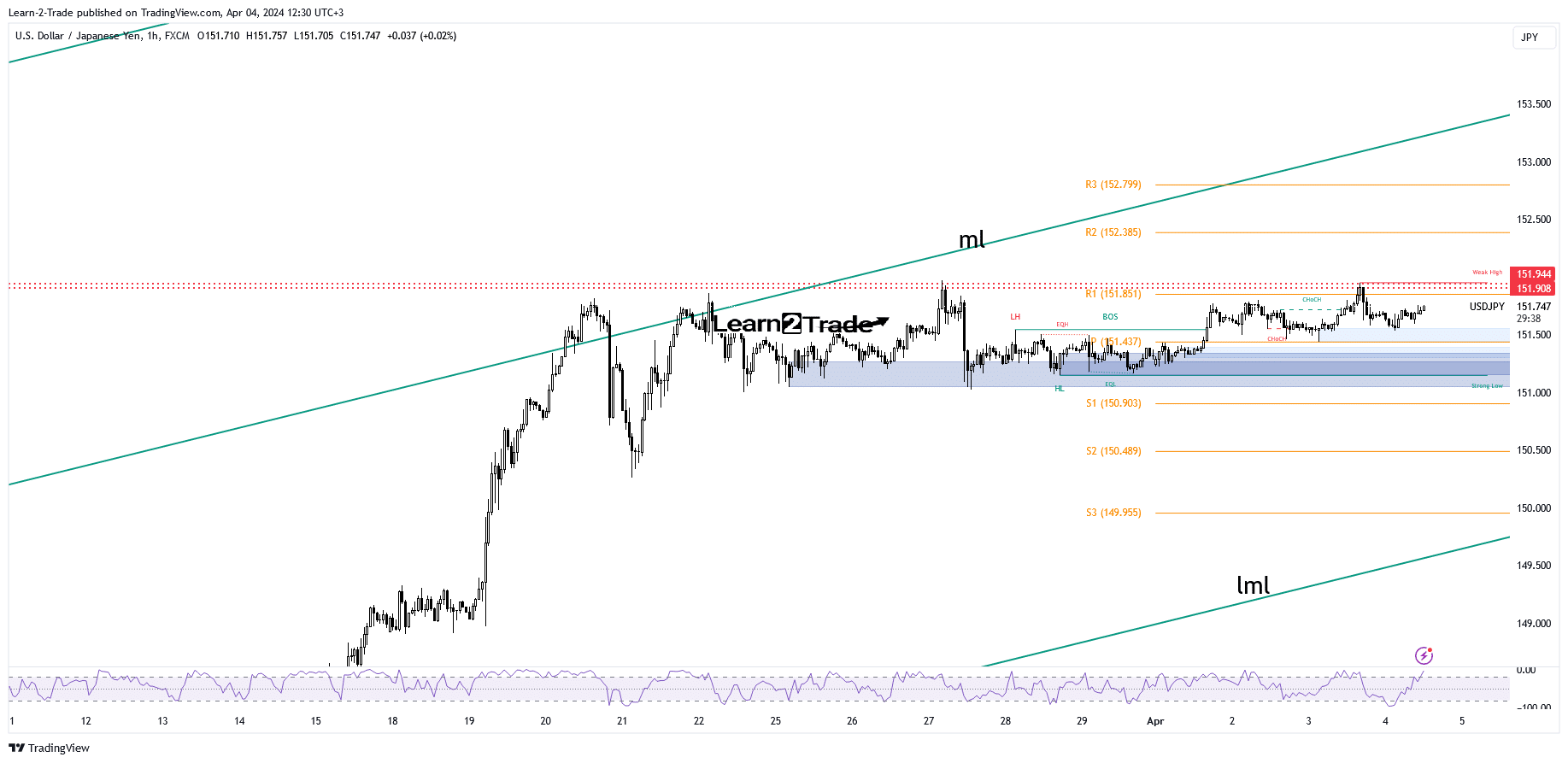

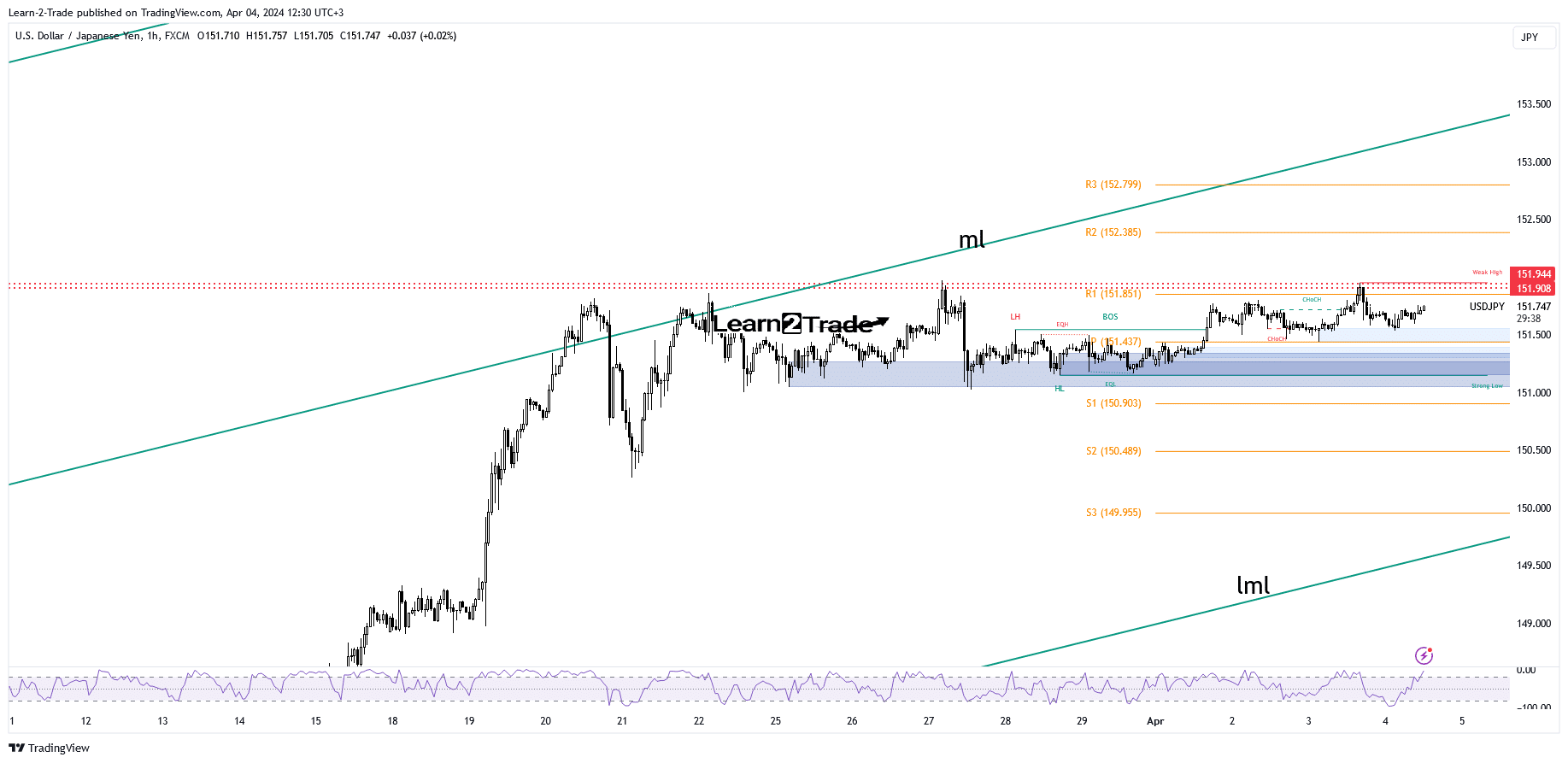

USD/JPI is trading in the green at 151.75 at the time of writing. The couple seems determined to reach new heights. Despite minor pullbacks or consolidations, the bias is bullish, so a continuation to the upside is on the cards.

–Are you interested in learning more about low spread forex brokers? Check out our detailed guide-

The price remains higher even though the US dollar has slipped lower. Yesterday, the US released mixed economic data. ADP Employment change in non-agricultural areas was better than expected. However, the ISM Services PMI was disappointing, while the Final Services PMI was in line with expectations.

Today, US jobless claims are expected to jump from 210k to 213k, which could be bad for the dollar, while the trade balance is expected to be -66.9 billion from -67.4 billion in the previous report period.

Furthermore, data on US Challenger job cuts and Canada’s trade balance will be released. Also, speeches by FOMC member Barkin and FOMC member Mester should have an impact.

The US dollar needs strong support to continue its growth. Japan’s leading indicators and household consumption should move the rate tomorrow morning, but only US economic data should be decisive.

The US will release NFP, average hourly earnings and the unemployment rate.

USD/JPI Price Technical Analysis: Bullish Bias Intact

From a technical point of view, the price of USD/JPI remains exactly below the 151.90 – 151.94 resistance level, thus favoring an imminent breakout.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

The price moved sideways after failing to stabilize above the middle line of the ascending fork (ml). After the previous rally, accumulation was expected.

The bias remains bullish as long as it is above the psychological level of 151.00. Only a drop below this key lower hurdle activates the corrective phase. Removal of 151.94, making a new higher high confirms further upside.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.